Answered step by step

Verified Expert Solution

Question

1 Approved Answer

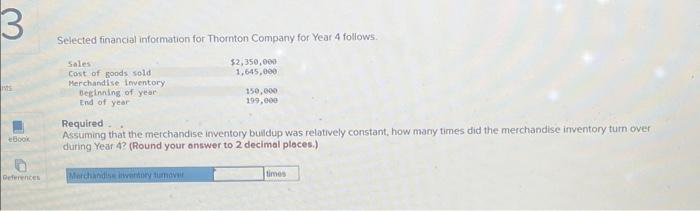

3 eBook Selected financial information for Thornton Company for Year 4 follows. Sales Cost of goods sold Merchandise Inventory Beginning of year End of

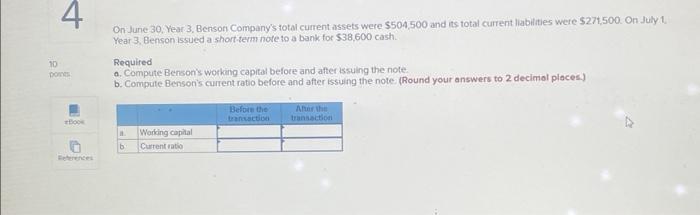

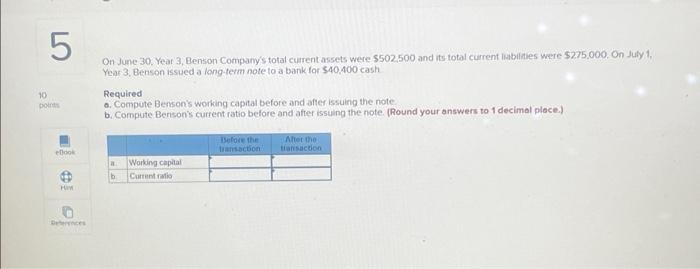

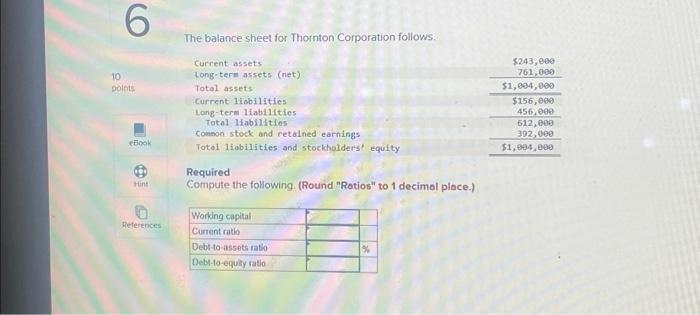

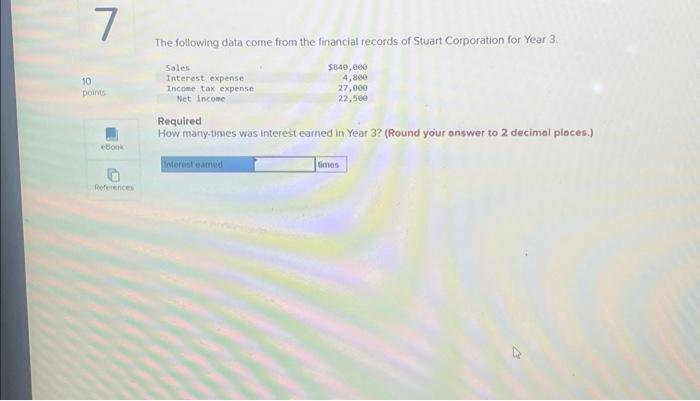

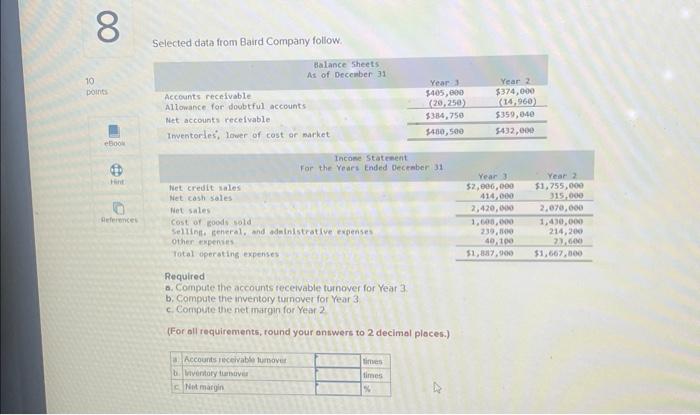

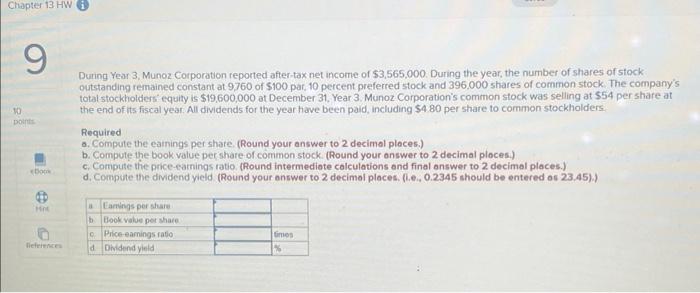

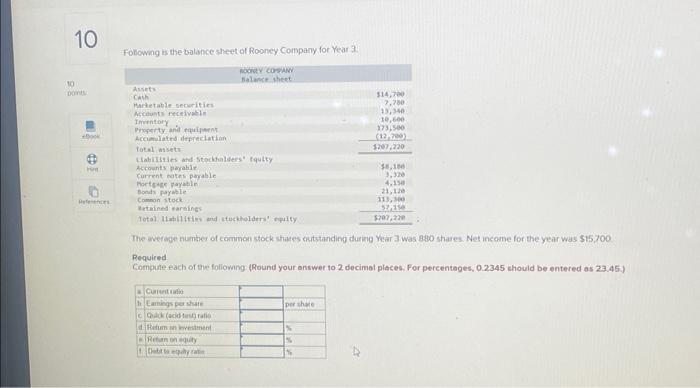

3 eBook Selected financial information for Thornton Company for Year 4 follows. Sales Cost of goods sold Merchandise Inventory Beginning of year End of year Required. $2,350,000 1,645,000 150,000 199,000 Assuming that the merchandise inventory buildup was relatively constant, how many times did the merchandise inventory turn over during Year 4? (Round your answer to 2 decimal places.) Deferences Merchandise inventory turnover times 4 10 pos On June 30, Year 3, Benson Company's total current assets were $504,500 and its total current liabilities were $271,500. On July 1, Year 3, Benson issued a short-term note to a bank for $38,600 cash. Required a. Compute Benson's working capital before and after issuing the note b. Compute Benson's current ratio before and after issuing the note. (Round your answers to 2 decimal places.) Before the transaction After the transaction Book Working capital b Current ratio References 5 10 points On June 30, Year 3, Benson Company's total current assets were $502,500 and its total current liabilities were $275,000. On July 1, Year 3, Benson issued a long-term note to a bank for $40,400 cash Required a. Compute Benson's working capital before and after issuing the note b. Compute Benson's current ratio before and after issuing the note. (Round your answers to 1 decimal place.) ellook Before the transaction After the transaction a Working capital b. Current ratio Deferences 6 10 points The balance sheet for Thornton Corporation follows. Current assets Long-term assets (net) $243,000 761,000 Total assets Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings eBook Total liabilities and stockholders' equity Hint Required Compute the following. (Round "Ratios" to 1 decimal place.) Working capital References Current ratio Debt-to-assets ratio Debt-to-equity ratio $1,004,000 $156,000 456,000 512,000 392,000 $1,004,000 10 7 points eBook The following data come from the financial records of Stuart Corporation for Year 3. Sales Interest expense Income tax expense Net income Required $840,000 4,800 27,000 22,500 How many-times was interest earned in Year 3? (Round your answer to 2 decimal places.) Interest earned times References 8 10 points Selected data from Baird Company follow. Accounts receivable Allowance for doubtful accounts Net accounts receivable Balance Sheets As of December 311 Year 3 $405,000 Year 2 $374,000 (20,250) (14,960) $384,750 $359,040 $480,500 $432,000 Inventories, lower of cost or market eBook Income Statement For the Years Ended December 31 Hint Net credit sales Year 3 $2,000,000 Net sales References Net cash sales Cost of goods sold Selling, general, and administrative expenses Other expenses 414,000 Year 2 $3,755,000 315,000 2,420,000 2.070,000 1,600,000 1,430,000 239,500 40,100 214,200 23,600 Total operating expenses Required $1,887,900 $1,667,000 a. Compute the accounts receivable turnover for Year 3. b. Compute the inventory turnover for Year 3 c. Compute the net margin for Year 2 (For all requirements, round your answers to 2 decimal places.) a Accounts receivable turnover biventory turnover Not margin times times % Chapter 13 HW i 9 10 points book During Year 3, Munoz Corporation reported after-tax net income of $3,565,000. During the year, the number of shares of stock outstanding remained constant at 9,760 of $100 par, 10 percent preferred stock and 396,000 shares of common stock. The company's total stockholders' equity is $19,600,000 at December 31, Year 3. Munoz Corporation's common stock was selling at $54 per share at the end of its fiscal year. All dividends for the year have been paid, including $4.80 per share to common stockholders. Required a. Compute the earnings per share. (Round your answer to 2 decimal places.) b. Compute the book value per share of common stock. (Round your answer to 2 decimal places.) c. Compute the price-earnings ratio. (Round intermediate calculations and final answer to 2 decimal places.) d. Compute the dividend yield (Round your answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) a Eamings per share - Hint b Book value per share c Price-earnings ratio Gimes lieferences d Dividend yield % 10 Following is the balance sheet of Rooney Company for Year 3 ROONEY COMPANY 10 points Assets Cash Marketable securities Accounts receivable Inventory Balance sheet $14,700 7,780 13,340 10,600 Book Property and equipment Accumulated depreciation Total assets Clabilities and Stockholders' Equity H Accounts payable Current notes payable Mortgage payable 173,500 (12,700) $207,220 $8,100 3,326 4,150 Bonds payable References Common stock Betained earnings Total liabilities and stockholders' equity 21,120 113,300 57,150 $207,220 The average number of common stock shares outstanding during Year 3 was 880 shares. Net income for the year was $15,700 Required Compute each of the following (Round your answer to 2 decimal places. For percentages, 0.2345 should be entered as 23.45.) Current Eamings per share c Quick (acid test) ratio d Refum on lovestment Rehan on equity Debt to epulty rat per share % % %

Step by Step Solution

★★★★★

3.38 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Average inventory Beginning inventory Ending inventory2 Merchandise inventory tur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started