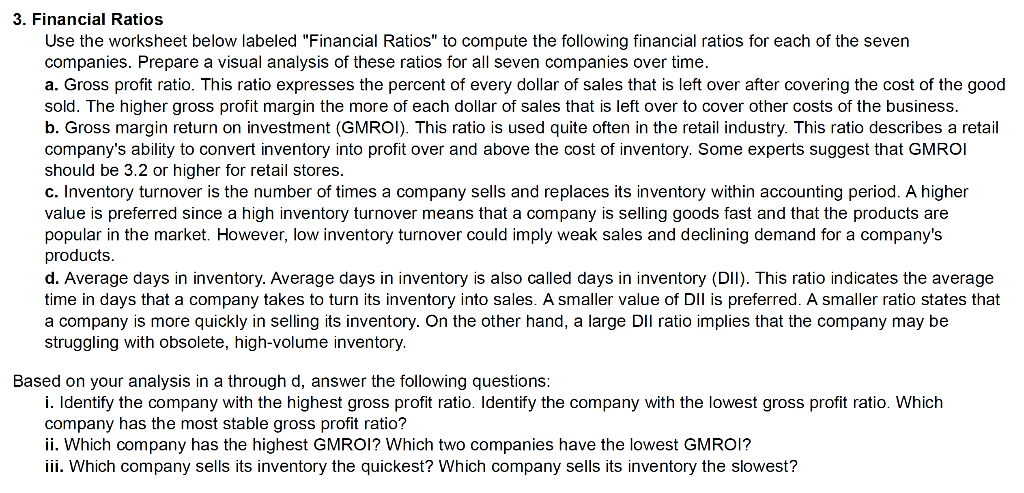

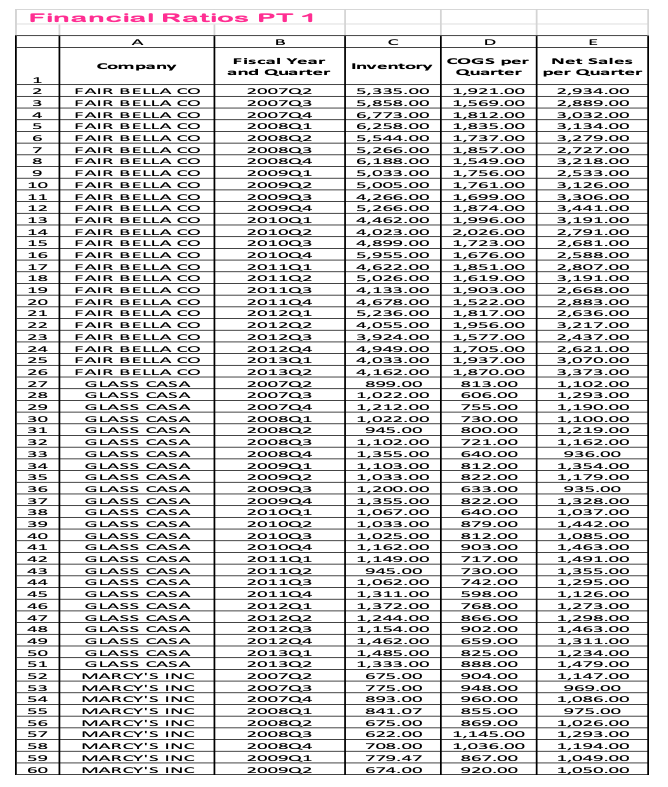

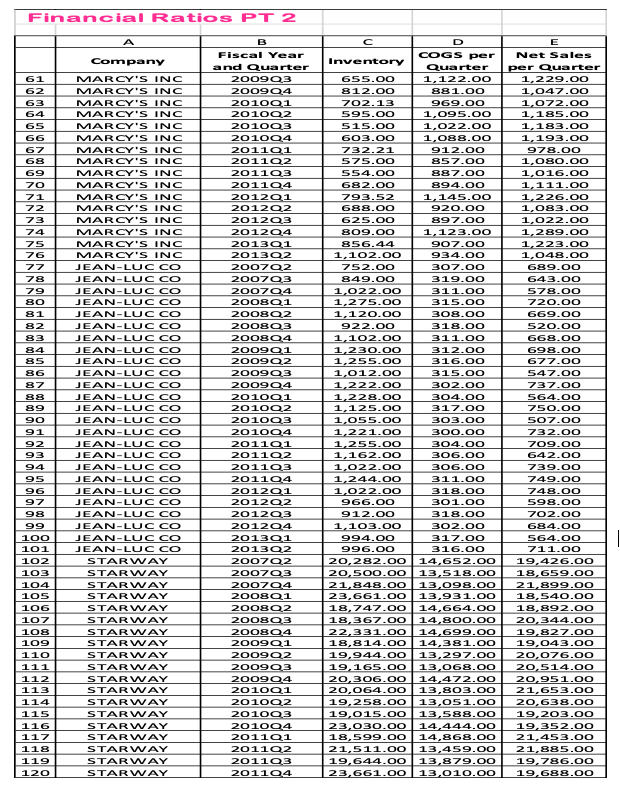

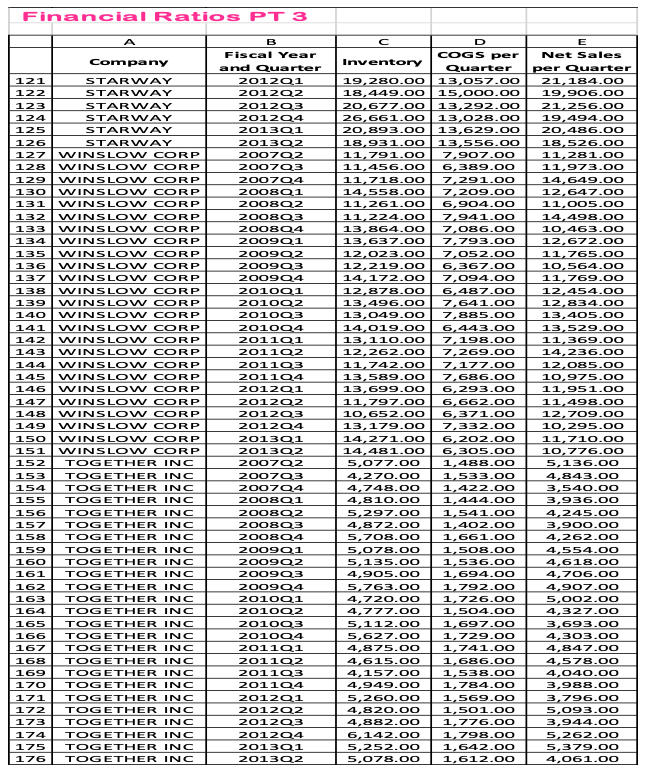

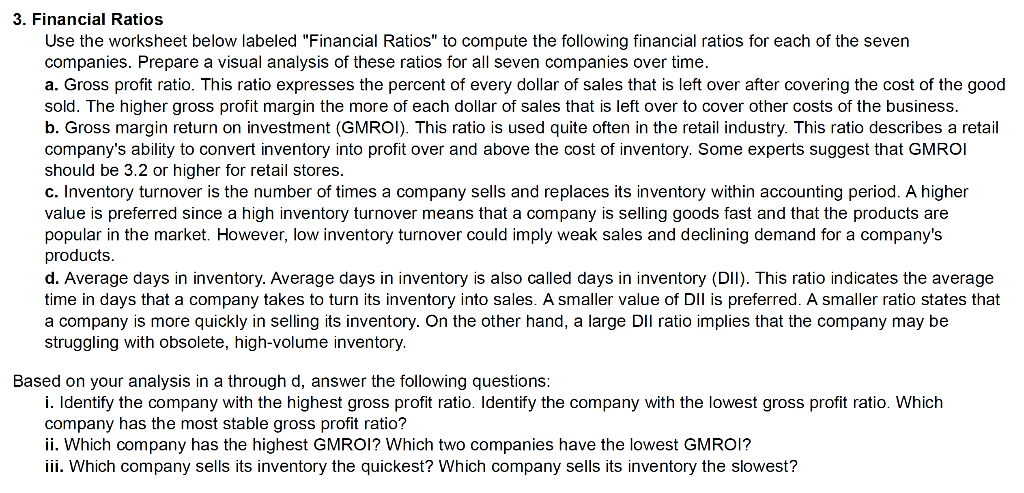

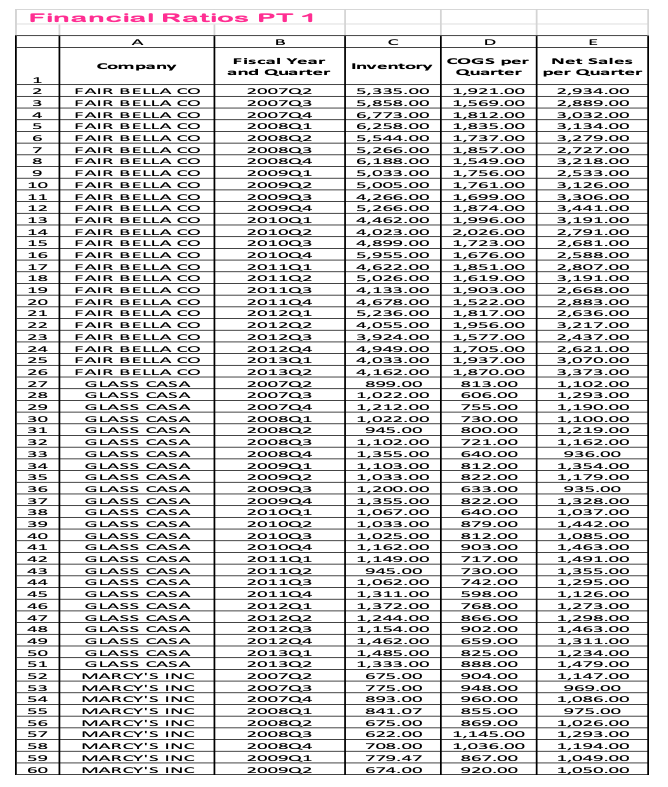

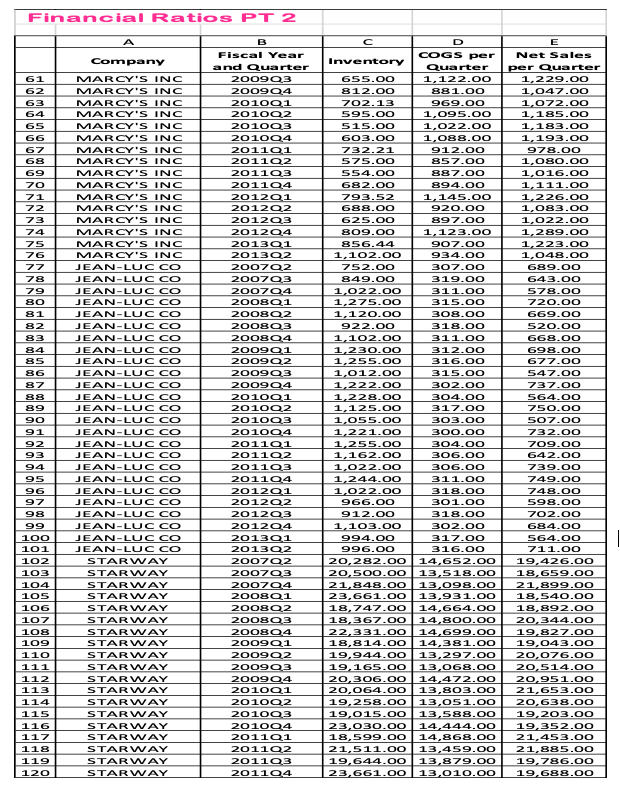

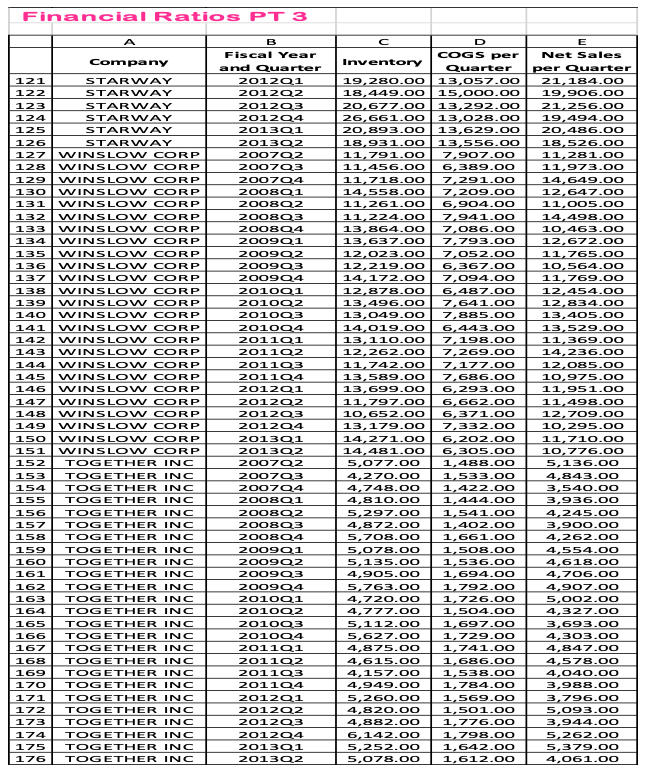

3. Financial Ratios Use the worksheet below labeled "Financial Ratios" to compute the following financial ratios for each of the seven companies. Prepare a visual analysis of these ratios for all seven companies over time. a. Gross profit ratio. This ratio expresses the percent of every dollar of sales that is left over after covering the cost of the good sold. The higher gross profit margin the more of each dollar of sales that is left over to cover other costs of the business. b. Gross margin return on investment (GMROI). This ratio is used quite often in the retail industry. This ratio describes a retail company's ability to convert inventory into profit over and above the cost of inventory. Some experts suggest that GMROI should be 3.2 or higher for retail stores. c. Inventory turnover is the number of times a company sells and replaces its inventory within accounting period. A higher value is preferred since a high inventory turnover means that a company is selling goods fast and that the products are popular in the market. However, low inventory turnover could imply weak sales and declining demand for a company's products. d. Average days in inventory. Average days in inventory is also called days in inventory (DII). This ratio indicates the average time in days that a company takes to turn its inventory into sales. A smaller value of DII is preferred. A smaller ratio states that a company is more quickly in selling its inventory. On the other hand, a large DII ratio implies that the company may be struggling with obsolete, high-volume inventory. Based on your analysis in a through d, answer the following questions: i. Identify the company with the highest gross profit ratio. Identify the company with the lowest gross profit ratio. Which company has the most stable gross profit ratio? ii. Which company has the highest GMROI? Which two companies have the lowest GMROI? iii. Which company sells its inventory the quickest? Which company sells its inventory the slowest? 3. Financial Ratios Use the worksheet below labeled "Financial Ratios" to compute the following financial ratios for each of the seven companies. Prepare a visual analysis of these ratios for all seven companies over time. a. Gross profit ratio. This ratio expresses the percent of every dollar of sales that is left over after covering the cost of the good sold. The higher gross profit margin the more of each dollar of sales that is left over to cover other costs of the business. b. Gross margin return on investment (GMROI). This ratio is used quite often in the retail industry. This ratio describes a retail company's ability to convert inventory into profit over and above the cost of inventory. Some experts suggest that GMROI should be 3.2 or higher for retail stores. c. Inventory turnover is the number of times a company sells and replaces its inventory within accounting period. A higher value is preferred since a high inventory turnover means that a company is selling goods fast and that the products are popular in the market. However, low inventory turnover could imply weak sales and declining demand for a company's products. d. Average days in inventory. Average days in inventory is also called days in inventory (DII). This ratio indicates the average time in days that a company takes to turn its inventory into sales. A smaller value of DII is preferred. A smaller ratio states that a company is more quickly in selling its inventory. On the other hand, a large DII ratio implies that the company may be struggling with obsolete, high-volume inventory. Based on your analysis in a through d, answer the following questions: i. Identify the company with the highest gross profit ratio. Identify the company with the lowest gross profit ratio. Which company has the most stable gross profit ratio? ii. Which company has the highest GMROI? Which two companies have the lowest GMROI? iii. Which company sells its inventory the quickest? Which company sells its inventory the slowest