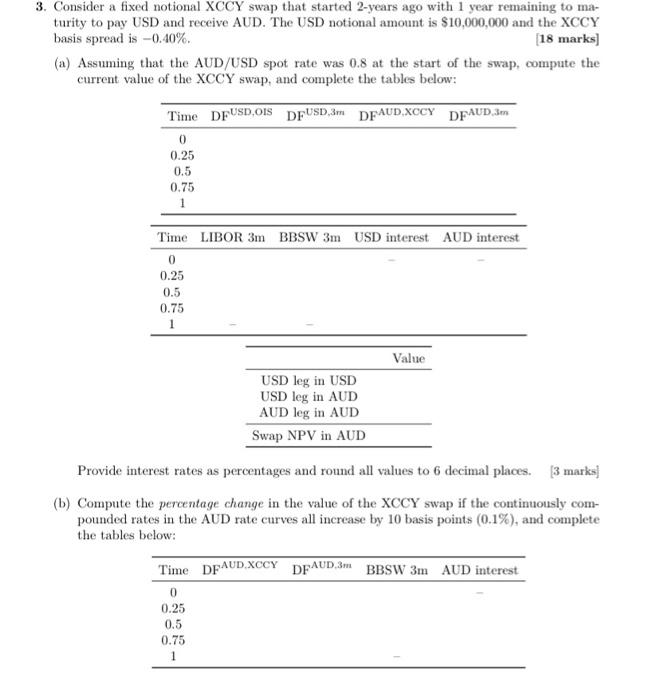

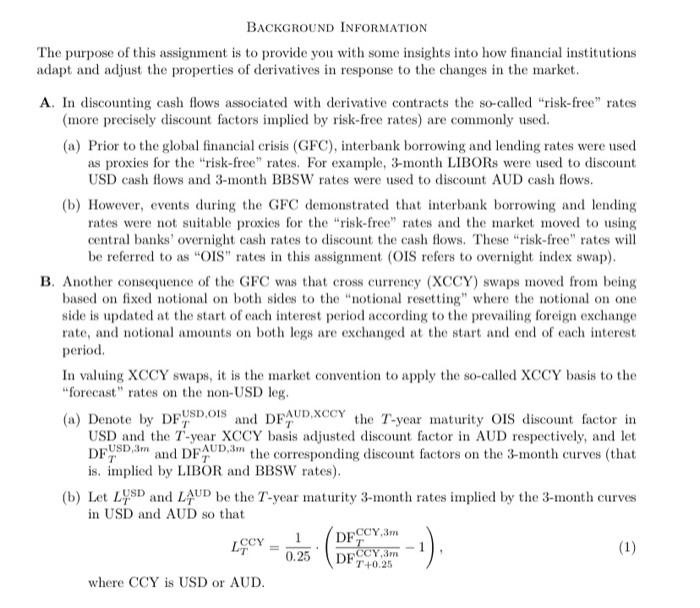

3. Consider a fixed notional XCCY swap that started 2-years ago with 1 year remaining to ma- turity to pay USD and receive AUD. The USD notional amount is $10,000,000 and the XCCY basis spread is -0.40%. (18 marks] (a) Assuming that the AUD/USD spot rate was 0.8 at the start of the swap, compute the current value of the XCCY swap, and complete the tables below: Time DFUSD,OIS DEUSD), DFAUD XOCY DFAUD.3m 0 0.25 0.5 0.75 1 Time LIBOR 3m BBSW 3m USD interest AUD interest 0 0.25 0.5 0.75 Value USD leg in USD USD leg in AUD AUD log in AUD Swap NPV in AUD Provide interest rates as percentages and round all values to 6 decimal places. 3 marks] (b) Compute the percentage change in the value of the XCCY swap if the continuously com- pounded rates in the AUD rate curves all increase by 10 basis points (0.1%), and complete the tables below: Time DFAUD.XCCY DFAUD,3m BBSW 3m AUD interest 0 0.25 0.5 0.75 1 BACKGROUND INFORMATION The purpose of this assignment is to provide you with some insights into how financial institutions adapt and adjust the properties of derivatives in response to the changes in the market. A. In discounting cash flows associated with derivative contracts the so-called "risk-free" rates (more precisely discount factors implied by risk-free rates) are commonly used. (a) Prior to the global financial crisis (GFC), interbank borrowing and lending rates were used as proxies for the "risk-free" rates. For example, 3-month LIBORs were used to discount USD cash flows and 3-month BBSW rates were used to discount AUD cash flows. (b) However, events during the GFC demonstrated that interbank borrowing and lending rates were not suitable proxies for the "risk-free" rates and the market moved to using central banks' overnight cash rates to discount the cash flows. These "risk-free" rates will be referred to as "OIS" rates in this assignment (OIS refers to overnight index swap). B. Another consequence of the GFC was that cross currency (XCCY) swaps moved from being based on fixed notional on both sides to the notional resetting" where the notional on one side is updated at the start of each interest period according to the prevailing foreign exchange rate, and notional amounts on both legs are exchanged at the start and end of each interest period In valuing XOCY swaps, it is the market convention to apply the so-called XCCY basis to the forecast" rates on the non-USD leg. (a) Denote by DF%8DOIS and DFAUD, XOCY the T-year maturity Ois discount factor in USD and the T-year XCCY basis adjusted discount factor in AUD respectively, and let and DFAUD,m the corresponding discount factors on the 3-month curves (that is. implied by LIBOR and BBSW rates). (b) Let LYSD and LAUD be the T-year maturity 3-month rates implied by the 3-month curves in USD and AUD so that DFPSD, 3m DF.COY 3m DECCY 3m T cy -1). (1) 0.25 T+0.25 where CCY is USD or AUD. 2 USDOIS let. 1.5. (e) Let A the notional amount on the USD leg, and denote by 8 the XCCY basis applicable for a given maturity (a different basis applies to swaps of different maturities). (d) Let T.