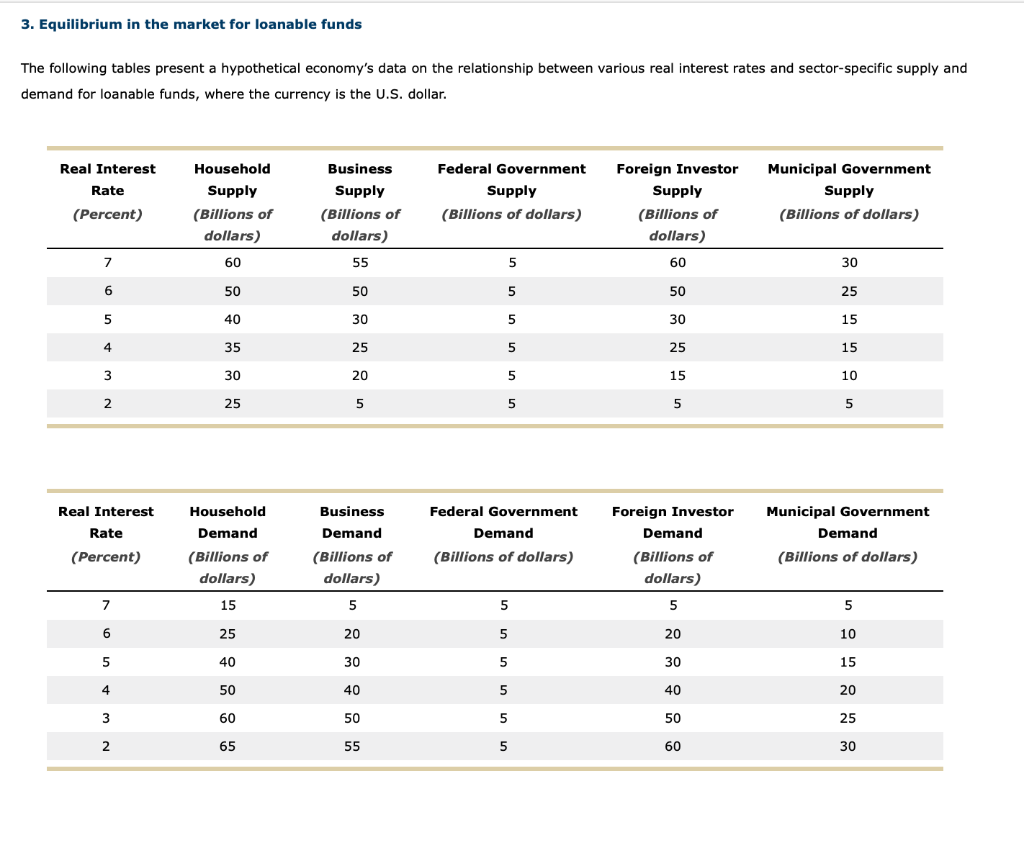

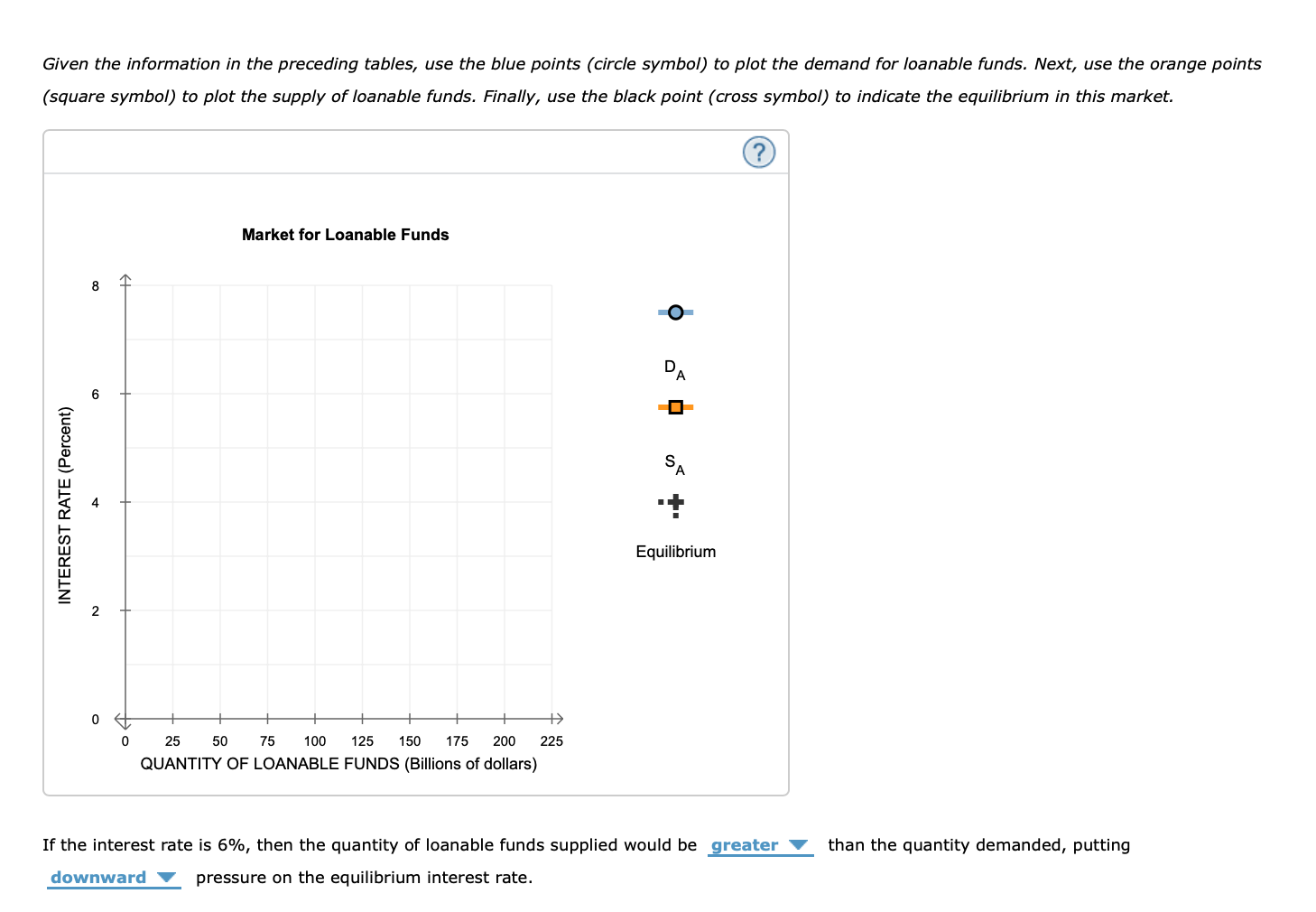

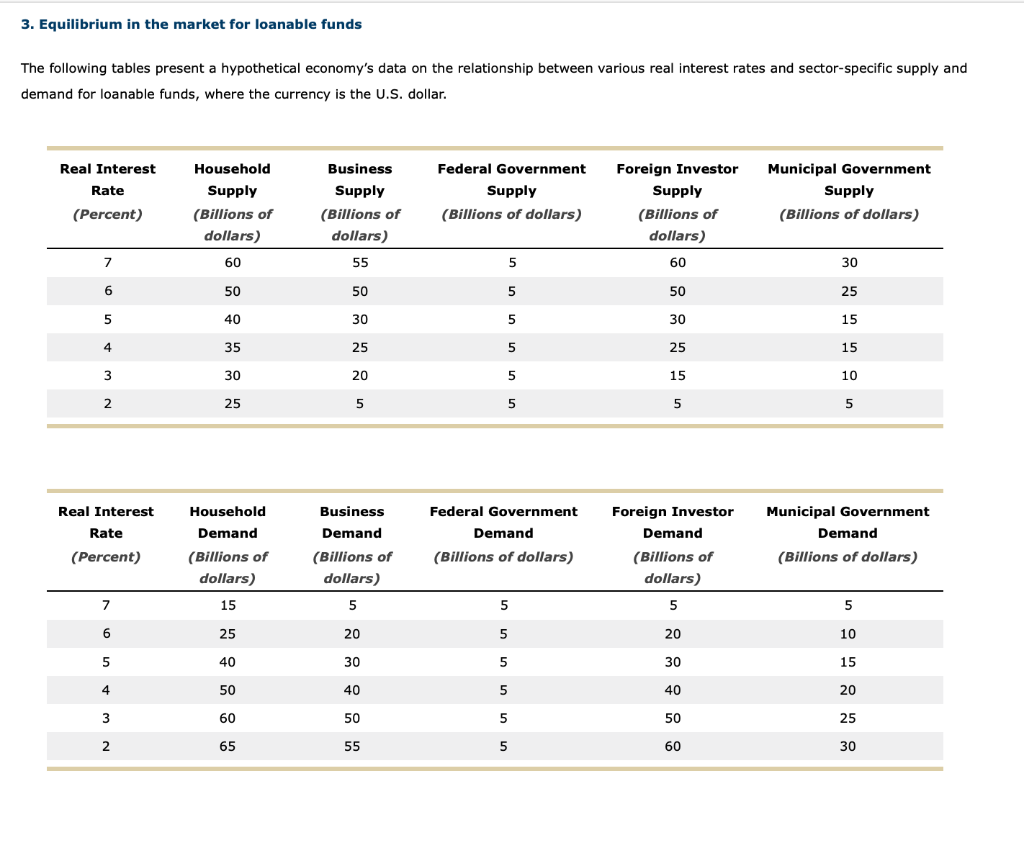

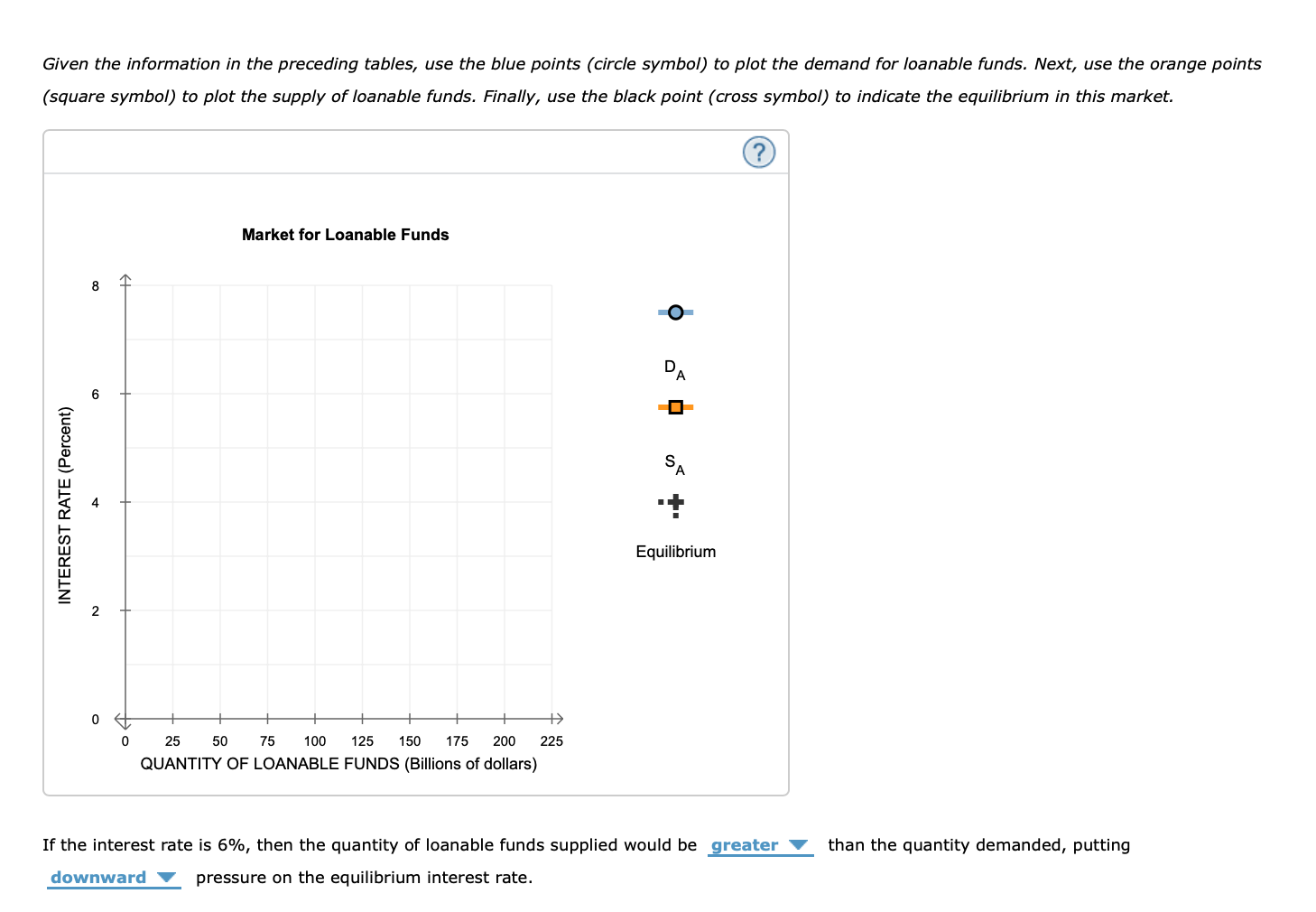

3. Equilibrium in the market for loanable funds The following tables present a hypothetical economy's data on the relationship between various real interest rates and sector-specific supply and demand for loanable funds, where the currency is the U.S. dollar. Real Interest Rate (Percent) Household Supply (Billions of dollars) Business Supply (Billions of dollars) Federal Government Supply (Billions of dollars) Foreign Investor Supply (Billions of dollars) Municipal Government Supply (Billions of dollars) 7 60 55 5 60 30 6 50 50 5 50 25 5 40 30 5 30 15 4 35 25 5 25 15 3 30 20 5 15 10 2 25 5 5 5 5 Real Interest Rate (Percent) Household Demand (Billions of dollars) 15 Business Demand (Billions of dollars) Federal Government Demand (Billions of dollars) Foreign Investor Demand (Billions of dollars) Municipal Government Demand (Billions of dollars) 7 5 5 5 5 6 25 20 5 20 10 5 40 30 5 30 15 4 50 40 5 40 20 3 60 50 5 50 25 2 65 55 5 60 30 Given the information in the preceding tables, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. Market for Loanable Funds 8 D 6 INTEREST RATE (Percent) Equilibrium 2 0 57 0 => 25 50 75 100 125 150 175 200 225 QUANTITY OF LOANABLE FUNDS (Billions of dollars) than the quantity demanded, putting If the interest rate is 6%, then the quantity of loanable funds supplied would be greater downward pressure on the equilibrium interest rate. 3. Equilibrium in the market for loanable funds The following tables present a hypothetical economy's data on the relationship between various real interest rates and sector-specific supply and demand for loanable funds, where the currency is the U.S. dollar. Real Interest Rate (Percent) Household Supply (Billions of dollars) Business Supply (Billions of dollars) Federal Government Supply (Billions of dollars) Foreign Investor Supply (Billions of dollars) Municipal Government Supply (Billions of dollars) 7 60 55 5 60 30 6 50 50 5 50 25 5 40 30 5 30 15 4 35 25 5 25 15 3 30 20 5 15 10 2 25 5 5 5 5 Real Interest Rate (Percent) Household Demand (Billions of dollars) 15 Business Demand (Billions of dollars) Federal Government Demand (Billions of dollars) Foreign Investor Demand (Billions of dollars) Municipal Government Demand (Billions of dollars) 7 5 5 5 5 6 25 20 5 20 10 5 40 30 5 30 15 4 50 40 5 40 20 3 60 50 5 50 25 2 65 55 5 60 30 Given the information in the preceding tables, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. Market for Loanable Funds 8 D 6 INTEREST RATE (Percent) Equilibrium 2 0 57 0 => 25 50 75 100 125 150 175 200 225 QUANTITY OF LOANABLE FUNDS (Billions of dollars) than the quantity demanded, putting If the interest rate is 6%, then the quantity of loanable funds supplied would be greater downward pressure on the equilibrium interest rate