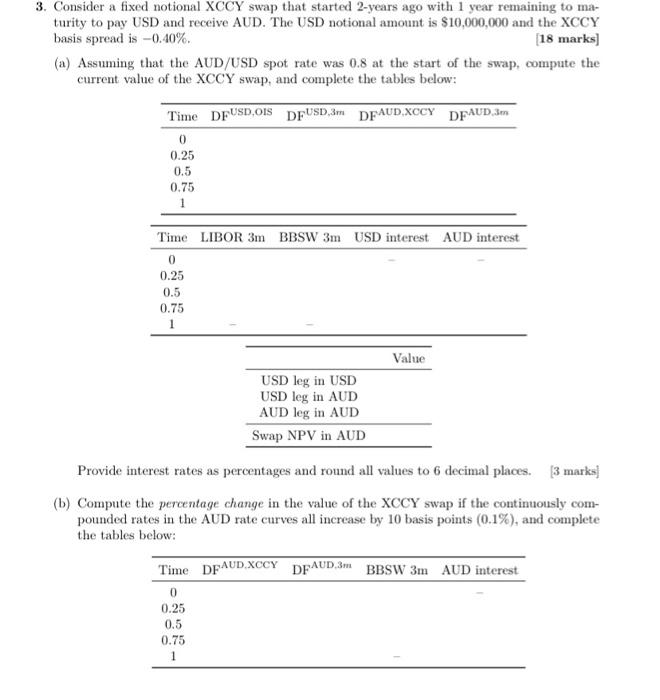

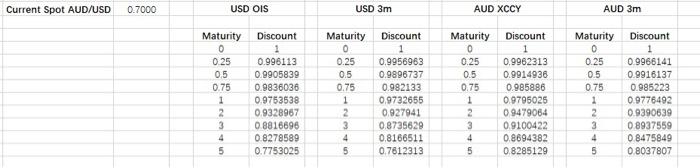

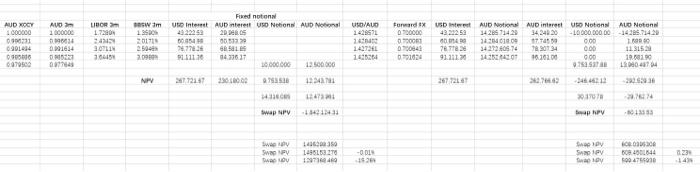

3. Consider a fixed notional XCCY swap that started 2-years ago with 1 year remaining to ma- turity to pay USD and receive AUD. The USD notional amount is $10,000,000 and the XCCY basis spread is -0.40%. (18 marks] (a) Assuming that the AUD/USD spot rate was 0.8 at the start of the swap, compute the current value of the XCCY swap, and complete the tables below: Time DFUSD,OIS DEUSD), DFAUD XOCY DFAUD.3m 0 0.25 0.5 0.75 1 Time LIBOR 3m BBSW 3m USD interest AUD interest 0 0.25 0.5 0.75 Value USD leg in USD USD leg in AUD AUD log in AUD Swap NPV in AUD Provide interest rates as percentages and round all values to 6 decimal places. 3 marks] (b) Compute the percentage change in the value of the XCCY swap if the continuously com- pounded rates in the AUD rate curves all increase by 10 basis points (0.1%), and complete the tables below: Time DFAUD.XCCY DFAUD,3m BBSW 3m AUD interest 0 0.25 0.5 0.75 1 Current Spot AUD/USD 0.7000 USD OIS USD 3m AUD XCCY AUD 3m Maturity 0 0.25 0.5 0.75 Maturity 0 0.25 0.5 0.75 1 2 3 4 5 Discount 1 0.996113 0.9905839 0.9836036 0.9753538 0.9328967 0.8816696 0.8278589 0.7753025 Maturity 0 0.25 0.5 0.75 1 2 3 4 5 Discount 1 0.9956963 0.9896737 0.982133 0.9732655 0.927941 0.8735629 0.8166511 0.7612313 Discount 1 0.9962313 0.9914936 0.985886 0.9705025 09479064 0.9100422 0.8694382 0.8285129 Maturity 0 0.25 0.5 0.75 1 2 3 4 5 Discount 1 0.9966141 0.9916137 0.985223 0.9776492 0.9390639 0 8937559 0 8475849 0.8037807 URN on LIBOR 1.72801 USD/AUD AUD XOCY 1600000 0001 6.900 000 6970500 AUD 1000000 1903 09164 D.NET CE CINE OT 30711 1045 142724 14:00 CO 000 .NET 000 Feed notions swim u interest AUDInterest USD Neon AUD Non 1940 20. 20170 00854 00512 2.50 7477 51 2010 111110 431617 10.000.000 12 500 000 172247 2010 12 1247 twap NPV SESEO Forward interest AUDI AUD interest USO Noten AUD Noten 0.0000 4993250 1428571423 3424220 10 000.000,00 14205.714.20 0.000 12.2010 17 0.00 07042 78 7 3421240574 7890134 113152 070104 91.211 16.10100 10.600 L0474 267 12:41 4622 2003 01707 24 map NP 6011330 M TESCO C WE TH TERIT dows Sway SwPY way 4350 1496153.170 1449 100- 10300 DO 4301644 19947500 Smy way 1926 123 14 3. Consider a fixed notional XCCY swap that started 2-years ago with 1 year remaining to ma- turity to pay USD and receive AUD. The USD notional amount is $10,000,000 and the XCCY basis spread is -0.40%. (18 marks] (a) Assuming that the AUD/USD spot rate was 0.8 at the start of the swap, compute the current value of the XCCY swap, and complete the tables below: Time DFUSD,OIS DEUSD), DFAUD XOCY DFAUD.3m 0 0.25 0.5 0.75 1 Time LIBOR 3m BBSW 3m USD interest AUD interest 0 0.25 0.5 0.75 Value USD leg in USD USD leg in AUD AUD log in AUD Swap NPV in AUD Provide interest rates as percentages and round all values to 6 decimal places. 3 marks] (b) Compute the percentage change in the value of the XCCY swap if the continuously com- pounded rates in the AUD rate curves all increase by 10 basis points (0.1%), and complete the tables below: Time DFAUD.XCCY DFAUD,3m BBSW 3m AUD interest 0 0.25 0.5 0.75 1 Current Spot AUD/USD 0.7000 USD OIS USD 3m AUD XCCY AUD 3m Maturity 0 0.25 0.5 0.75 Maturity 0 0.25 0.5 0.75 1 2 3 4 5 Discount 1 0.996113 0.9905839 0.9836036 0.9753538 0.9328967 0.8816696 0.8278589 0.7753025 Maturity 0 0.25 0.5 0.75 1 2 3 4 5 Discount 1 0.9956963 0.9896737 0.982133 0.9732655 0.927941 0.8735629 0.8166511 0.7612313 Discount 1 0.9962313 0.9914936 0.985886 0.9705025 09479064 0.9100422 0.8694382 0.8285129 Maturity 0 0.25 0.5 0.75 1 2 3 4 5 Discount 1 0.9966141 0.9916137 0.985223 0.9776492 0.9390639 0 8937559 0 8475849 0.8037807 URN on LIBOR 1.72801 USD/AUD AUD XOCY 1600000 0001 6.900 000 6970500 AUD 1000000 1903 09164 D.NET CE CINE OT 30711 1045 142724 14:00 CO 000 .NET 000 Feed notions swim u interest AUDInterest USD Neon AUD Non 1940 20. 20170 00854 00512 2.50 7477 51 2010 111110 431617 10.000.000 12 500 000 172247 2010 12 1247 twap NPV SESEO Forward interest AUDI AUD interest USO Noten AUD Noten 0.0000 4993250 1428571423 3424220 10 000.000,00 14205.714.20 0.000 12.2010 17 0.00 07042 78 7 3421240574 7890134 113152 070104 91.211 16.10100 10.600 L0474 267 12:41 4622 2003 01707 24 map NP 6011330 M TESCO C WE TH TERIT dows Sway SwPY way 4350 1496153.170 1449 100- 10300 DO 4301644 19947500 Smy way 1926 123 14