Answered step by step

Verified Expert Solution

Question

1 Approved Answer

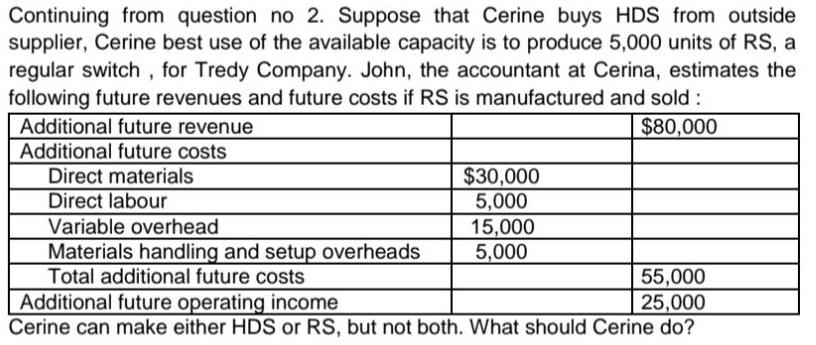

Continuing from question no 2. Suppose that Cerine buys HDS from outside supplier, Cerine best use of the available capacity is to produce 5,000

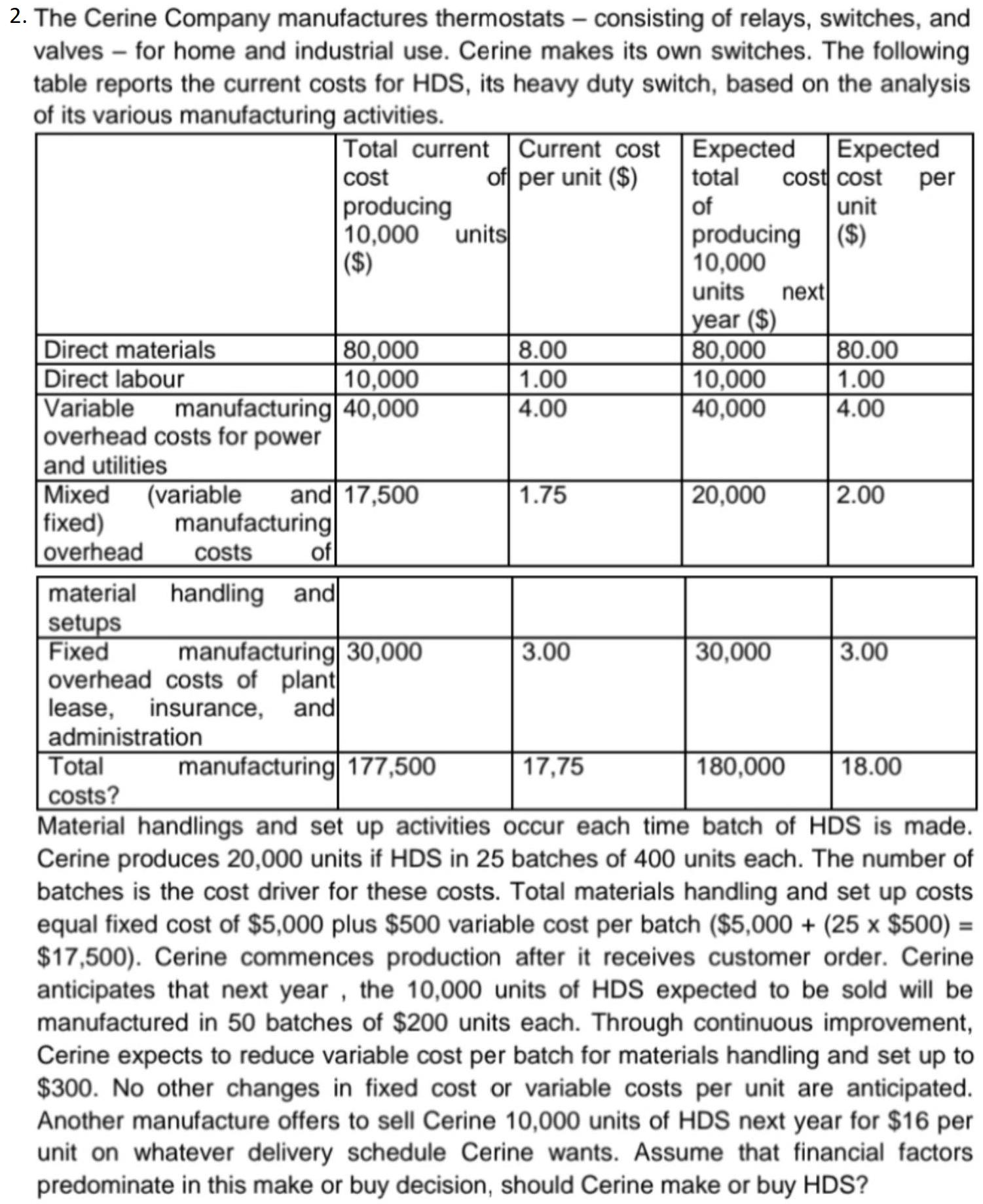

Continuing from question no 2. Suppose that Cerine buys HDS from outside supplier, Cerine best use of the available capacity is to produce 5,000 units of RS, a regular switch , for Tredy Company. John, the accountant at Cerina, estimates the following future revenues and future costs if RS is manufactured and sold : Additional future revenue Additional future costs Direct materials Direct labour $80,000 $30,000 5,000 15,000 5,000 Variable overhead Materials handling and setup overheads Total additional future costs 55,000 25,000 Cerine can make either HDS or RS, but not both. What should Cerine do? Additional future operating income 2. The Cerine Company manufactures thermostats consisting of relays, switches, and valves for home and industrial use. Cerine makes its own switches. The following table reports the current costs for HDS, its heavy duty switch, based on the analysis of its various manufacturing activities. Total current Current cost Expected cost producing 10,000 units ($) Expected cost cost unit of per unit ($) total per of producing ($) 10,000 units next year ($) 80,000 10,000 40,000 Direct materials Direct labour Variable overhead costs for power and utilities Mixed fixed) 80,000 10,000 manufacturing 40,000 80.00 1.00 8.00 1.00 4.00 4.00 (variable and 17,500 1.75 20,000 2.00 manufacturing overhead costs of material handling and setups Fixed overhead costs of plant lease, insurance, and administration Total costs? Material handlings and set up activities occur each time batch of HDS is made. Cerine produces 20,000 units if HDS in 25 batches of 400 units each. The number of batches is the cost driver for these costs. Total materials handling and set up costs equal fixed cost of $5,000 plus $500 variable cost per batch ($5,000 + (25 x $500) = $17,500). Cerine commences production after it receives customer order. Cerine anticipates that next year, the 10,000 units of HDS expected to be sold will be manufactured in 50 batches of $200 units each. Through continuous improvement, Cerine expects to reduce variable cost per batch for materials handling and set up to $300. No other changes in fixed cost or variable costs per unit are anticipated. Another manufacture offers to sell Cerine 10,000 units of HDS next year for $16 per unit on whatever delivery schedule Cerine wants. Assume that financial factors predominate in this make or buy decision, should Cerine make or buy HDS? manufacturing 30,000 3.00 30,000 3.00 manufacturing 177,500 17,75 180,000 18.00

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Compare cost to make HDS computed in requirement 2 per 5000 units and cost to make RS and choose to produce with the lower cost to make Cost to make is computed by dividing total cost in 10000 units then multiply to 5000 unit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started