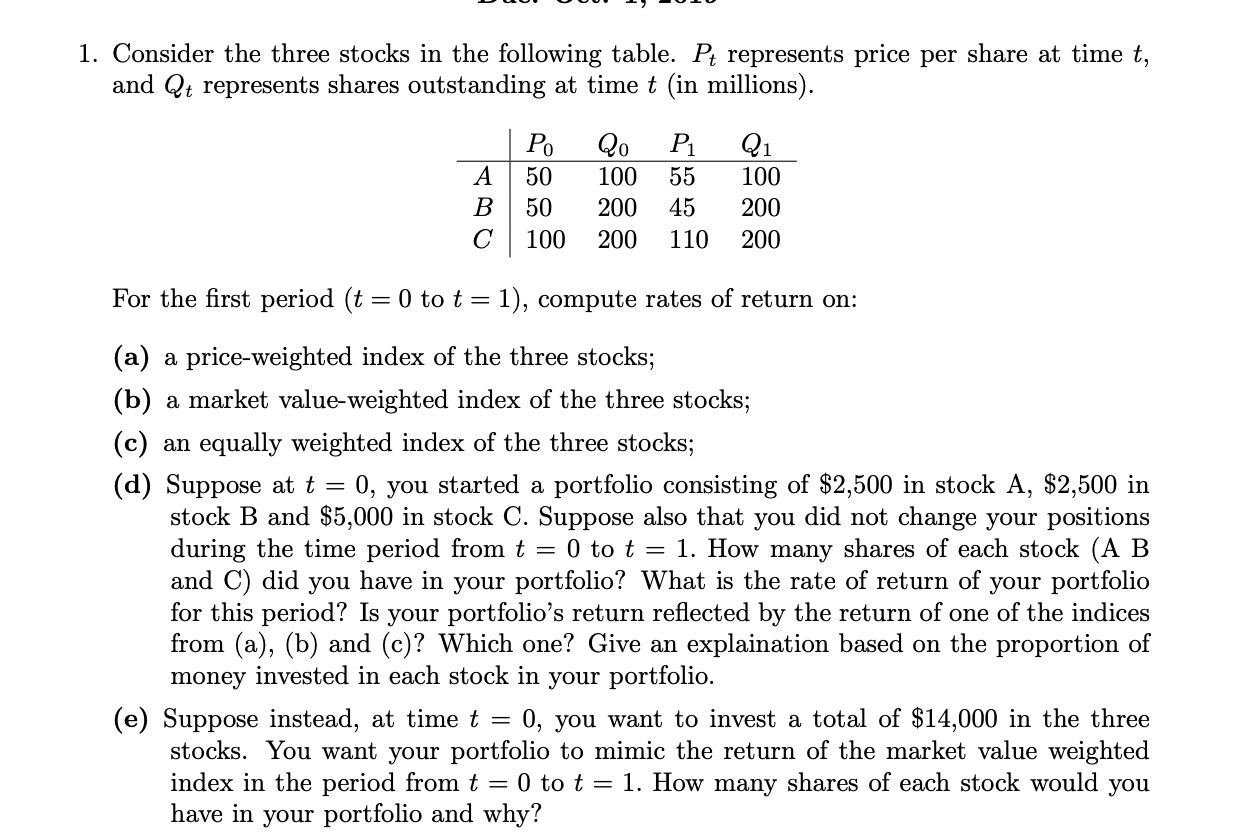

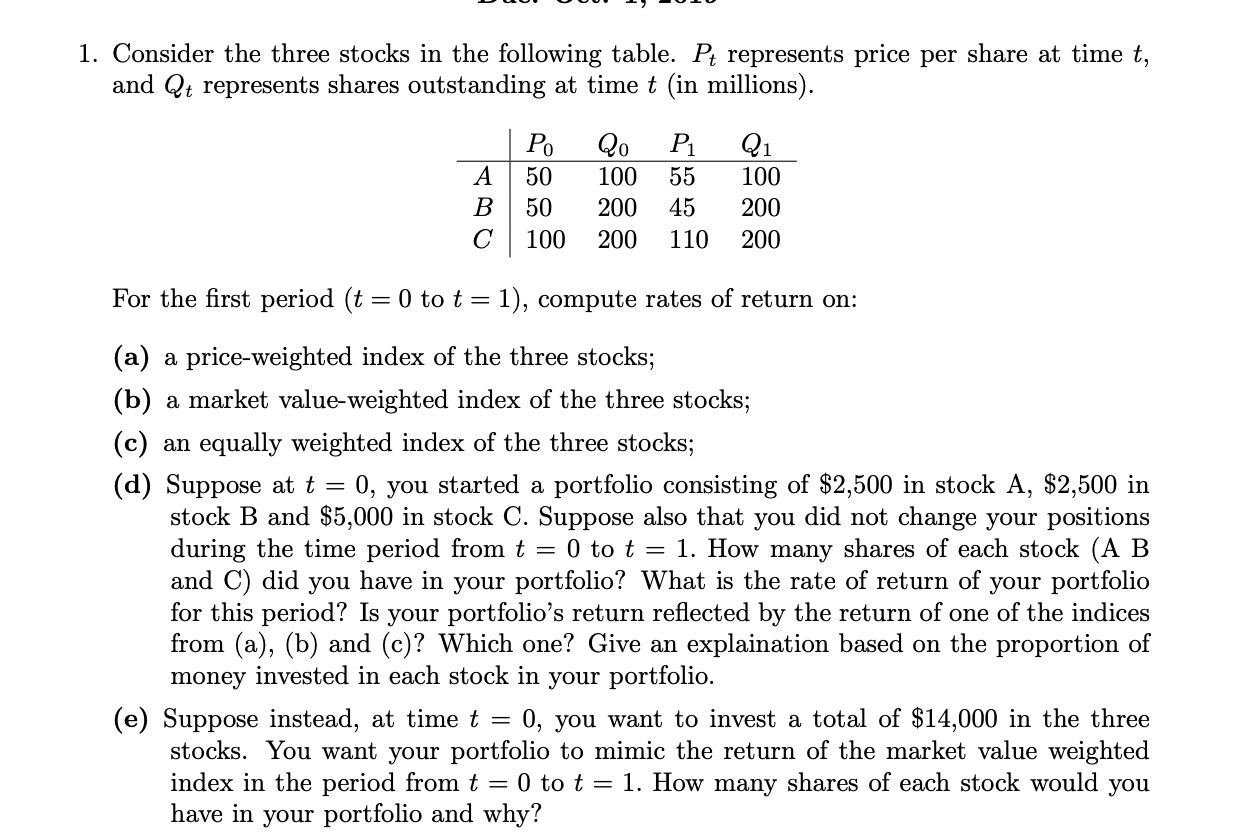

3. Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $50,000 with probability 0.6 or $150,000 with probability 0.4. The alternative riskless investment in T-bill pays 5%. (a) If you require a risk premium of 10%, how much will you be willing to pay for the portfolio? (b) Suppose the portfolio can be purchased for the amount you found in (a). What will be the expected rate of return on the portfolio? (c) Now suppose you require a risk premium of 15%. What is the price you will be willing to pay now? (d) Comparing your answers to (a) and (c), what do you conclude about the relationship between the required risk premium on a portfolio and the price at which the portfolio will sell? UL 1. Consider the three stocks in the following table. Pt represents price per share at time t, and Qt represents shares outstanding at time t (in millions). A B C | P. 50 50 100 Qo 100 200 200 Pi 55 45 110 Qi 100 200 200 For the first period (t = 0 to t= 1), compute rates of return on: (a) a price-weighted index of the three stocks; (b) a market value-weighted index of the three stocks; (c) an equally weighted index of the three stocks; (d) Suppose at t = 0, you started a portfolio consisting of $2,500 in stock A, $2,500 in stock B and $5,000 in stock C. Suppose also that you did not change your positions during the time period from t = 0 to t = 1. How many shares of each stock (A B and C) did you have in your portfolio? What is the rate of return of your portfolio for this period? Is your portfolio's return reflected by the return of one of the indices from (a), (b) and (c)? Which one? Give an explaination based on the proportion of money invested in each stock in your portfolio. (e) Suppose instead, at time t = 0, you want to invest a total of $14,000 in the three stocks. You want your portfolio to mimic the return of the market value weighted index in the period from t = 0 to t = 1. How many shares of each stock would you have in your portfolio and why? 3. Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $50,000 with probability 0.6 or $150,000 with probability 0.4. The alternative riskless investment in T-bill pays 5%. (a) If you require a risk premium of 10%, how much will you be willing to pay for the portfolio? (b) Suppose the portfolio can be purchased for the amount you found in (a). What will be the expected rate of return on the portfolio? (c) Now suppose you require a risk premium of 15%. What is the price you will be willing to pay now? (d) Comparing your answers to (a) and (c), what do you conclude about the relationship between the required risk premium on a portfolio and the price at which the portfolio will sell? UL 1. Consider the three stocks in the following table. Pt represents price per share at time t, and Qt represents shares outstanding at time t (in millions). A B C | P. 50 50 100 Qo 100 200 200 Pi 55 45 110 Qi 100 200 200 For the first period (t = 0 to t= 1), compute rates of return on: (a) a price-weighted index of the three stocks; (b) a market value-weighted index of the three stocks; (c) an equally weighted index of the three stocks; (d) Suppose at t = 0, you started a portfolio consisting of $2,500 in stock A, $2,500 in stock B and $5,000 in stock C. Suppose also that you did not change your positions during the time period from t = 0 to t = 1. How many shares of each stock (A B and C) did you have in your portfolio? What is the rate of return of your portfolio for this period? Is your portfolio's return reflected by the return of one of the indices from (a), (b) and (c)? Which one? Give an explaination based on the proportion of money invested in each stock in your portfolio. (e) Suppose instead, at time t = 0, you want to invest a total of $14,000 in the three stocks. You want your portfolio to mimic the return of the market value weighted index in the period from t = 0 to t = 1. How many shares of each stock would you have in your portfolio and why