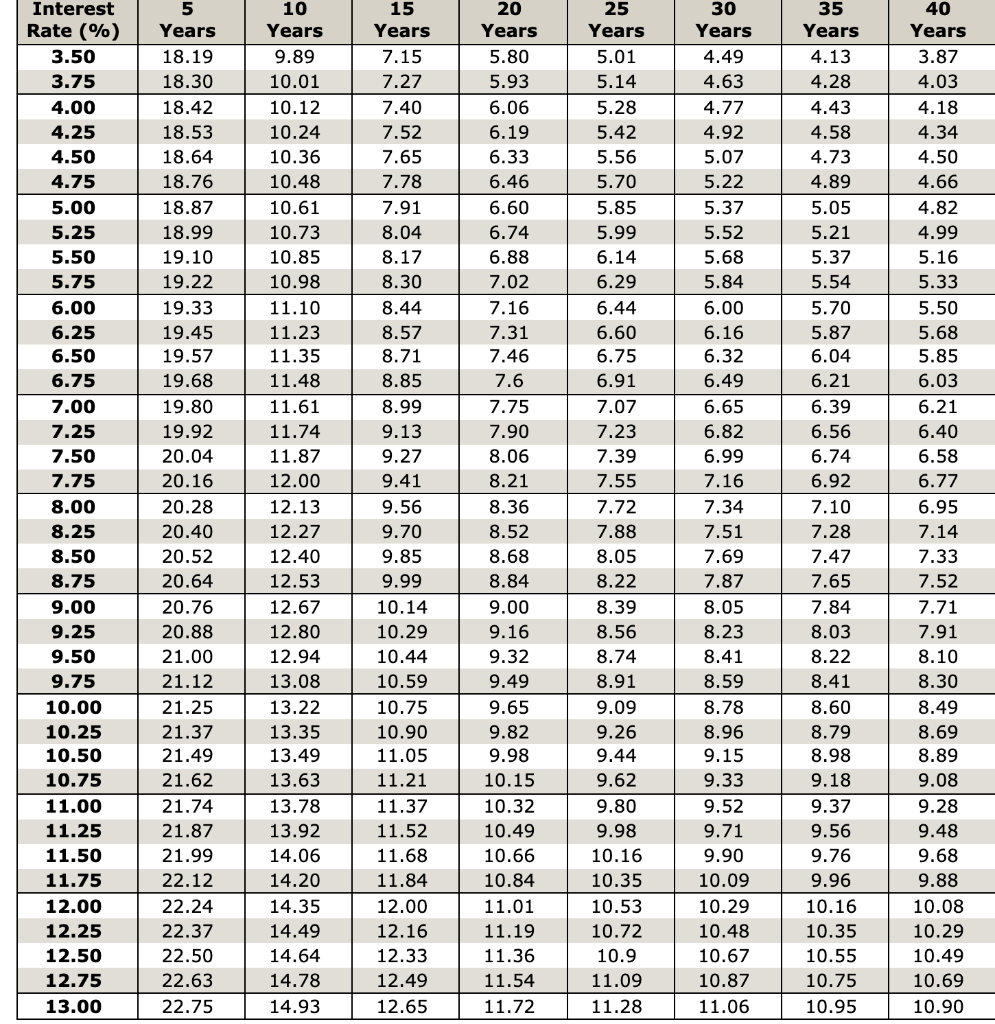

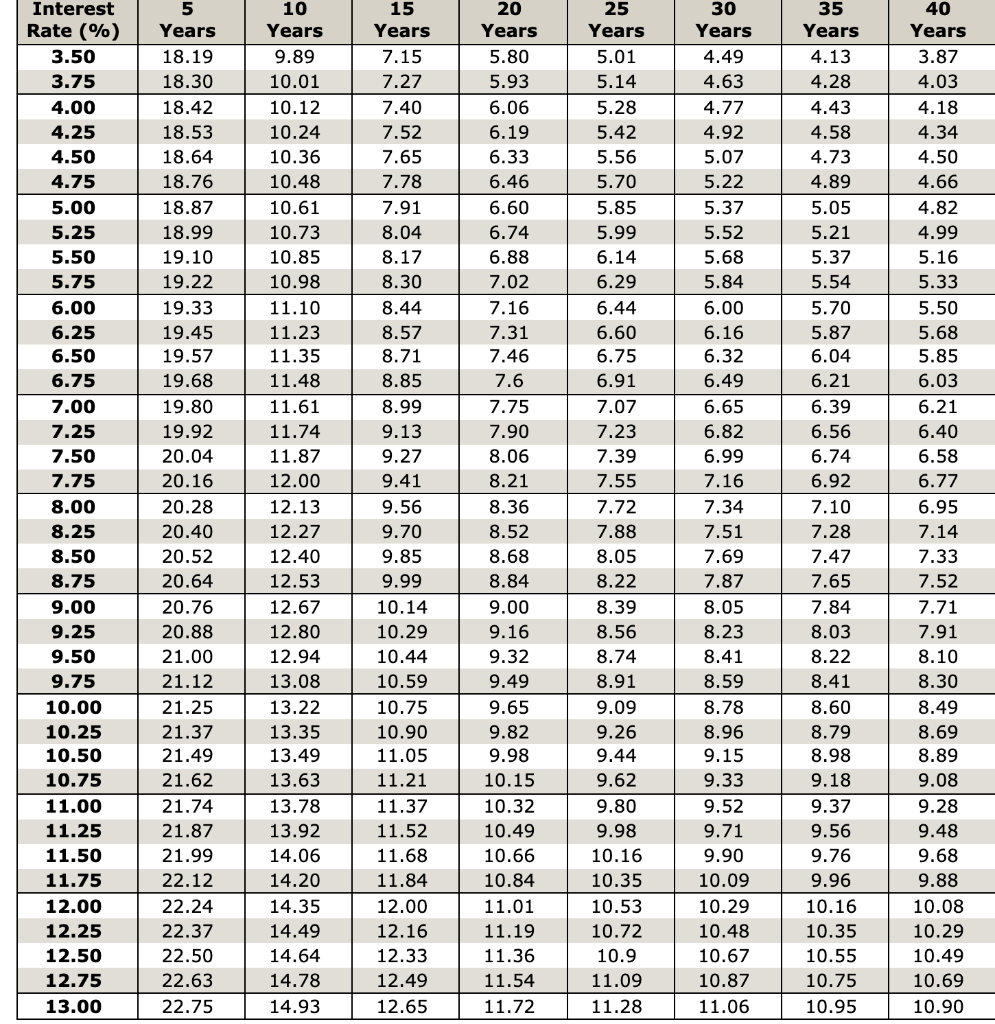

3 Find the monthly payment (in $) and the total interest (in $) for a mortgage of $42,000 at 52% for 30 years. Use this table and give the total interest as your 4 answer. (Round your answers to the nearest cent.) Monthly payment $ Total interest $ $ James has a mortgage of $92,500 at 4% for 15 years. The property taxes are $3,700 per year, and the hazard insurance premium is $754.50 per year. Find the monthly PITI payment (in $). (Round your answer to the nearest cent. Use this table as needed.) $ 15 35 Interest Rate (%) 3.50 5 Years 10 Years 20 Years 30 Years 25 Years 5.01 40 Years Years Years 18.19 9.89 7.15 5.80 4.49 3.87 4.13 4.28 3.75 18.30 10.01 7.27 5.93 5.14 4.63 4.03 4.00 18.42 10.12 7.40 6.06 5.28 4.77 4.43 4.18 4.25 18.53 10.24 7.52 6.19 5.42 4.92 4.58 4.34 4.50 18.64 10.36 7.65 6.33 5.56 5.07 4.73 4.50 4.75 18.76 10.48 7.78 6.46 5.70 5.22 4.89 4.66 5.00 18.87 10.61 6.60 5.85 5.37 5.05 4.82 7.91 8.04 5.25 10.73 6.74 5.99 5.52 5.21 4.99 18.99 19.10 5.50 10.85 8.17 6.88 6.14 5.68 5.37 5.16 5.75 19.22 10.98 8.30 7.02 6.29 5.84 5.54 5.33 6.00 19.33 11.10 8.44 7.16 6.44 6.00 5.70 5.50 19.45 11.23 8.57 7.31 6.60 6.25 6.50 6.16 6.32 5.87 6.04 5.68 5.85 19.57 11.35 8.71 7.46 6.75 6.75 19.68 11.48 8.85 7.6 6.91 6.49 6.21 6.03 7.00 19.80 8.99 7.75 7.07 6.39 6.21 11.61 11.74 6.65 6.82 7.25 19.92 9.13 7.90 6.56 7.23 7.39 6.40 6.58 7.50 20.04 11.87 9.27 8.06 6.99 6.74 7.75 20.16 12.00 9.41 8.21 7.55 7.16 6.92 6.77 8.00 20.28 12.13 9.56 8.36 7.72 7.34 7.10 6.95 8.25 20.40 12.27 9.70 8.52 7.51 7.28 7.14 7.88 8.05 8.50 20.52 12.40 9.85 7.69 7.47 7.33 8.68 8.84 8.75 20.64 12.53 9.99 8.22 7.87 7.65 7.52 9.00 20.76 12.67 9.00 8.39 8.05 7.84 7.71 10.14 10.29 9.25 20.88 12.80 9.16 8.23 8.03 7.91 8.56 8.74 9.50 21.00 10.44 9.32 8.41 8.22 8.10 12.94 13.08 9.75 21.12 10.59 9.49 8.91 8.59 8.41 8.30 10.00 21.25 13.22 10.75 9.09 8.60 10.25 10.50 21.37 21.49 13.35 13.49 10.90 11.05 9.65 9.82 9.98 10.15 9.26 9.44 8.78 8.96 9.15 9.33 8.79 8.98 9.18 8.49 8.69 8.89 9.08 10.75 21.62 13.63 11.21 9.62 11.00 21.74 11.37 10.32 9.80 9.52 9.37 9.28 13.78 13.92 11.25 21.87 10.49 9.98 9.71 9.56 9.48 11.52 11.68 11.50 21.99 14.06 10.66 10.16 9.90 9.76 9.68 11.75 22.12 14.20 11.84 10.84 10.35 10.09 9.96 9.88 12.00 22.24 14.35 12.00 11.01 10.53 10.29 10.16 10.08 12.25 22.37 14.49 12.16 11.19 10.72 10.48 10.35 10.29 12.50 22.50 14.64 12.33 11.36 10.9 10.67 10.55 10.49 12.75 22.63 14.78 12.49 11.54 11.09 10.87 10.75 10.69 13.00 22.75 14.93 12.65 11.72 11.28 11.06 10.95 10.90