Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Consider the Allen and Gale model of contagion, where the storage asset allows the costless transfer of one unit from one time period

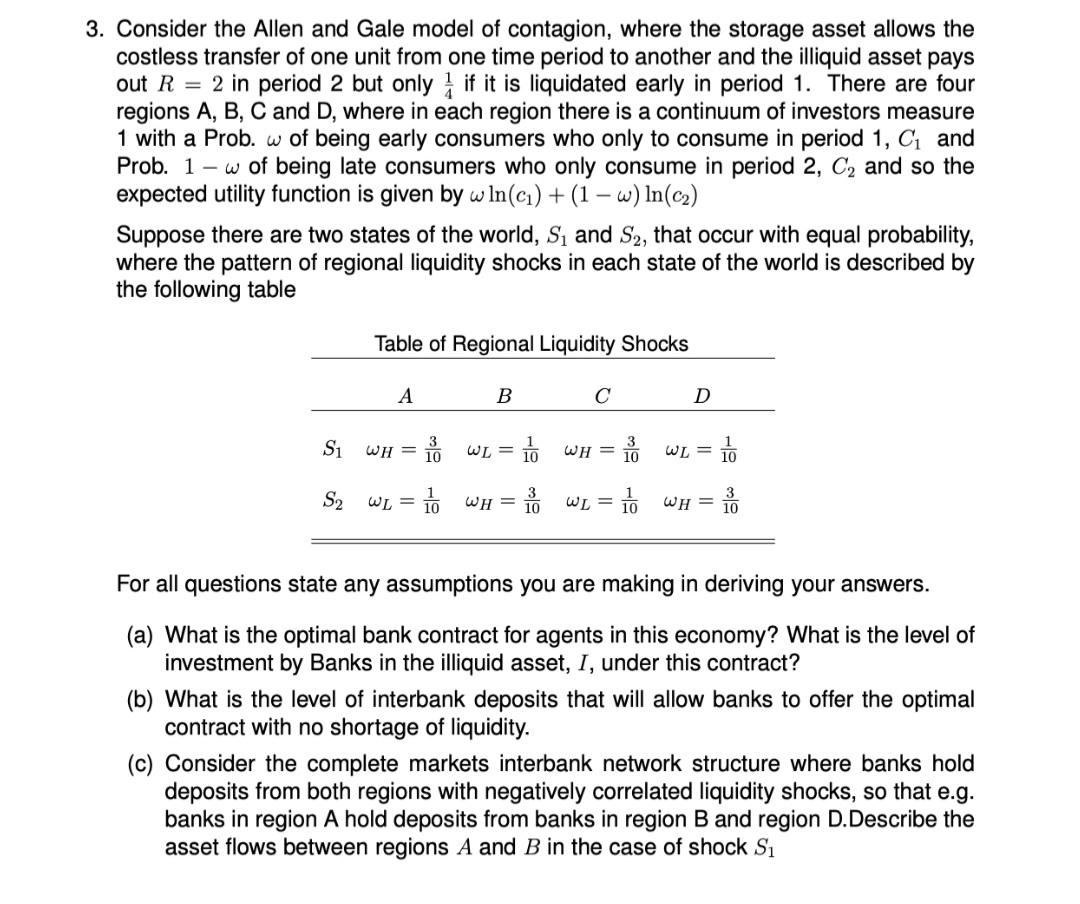

3. Consider the Allen and Gale model of contagion, where the storage asset allows the costless transfer of one unit from one time period to another and the illiquid asset pays out R = 2 in period 2 but only 1 if it is liquidated early in period 1. There are four regions A, B, C and D, where in each region there is a continuum of investors measure 1 with a Prob. w of being early consumers who only to consume in period 1, C and Prob. 1w of being late consumers who only consume in period 2, C and so the expected utility function is given by wln(c) + (1 - w) In(c2) Suppose there are two states of the world, S and S2, that occur with equal probability, where the pattern of regional liquidity shocks in each state of the world is described by the following table Table of Regional Liquidity Shocks A B C D S1 WH = WL = 110 WH = 311 WL = S2 WL = 10 WH = 11 WL = WH = 39 For all questions state any assumptions you are making in deriving your answers. (a) What is the optimal bank contract for agents in this economy? What is the level of investment by Banks in the illiquid asset, I, under this contract? (b) What is the level of interbank deposits that will allow banks to offer the optimal contract with no shortage of liquidity. (c) Consider the complete markets interbank network structure where banks hold deposits from both regions with negatively correlated liquidity shocks, so that e.g. banks in region A hold deposits from banks in region B and region D.Describe the asset flows between regions A and B in the case of shock S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the optimal bank contract for agents in this economy we need to consider the optimal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started