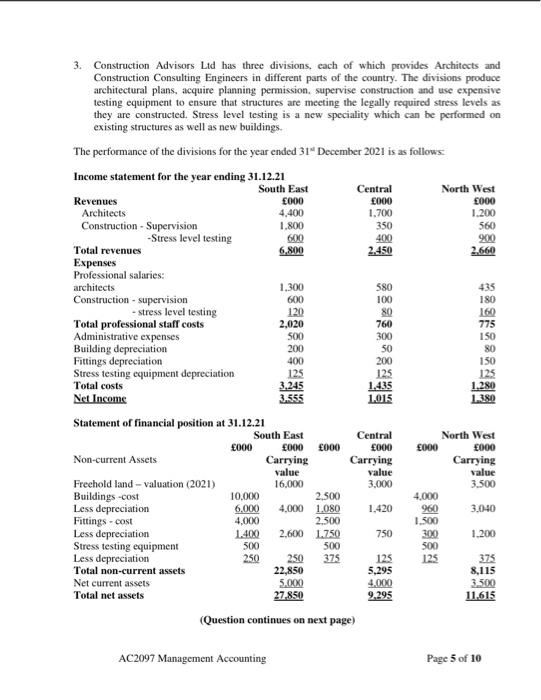

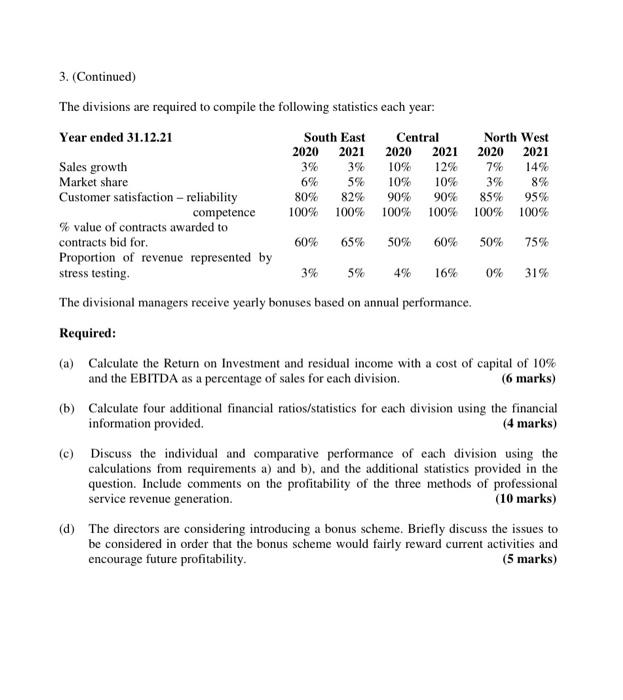

3. Construction Advisors Ltd has three divisions, each of which provides Architects and Construction Consulting Engineers in different parts of the country. The divisions produce architectural plans, acquire planning permission, supervise construction and use expensive testing equipment to ensure that structures are meeting the legally required stress levels as they are constructed. Stress level testing is a new speciality which can be performed on existing structures as well as new buildings The performance of the divisions for the year ended 31 December 2021 is as follows Income statement for the year ending 31.12.21 South East Central North West Revenues 000 000 2000 Architects 4,400 1.700 1.200 Construction - Supervision 1.800 350 560 -Stress level testing 400 900 Total revenues 6,800 2.660 Expenses Professional salaries: architects 1,300 580 435 Construction - supervision 600 100 180 -stress level testing 120 80 160 Total professional staff costs 2,020 760 775 Administrative expenses 500 300 150 Building depreciation 200 50 SO Fittings depreciation 400 200 150 Stress testing equipment depreciation 125 125 125 Total costs 3.245 1.280 Net Income 3.555 1015 Statement of financial position at 31.12.21 South East Central North West 000 000 000 000 000 000 Non-current Assets Carrying Carrying Carrying value value value Freehold land - valuation (2021) 16.000 3,000 3.500 Buildings -cost 10.000 2,500 4,000 Less depreciation 6,000 4,000 1,080 1,420 960 3.040 Fittings -cost 4.000 2.500 1.500 Less depreciation 1.400 2.600 1.750 750 300 1.200 Stress testing equipment 500 500 500 Less depreciation 250 250 375 125 125 375 Total non-current assets 22,850 5,295 8,115 Net current assets 5.000 4.000 3.500 Total net assets 27,850 11,615 (Question continues on next page) 1.435 1380 2.295 AC2097 Management Accounting Page 5 of 10 2020 3. (Continued) The divisions are required to compile the following statistics each year: Year ended 31.12.21 South East Central North West 2020 2021 2020 2021 2021 Sales growth 3% 3% 10% 12% 7% 14% Market share 6% 5% 10% 10% 3% 8% Customer satisfaction - reliability 80% 82% 90% 90% 85% 95% competence 100% 100% 100% 100% 100% 100% % value of contracts awarded to contracts bid for. 65% 50% 60% 50% 75% Proportion of revenue represented by stress testing. 3% 5% 4% 16% 0% 31% The divisional managers receive yearly bonuses based on annual performance. Required: (a) Calculate the Return on Investment and residual income with a cost of capital of 10% and the EBITDA as a percentage of sales for each division. (6 marks) 60% (b) Calculate four additional financial ratios/statistics for each division using the financial information provided. (4 marks) (c) Discuss the individual and comparative performance of each division using the calculations from requirements a) and b), and the additional statistics provided in the question. Include comments on the profitability of the three methods of professional service revenue generation. (10 marks) (d) The directors are considering introducing a bonus scheme. Briefly discuss the issues to be considered in order that the bonus scheme would fairly reward current activities and encourage future profitability