Answered step by step

Verified Expert Solution

Question

1 Approved Answer

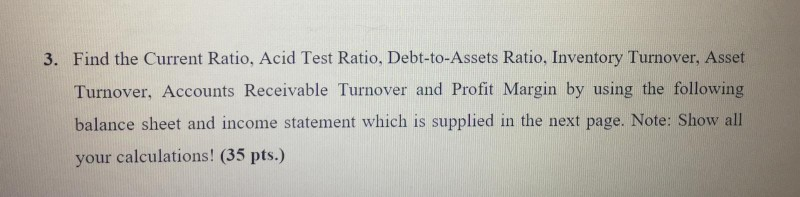

3. Find the Current Ratio, Acid Test Ratio, Debt-to-Assets Ratio, Inventory Turnover, Asset Turnover, Accounts Receivable Turnover and Profit Margin by using the following balance

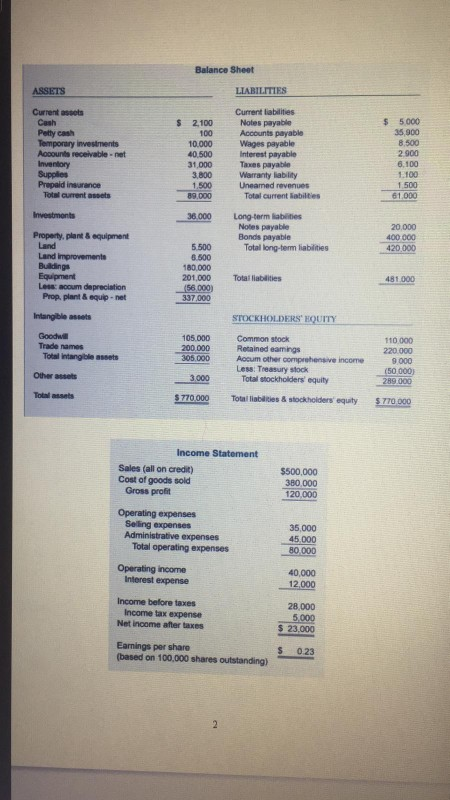

3. Find the Current Ratio, Acid Test Ratio, Debt-to-Assets Ratio, Inventory Turnover, Asset Turnover, Accounts Receivable Turnover and Profit Margin by using the following balance sheet and income statement which is supplied in the next page. Note: Show all your calculations! (35 pts.) Balance Sheet ASSETS LIABILITIES Current as Cash Potty cash Temporary investments Accounts receivable.net Inventory Supplies Prepaid insurance Total current assets $ 2.100 100 10.000 40.500 31,000 3.800 1,500 89.000 Current liabilities Notes payable Accounts payable Wages payable Interest payable Taxes payable Warranty liability Uneamed revenues Total current liabilities $ 5000 35 900 8.500 2900 6.100 1.100 1.500 61.000 Investments 36.000 Long-term labities Notes payable Bonds payable Total long-term liabilities 20.000 400 000 420.000 Property, plant & equipment Land Land improvements Buldinge Equipment Les acum depreciation Prop plant & equip-net 5.500 5.500 180.000 201,000 (56.000) 337.000 Total liabilities 481.000 Intangible assets STOCKHOLDERS' EQUITY Goodwie Trade names Total intangible assets 105.000 200.000 305.000 Common stock Retained earings Accum other comprehensive income Less Treasury stock Total stockholders equity 110 000 220.000 9000 (50 000) 289.000 Other assets 3.000 Total 5770.000 Total liabilities & stockholders equity 5.770 000 Income Statement Sales (all on credit) Cost of goods sold Gross profit $500,000 380.000 120.000 Operating expenses Selling expenses Administrative expenses Total operating expenses 35,000 45,000 80 000 Operating income Interest expense 40,000 12.000 Income before taxes Income tax expense Net income after taxes 28.000 5.000 $ 23,000 Earnings per share (based on 100,000 shares outstanding) $ 0.23 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started