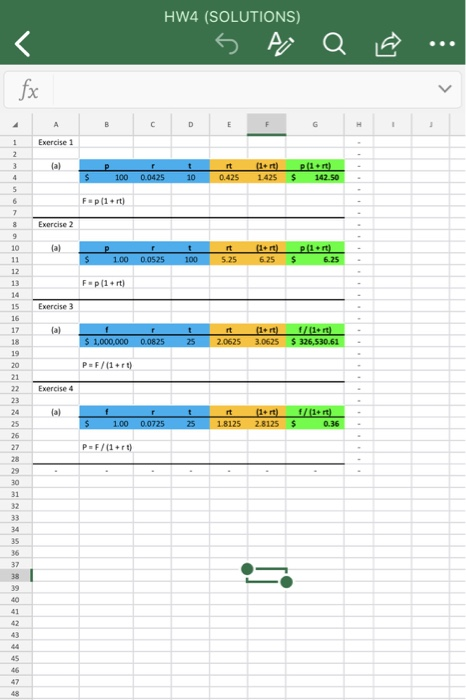

The questions are supposed to be done in excel. Also, if you could please make it look like the second photo thatll really be appropriated. :)

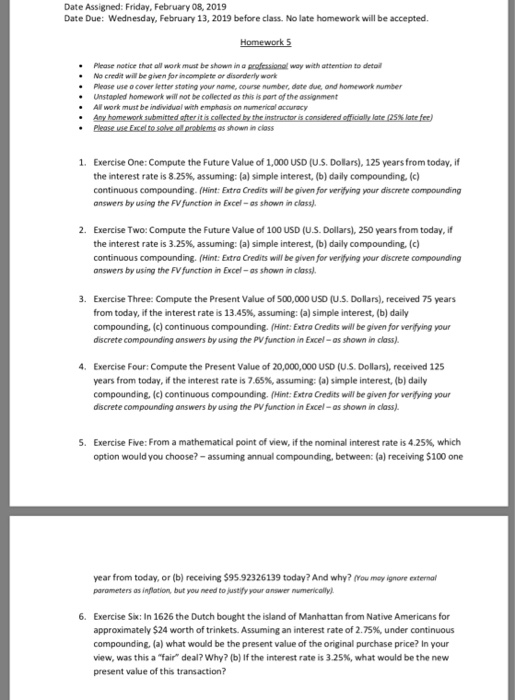

Date Assigned: Friday, February 08, 2019 Date Due: Wednesday, February 13, 2019 before class. No late homework will be accepted. Homework S * Please notice that all work mut be shown in @ 1mional way with attention to detal No credit will be given for incomplete or disorderly work Please use o cover letter stating your nome, course number, date due and homework number Unstapled homework will not be collected as this is port of the assignment e .All work must be individual with emphasis on numerical accuracy 1. Exercise One: Compute the Future Value of 1,000 USD (U.S. Dollars), 125 years from today, if the interest rate is 8.25%, assuming: (a) simple interest, (b) daily compounding, (c) continuous compounding. (Hint: Extra Credits will be given for veridying your discrete compounding answers by using the FV function in Excel-as shown in class 2. Exercise Two: Compute the Future Value of 100 USD (U.S. Dollars), 250 years from today, if the interest rate is 3.25%, assuming: (a) simple interest, (b) daily compounding, (c) continuous compounding. (Hint: Extra Credits will be given for verfying your discrete compounding answers by using the FV function in Excel-as shown in class) 3. Exercise Three: Compute the Present Value of 500,000 USD (U.S. Dollars), received 75 years from today, if the interest rate is 13.45%, assuming: (a) simple interest, (b) daily compounding, (c) continuous compounding. (Hint: Extra Credits will be given for verfying your dscrete compounding answers by using the PV function in Excel- as shown in class) 4. Exercise Four: Compute the Present Value of 20,000,000 USD (U.S. Dollars), received 125 years from today, if the interest rate is 7.65%, assuming: (a) simple interest, (b) daily compounding, (c) continuous compounding. (Hint: Extra Credits will be given for verifying your discrete compounding answers by using the PV function in Excel-as shown in class) 5, Exercise Five: From a mathematical point of view, if the nominal interest rate is 4.25%, which option would you choose?- assuming annual compounding, between: (a) receiving $100 one year from today, or (b) receiving $95.92326139 today? And why? (You may ignore external parometers as inflation, but you need to justify your answer numenically 6. Exercise Six: In 1626 the Dutch bought the island of Manhattan from Native Americans for approximately $24 worth of trinkets. Assuming an interest rate of 2.75%, under continuous compounding, (a) what would be the present value of the original purchase price? In your view, was this a "fair" deal? Why? (b) if the interest rate is 3.25%, what would be the new present value of this transaction? HW4 (SOLUTIONS) B .. fx Exercise 1 Fap(1 rt Exercise 2 10 (a) 15 Exercise 3 16 17 1,000,000 0.0 22 Exercise 4 24 a) 3s