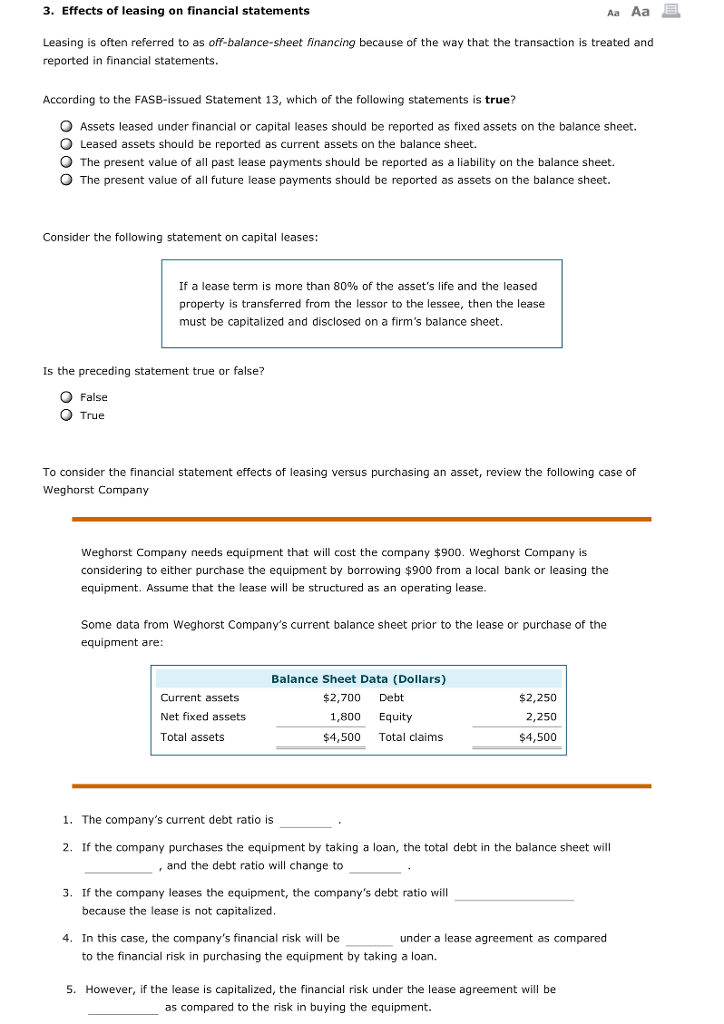

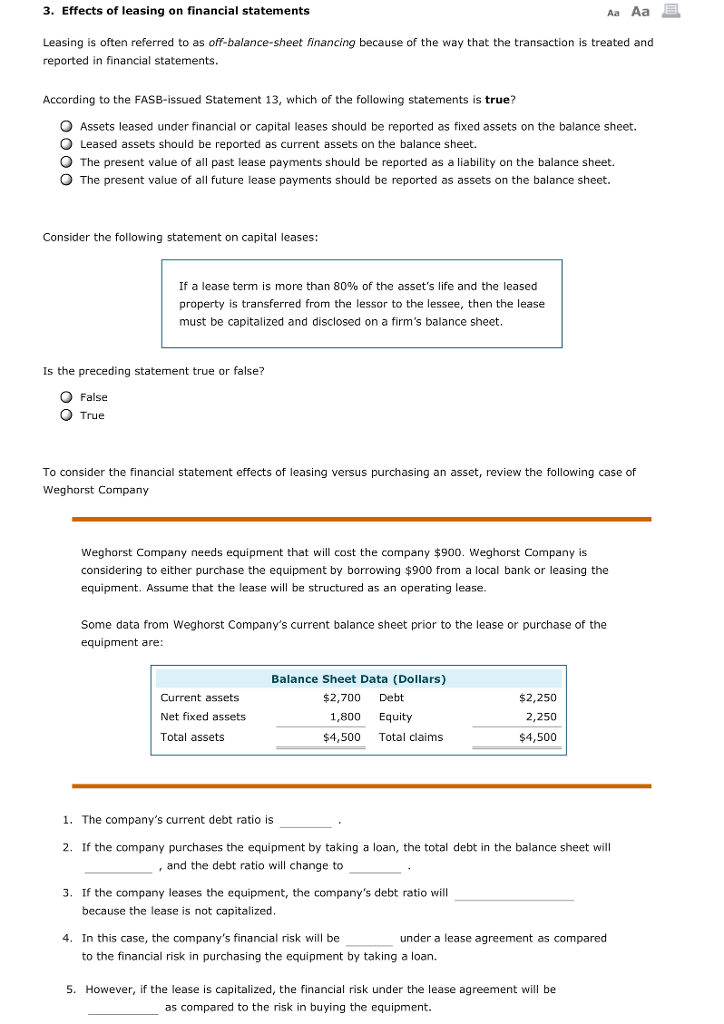

3. Effects of leasing on financial statements Aa Aa Leasing is often referred to as off-balance-sheet financing because of the way that the transaction is treated and reported in financial statements According to the FASB-issued Statement 13, which of the following statements is true? O Assets leased under financial or capital leases should be reported as fixed assets on the balance sheet. O Leased assets should be reported as current assets on the balance sheet. O The present value of all past lease payments should be reported as a liability on the balance sheet. O The present value of all future lease payments should be reported as assets on the balance sheet. Consider the following statement on capital leases: If a lease term is more than 80% of the asset's life and the leased property is transferred from the lessor to the lessee, then the lease must be capitalized and disclosed on a firm's balance sheet Is the preceding statement true or false? O False O True To consider the financial statement effects of leasing versus purchasing an asset, review the following case of Weghorst Company Weghorst Company needs equipment that will cost the company $900. Weghorst Company is considering to either purchase the equipment by borrowing $900 from a local bank or leasing the equipment. Assume that the lease will be structured as an operating lease Some data from Weghorst Company's current balance sheet prior to the lease or purchase of the equipment are Balance Sheet Data (Dollars) $2,700 Debt Current assets Net fixed assets Total assets 1,800 Equity $4,500 Total claims $2,250 2,250 $4,500 1. The company's current debt ratio is 2. If the company purchases the equipment by taking a loan, the total debt in the balance sheet will and the debt ratio will change to 3. If the company leases the equipment, the company's debt ratio will because the lease is not capitalized 4. In this case, the company's financial risk will be under a lease agreement as compared to the financial risk in purchasing the equipment by taking a loan. S. However, if the lease is capitalized, the financial risk under the lease agreement will be as compared to the risk in buying the equipment