Answered step by step

Verified Expert Solution

Question

1 Approved Answer

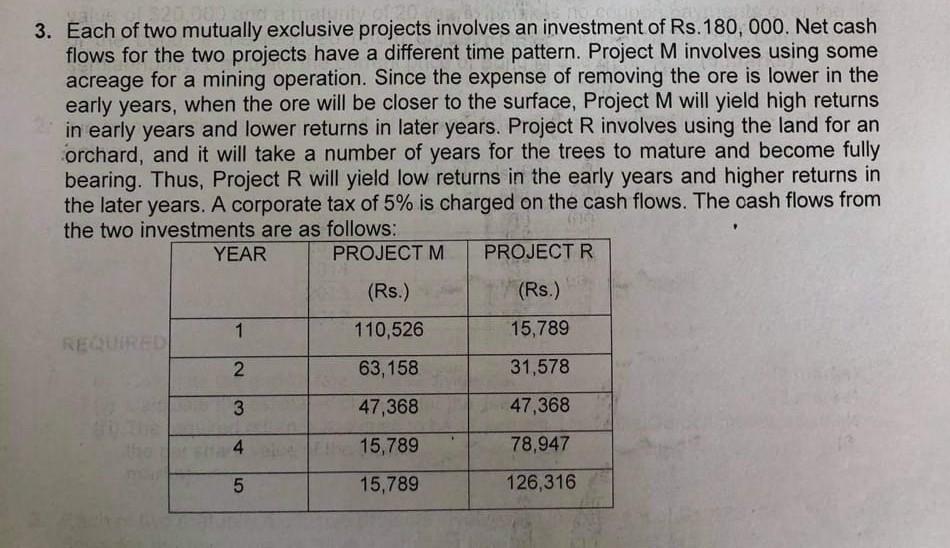

3. Each of two mutually exclusive projects involves an investment of Rs. 180, 000. Net cash flows for the two projects have a different time

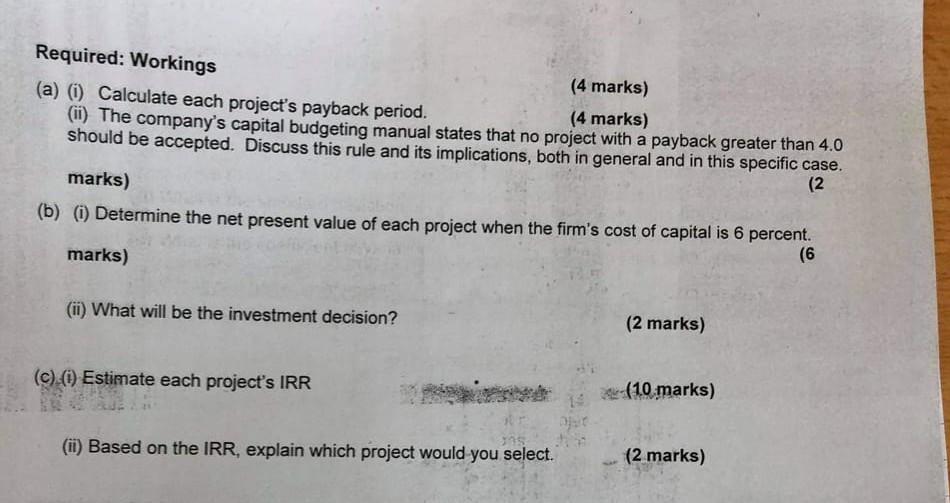

3. Each of two mutually exclusive projects involves an investment of Rs. 180, 000. Net cash flows for the two projects have a different time pattern. Project M involves using some acreage for a mining operation. Since the expense of removing the ore is lower in the early years, when the ore will be closer to the surface, Project M will yield high returns in early years and lower returns in later years. Project R involves using the land for an orchard, and it will take a number of years for the trees to mature and become fully bearing. Thus, Project R will yield low returns in the early years and higher returns in the later years. A corporate tax of 5% is charged on the cash flows. The cash flows from the two investments are as follows: YEAR PROJECT M PROJECT R (Rs.) (Rs.) 110,526 1 15,789 2 63,158 31,578 3 47,368 47,368 4 115,789 78,947 5 15,789 126,316 Required: Workings (4 marks) (a) (0) Calculate each project's payback period. (4 marks) (ii) The company's capital budgeting manual states that no project with a payback greater than 4.0 should be accepted. Discuss this rule and its implications, both in general and in this specific case. (2 marks) (b) (i) Determine the net present value of each project when the firm's cost of capital is 6 percent. marks) (6 (ii) What will be the investment decision? (2 marks) (C).() Estimate each project's IRR (10 marks) (ii) Based on the IRR, explain which project would you select. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started