Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Entity H acquired 80% of Entity S's ordinary shares on 1 July 2020. The purchase consideration given at the date of acquisition was

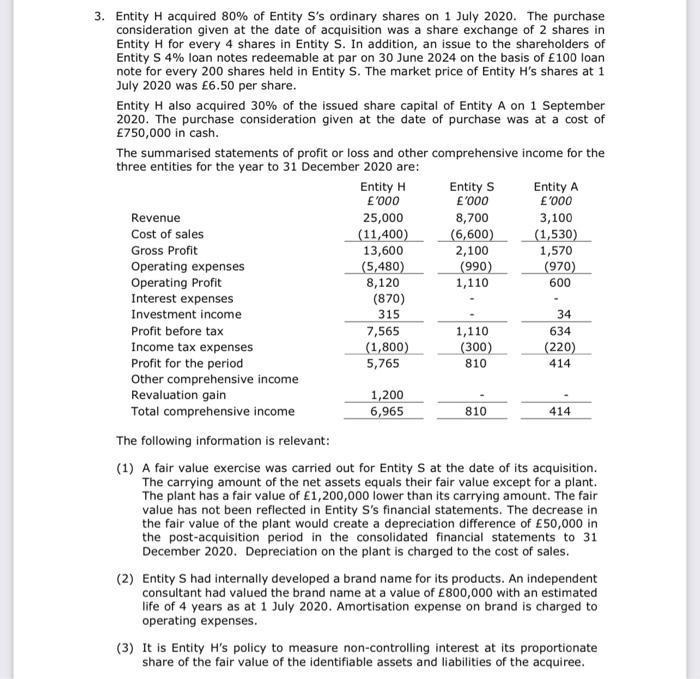

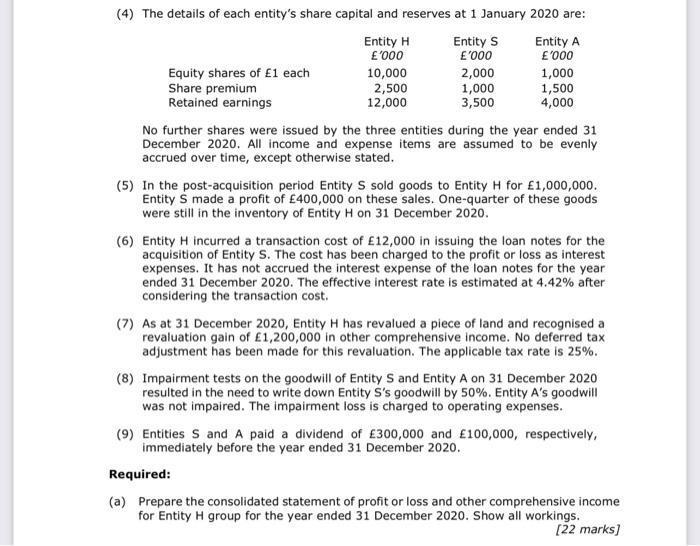

3. Entity H acquired 80% of Entity S's ordinary shares on 1 July 2020. The purchase consideration given at the date of acquisition was a share exchange of 2 shares in Entity H for every 4 shares in Entity S. In addition, an issue to the shareholders of Entity S 4% loan notes redeemable at par on 30 June 2024 on the basis of 100 loan note for every 200 shares held in Entity S. The market price of Entity H's shares at 1 July 2020 was 6.50 per share. Entity H also acquired 30% of the issued share capital of Entity A on 1 September 2020. The purchase consideration given at the date of purchase was at a cost of 750,000 in cash. The summarised statements of profit or loss and other comprehensive income for the three entities for the year to 31 December 2020 are: Entity H E'000 Entity S E'000 Entity A '000 Revenue 25,000 8,700 3,100 (6,600) 2,100 (990) 1,110 (1,530) 1,570 (970) 600 Cost of sales (11,400) 13,600 Gross Profit Operating expenses Operating Profit Interest expenses (5,480) 8,120 (870) 315 Investment income 34 Profit before tax 7,565 1,110 634 Income tax expenses Profit for the period (1,800) 5,765 (300) (220) 810 414 Other comprehensive income Revaluation gain Total comprehensive income 1,200 6,965 810 414 The following information is relevant: (1) A fair value exercise was carried out for Entity S at the date of its acquisition. The carrying amount of the net assets equals their fair value except for a plant. The plant has a fair value of 1,200,000 lower than its carrying amount. The fair value has not been reflected in Entity S's financial statements. The decrease in the fair value of the plant would create a depreciation difference of 50,000 in the post-acquisition period in the consolidated financial statements to 31 December 2020. Depreciation on the plant is charged to the cost of sales. (2) Entity S had internally developed a brand name for its products. An independent consultant had valued the brand name at a value of 800,000 with an estimated life of 4 years as at 1 July 2020. Amortisation expense on brand is charged to operating expenses. (3) It is Entity H's policy to measure non-controlling interest at its proportionate share of the fair value of the identifiable assets and liabilities of the acquiree. (4) The details of each entity's share capital and reserves at 1 January 2020 are: Entity H '000 Entity S E'000 Entity A '000 Equity shares of 1 each Share premium Retained earnings 2,000 1,000 3,500 10,000 2,500 12,000 1,000 1,500 4,000 No further shares were issued by the three entities during the year ended 31 December 2020. All income and expense items are assumed to be evenly accrued over time, except otherwise stated. (5) In the post-acquisition period Entity S sold goods to Entity H for 1,000,000. Entity S made a profit of 400,000 on these sales. One-quarter of these goods were still in the inventory of Entity H on 31 December 2020. (6) Entity H incurred a transaction cost of 12,000 in issuing the loan notes for the acquisition of Entity S. The cost has been charged to the profit or loss as interest expenses. It has not accrued the interest expense of the loan notes for the year ended 31 December 2020. The effective interest rate is estimated at 4.42% after considering the transaction cost. (7) As at 31 December 2020, Entity H has revalued a piece of land and recognised a revaluation gain of 1,200,000 in other comprehensive income. No deferred tax adjustment has been made for this revaluation. The applicable tax rate is 25%. (8) Impairment tests on the goodwill of Entity S and Entity A on 31 December 2020 resulted in the need to write down Entity S's goodwill by 50%. Entity A's goodwill was not impaired. The impairment loss is charged to operating expenses. (9) Entities S and A paid a dividend of 300,000 and 100,000, respectively, immediately before the year ended 31 December 2020. Required: (a) Prepare the consolidated statement of profit or loss and other comprehensive income for Entity H group for the year ended 31 December 2020. Show all workings. [22 marks)

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

claim amount received will not be treated as extraordinary item AS5 Revised furtherstates ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started