Answered step by step

Verified Expert Solution

Question

1 Approved Answer

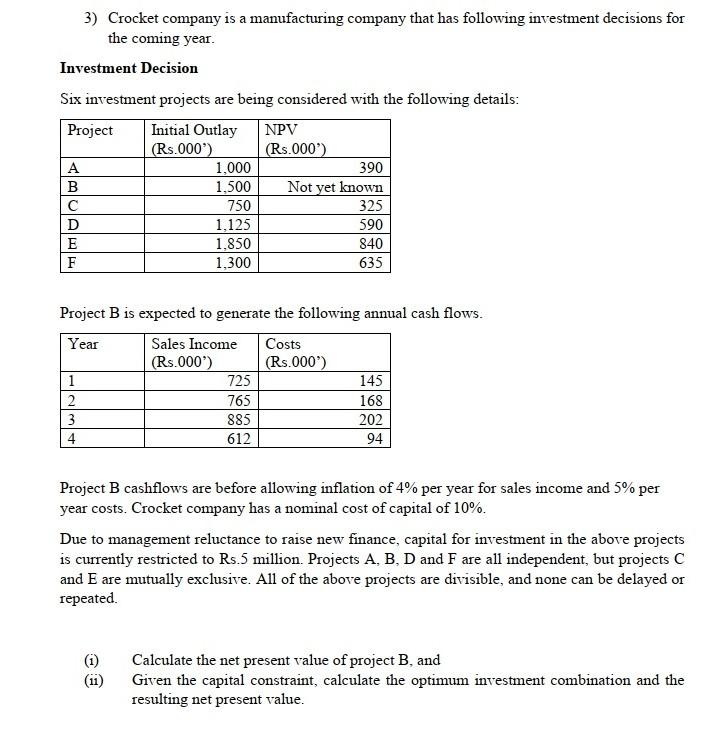

3) Crocket company is a manufacturing company that has following investment decisions for the coming year. Investment Decision Six investment projects are being considered with

3) Crocket company is a manufacturing company that has following investment decisions for the coming year. Investment Decision Six investment projects are being considered with the following details: Project Initial Outlay NPV (Rs.000) (Rs.000) A 1,000 390 B 1,500 Not yet known 750 325 D 1.125 590 E 1,850 840 F 1,300 635 Project B is expected to generate the following annual cash flows. Year Sales Income Costs (Rs.000) (Rs.000) 1 725 145 2 765 168 3 885 202 4 612 94 Project B cashflows are before allowing inflation of 4% per year for sales income and 5% per year costs. Crocket company has a nominal cost of capital of 10%. Due to management reluctance to raise new finance, capital for investment in the above projects is currently restricted to Rs.5 million. Projects A, B, D and F are all independent, but projects C and E are mutually exclusive. All of the above projects are divisible, and none can be delayed or repeated. (1) (11) Calculate the net present value of project B, and Given the capital constraint, calculate the optimum investment combination and the resulting net present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started