Question

Fill in the sheet titled NPV-IRR. Lydia will buy the property in 2014, she will collect NOI for 5 years 2015-2019, and she will sell

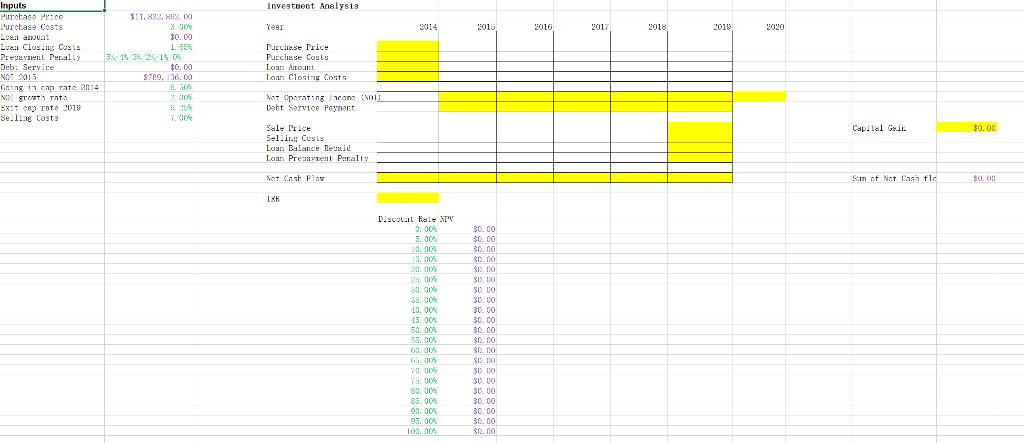

Fill in the sheet titled “NPV-IRR”. Lydia will buy the property in 2014, she will collect NOI for 5 years 2015-2019, and she will sell it in 2019.

Lydia’s loan has a 5/4/3/2/1 prepayment penalty structure, so if she prepays in the first year, she will pay a penalty equal to 5% of the balance, in the second year she will pay a penalty equal to 4% of the balance etc.

Lydia forecasts NOI will grow at 2% per year, compounded annually. Lydia forecasts she can sell the property in 2019 at a 6.25% cap rate. Recall: Sale Price in 2019=NOI 2020/Cap rate 2019

(3.a) How much will Lydia sell the property for in 2019?

(3.b) How much of a capital gain will Lydia earn? (Hint: capital gain = sale price – purchase price)

(3.c) What is Lydia’s IRR for this investment?

(3.d) If Lydia’s discount rate is 25%, what is her NPV? Should she make this investment?

(3.e) Plot Lydia’s NPV for discount rates 0%-100%. Copy and paste the chart below.

Inputs Purchase Price Purchase CostS Loan amount Luan Closing Costs Preuavent Penalty Debi Service NOT 2013 Gring in cap rate 2014 ww ND growth rata EXIT ce rate 2019 Selling Costs $11.832, 802, 00 3.00% $0.00 1..65% 3% 15/3/26/15/0% $0.00 $769. 136.00 8. 30% 10% 5. 25% 7.00% Investment Analysis Year Purchase Price Purchase Costs Loan Anount Loan Closing Costs Net Operating come (101) Debt Service Payment. Sale Price Selling Costs Loan Balance Reunid Loan Prenavnent Penalty Net Cash Flow IKK 2014 Discutat Rate NPV 0.00% 3.00% 10.00% 15.00% 20.00% 20.00% 30,00% 35.00% 40.00% 45.00% 50.00% 55.00% 60.00% 65.00% 20.00% 75.00% 80.00% 85.00% 90.00% 93.00% 100, 005 2015 30.00 30.00 $0.00 $0.00 SD. DO SD. DO 30.00 30.00 30.00 30.00 30.00 30.00 $0.00 $D 10 $0 00 30.00 30.00 30.00 30.00 30.00 $0.00 2016 2017 2018 2019 2020 Capital Gain Sum of Net Cash fle $0.00 $0.00

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Question Formulas NOINOI in previous year12 Net Cash Flow for each year Purchase Price Purchase Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started