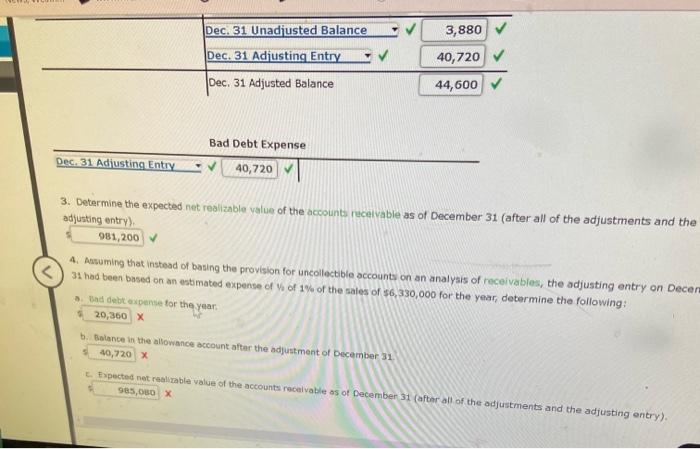

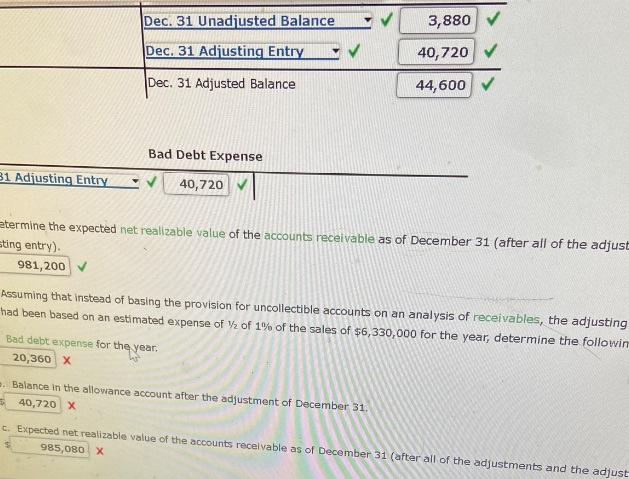

3. Determine the expected net reslizable value of the accounts recelvable as of December 31 (after all of the adjustments and the adfustina entrul. 4. Aasuming that instead of basing the provision for uncollectible accounts on an analyais of receivables, the adjusting entry on Dece 31 had been based on an estmated expense of w of 1% of the sates of 56,330,000 for the year, determine the following: Bad debt evpense tor the year. x b. Balance in the allowance account after the adjustment of December 31 x Expected nat ravalimble value of the accounts roceivable os of December 31 (after all of the odjustments and the adjusting entry). etermine the expected net realizable value of the accounts recelvable as of December 31 (after all of the adjust ting entry). Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables, the adjusting had been based on an estimated expense of 1/2 of 1% of the sales of $6,330,000 for the year, determine the followin Bad debt expense for the year. x Balance in the allowance account after the adjustment of December 31 x c. Expected nat raalizable value of the accounts recelvable as of December 31 (after all of the adjustments and the adjust 3. Determine the expected net reslizable value of the accounts recelvable as of December 31 (after all of the adjustments and the adfustina entrul. 4. Aasuming that instead of basing the provision for uncollectible accounts on an analyais of receivables, the adjusting entry on Dece 31 had been based on an estmated expense of w of 1% of the sates of 56,330,000 for the year, determine the following: Bad debt evpense tor the year. x b. Balance in the allowance account after the adjustment of December 31 x Expected nat ravalimble value of the accounts roceivable os of December 31 (after all of the odjustments and the adjusting entry). etermine the expected net realizable value of the accounts recelvable as of December 31 (after all of the adjust ting entry). Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables, the adjusting had been based on an estimated expense of 1/2 of 1% of the sales of $6,330,000 for the year, determine the followin Bad debt expense for the year. x Balance in the allowance account after the adjustment of December 31 x c. Expected nat raalizable value of the accounts recelvable as of December 31 (after all of the adjustments and the adjust