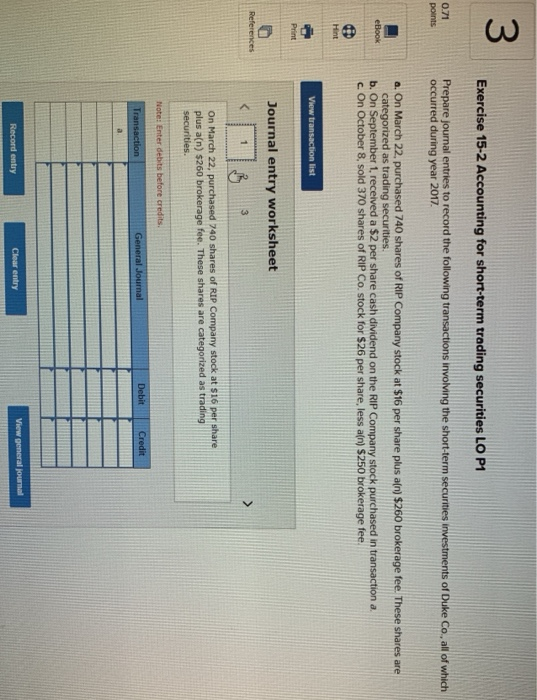

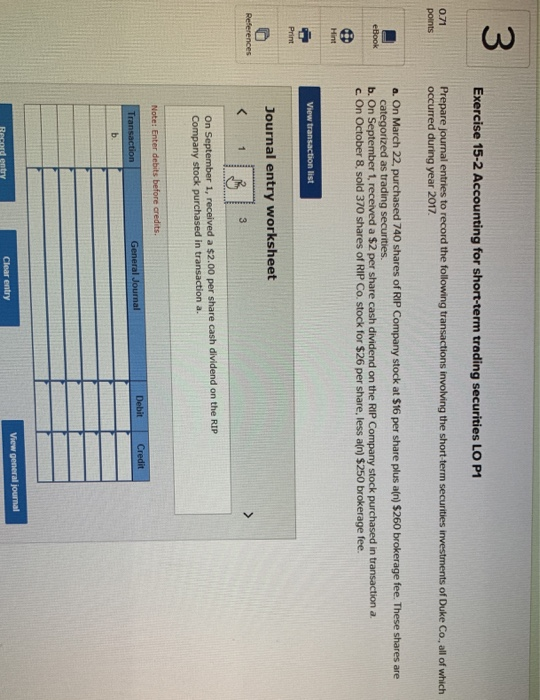

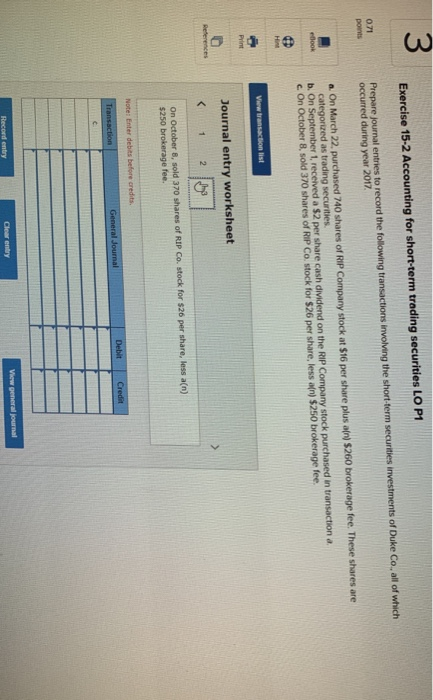

3 Exercise 15-2 Accounting for short-term trading securities LO P1 0.71 Prepare journal entries to record the following transactions involving the sh occurred during year 2017 ort-term securities investments of Duke Co, all of which a. On March 22 purchased 740 shares of RIP Company stock at $16 per share plus atn) $260 brokerage fee. These shares are categorized as trading securities. b. On September 1, received a $2 per share cash dividend on the RIP Company stock purchased in transaction a c. On October 8, sold 370 shares of RIP Co. stock for $26 per share, less a(n) $250 brokerage fee Journal entry worksheet On March 22, purchased 740 shares of RIP Company stock at s16 per share plus a(n) $260 brokerage fee. These shares are categorized as trading Clear entry 3 Exercise 15-2 Accounting for short-term trading securities LO P1 Prepare journal entries to record the following transactions involving the short term securities investments of Duke Co, all of which occurred during year 2017 0.71 points a. On March 22, purchased 740 shares of RIP Company stock at $16 per share plus a(n) $260 brokerage fee. These shares are categorized as trading securities. b. On September 1, received a $2 per share cash dividend on the RIP Company stock purchased in transaction a c On October 8, sold 370 shares of RIP Co. stock for $26 per share, less an) $250 brokerage fee. Journal entry worksheet On Company stock purchased in transaction a. Clear entry 3 Exercise 15-2 Accounting for short-term trading securities LO Pt Prepare journal entries to record the following transactions involving the short-term securities investments of Duke Co, all of which occurred during year 2017 071 ponts a On March 22, purchased 740 shares of RIP Company stock at $16 per share plus atn) $260 brokerage fee. These shares are categorized as trading securities b. On September 1, received a $2 per share cash dividend on the RIP Company stock purchased in transaction a c On October 8, sold 370 shares of RIP Co. stock for $26 per share, less atn) $250 brokerage fee Journal entry worksheet Rederences on October 8, sold 370 shares of RIP Co. stock for $26 per share, less a(n) $250 brokerage fee. Note: Enter debas Clear enry