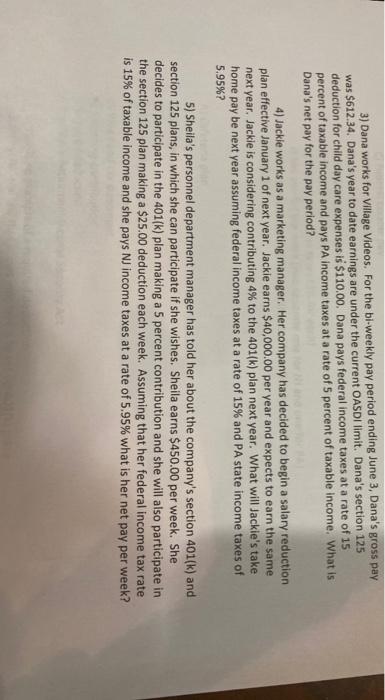

3) Dana works for Village Videos. For the bi-weekly pay period ending June 3, Dana's gross pay was $612.34. Dana's year to date earnings are under the current OASDI limit. Dana's section 125 deduction for child day care expenses is $110.00. Dana pays federal income taxes at a rate of 15 percent of taxable income and pays PA income taxes at a rate of 5 percent of taxable income. What is Dana's net pay for the pay period? 4) Jackie works as a marketing manager. Her company has decided to begin a salary reduction plan effective January 1 of next year. Jackie earns $40,000.00 per year and expects to earn the same next year. Jackie is considering contributing 4% to the 401(k) plan next year. What will Jackie's take home pay be next year assuming federal income taxes at a rate of 15% and PA state income taxes of 5.95%? 5) Sheila's personnel department manager has told her about the company's section 401(k) and section 125 plans, in which she can participate if she wishes, Sheila earns $450.00 per week. She decides to participate in the 401(k) plan making a 5 percent contribution and she will also participate in the section 125 plan making a $25.00 deduction each week. Assuming that her federal income tax rate is 15% of taxable income and she pays NJ income taxes at a rate of 5.95% what is her net pay per week? 3) Dana works for Village Videos. For the bi-weekly pay period ending June 3, Dana's gross pay was $612.34. Dana's year to date earnings are under the current OASDI limit. Dana's section 125 deduction for child day care expenses is $110.00. Dana pays federal income taxes at a rate of 15 percent of taxable income and pays PA income taxes at a rate of 5 percent of taxable income. What is Dana's net pay for the pay period? 4) Jackie works as a marketing manager. Her company has decided to begin a salary reduction plan effective January 1 of next year. Jackie earns $40,000.00 per year and expects to earn the same next year. Jackie is considering contributing 4% to the 401(k) plan next year. What will Jackie's take home pay be next year assuming federal income taxes at a rate of 15% and PA state income taxes of 5.95%? 5) Sheila's personnel department manager has told her about the company's section 401(k) and section 125 plans, in which she can participate if she wishes, Sheila earns $450.00 per week. She decides to participate in the 401(k) plan making a 5 percent contribution and she will also participate in the section 125 plan making a $25.00 deduction each week. Assuming that her federal income tax rate is 15% of taxable income and she pays NJ income taxes at a rate of 5.95% what is her net pay per week