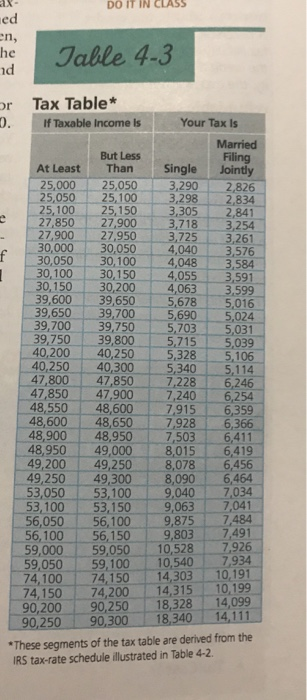

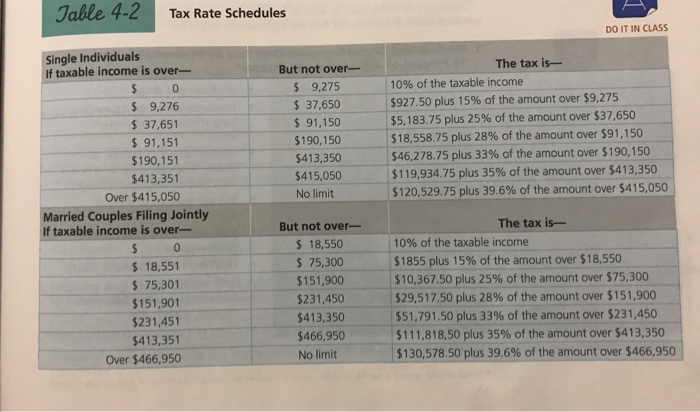

3. Determine Tax Liability. Find the tax liabilities based on the taxable income of the following people: (a) married couple, $92,225; (b) married couple, $74,170; (c) , DO IT IN CLASS single person, $27,880; (d) single person, Page 129 $56,060. (Hint: Use Table 4-3.) E- DO IT IN CLASS led en, Table 4-3 ad or Tax Table* If Taxable income is Your Tax Is Married But Less Filing At Least Than Single Jointly 25,000 25,050 3,290 2,826 25,050 25,100 3,298 2,834 25,100 25,150 3,305 2,841 27,850 27,900 3,718 3,254 27,900 27,950 3,725 3,261 30,000 30,050 4,040 3,576 30,050 30,100 4,048 3,584 30, 100 30,150 4,055 3,591 30,150 30,200 4,063 3.599 39,600 39,650 5,678 5,016 39,650 39,700 5,690 5,024 39,700 39.750 5,703 5,031 39,750 39,800 5,715 5,039 40,200 40,250 5,328 5,106 40,250 40,300 5,3401 5,114 47,800 47,850 7,228 6,246 47,850 47,900 7,240 6,254 48,550 48,600 7.915 6,359 48,600 48,650 7,928 6,366 48,900 48,950 7,503 6,411 48,950 49,000 8,015 6,419 49,200 49,250 8,078 6,456 49,250 49,300 8,090 6,464 53,050 53,100 9,040 7,034 53,100 53,150 9,063 7,041 56,050 56,100 9,875 7,484 56,100 56,150 9,803 7,491 59,000 59,050 10,528 7,926 59,050 59,100 7,934 74,100 74,150 14,303 10,191 74,15074,200 14,315 10.199 90,200 90,250 18,328 14,099 90.250 90.300 18.340 14,111 *These segments of the tax table are derived from the IRS tax-rate schedule illustrated in Table 4-2. 10,540 Table 4.2 Tax Rate Schedules DO IT IN CLASS But not over- $ 9,275 $ 37,650 $ 91,150 $190,150 $413,350 $415,050 No limit The tax is- 10% of the taxable income $927.50 plus 15% of the amount over $9,275 $5,183.75 plus 25% of the amount over $37,650 $18,558.75 plus 28% of the amount over $91,150 $46,278.75 plus 33% of the amount over $190,150 $119,934.75 plus 35% of the amount over $413,350 $120,529.75 plus 39.6% of the amount over $415,050 Single Individuals If taxable income is over- 0 $ 9,276 $ 37,651 $ 91,151 $190,151 $413,351 Over $415,050 Married couples Filing Jointly If taxable income is over- $ 0 $ 18,551 $ 75,301 $151,901 $231,451 $413,351 Over $466,950 But not over- $ 18,550 $ 75,300 $151,900 $231,450 $413,350 $466,950 No limit The tax is- 10% of the taxable income $1855 plus 15% of the amount over $18,550 $10,367.50 plus 25% of the amount over $75,300 $29,517.50 plus 28% of the amount over $151,900 $51,791.50 plus 33% of the amount over $231,450 $111,818,50 plus 35% of the amount over $413,350 $130,578.50 plus 39.6% of the amount over $466,950