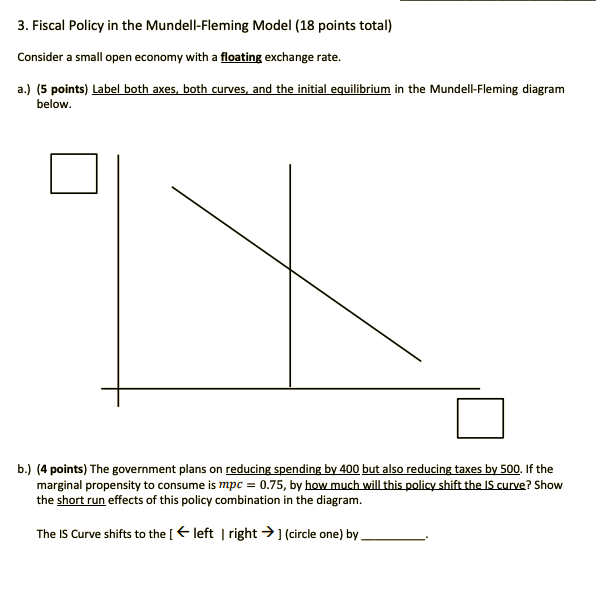

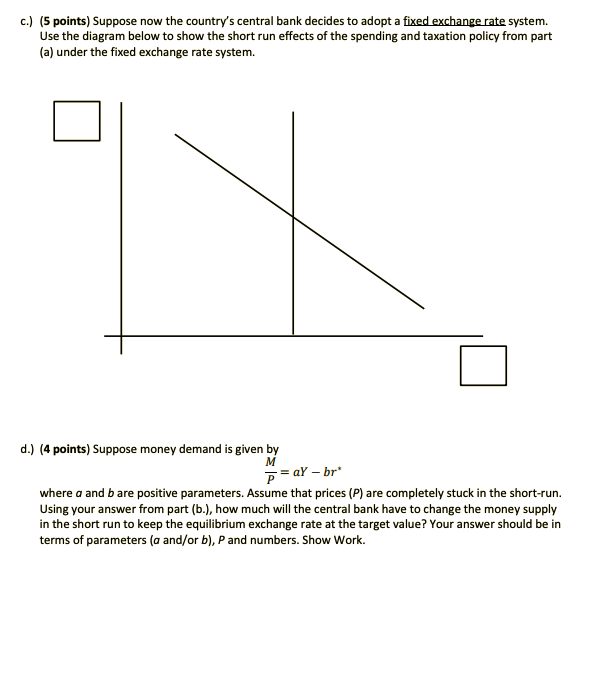

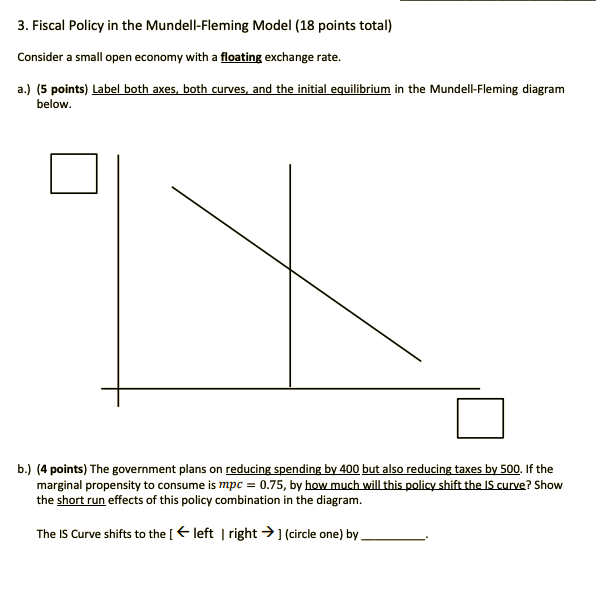

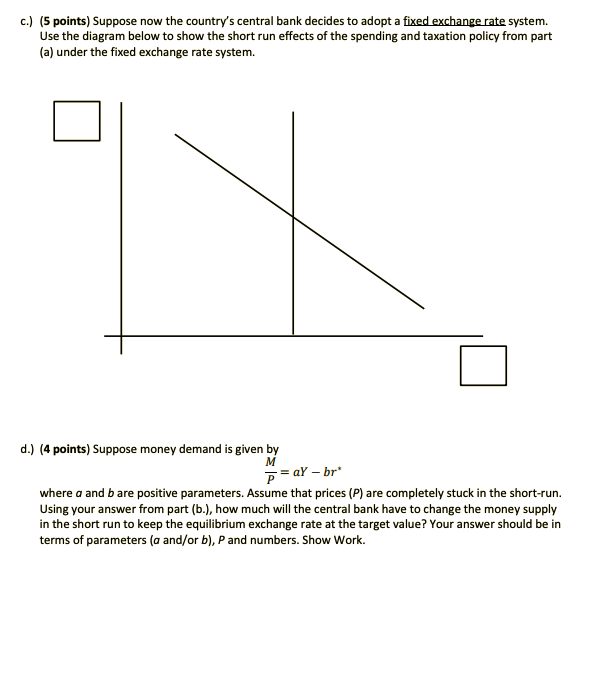

3. Fiscal Policy in the Mundell-Fleming Model (18 points total) Consider a small open economy with a floating exchange rate. a.) (5 points) Label both axes, both curves, and the initial equilibrium in the Mundell-Fleming diagram below. b.) (4 points) The government plans on reducing spending by 400 but also reducing taxes by 500. If the marginal propensity to consume is mpc = 0.75, by how much will this policy shift the 15 curve? Show the short run effects of this policy combination in the diagram. The Is Curve shifts to the left | right ] (circle one) by c.) (5 points) Suppose now the country's central bank decides to adopt a fixed exchange rate system. Use the diagram below to show the short run effects of the spending and taxation policy from part (a) under the fixed exchange rate system. d.) (4 points) Suppose money demand is given by M P=ay - br* where a and bare positive parameters. Assume that prices (P) are completely stuck in the short-run. Using your answer from part (b.), how much will the central bank have to change the money supply in the short run to keep the equilibrium exchange rate at the target value? Your answer should be in terms of parameters (a and/or b), P and numbers. Show Work. 3. Fiscal Policy in the Mundell-Fleming Model (18 points total) Consider a small open economy with a floating exchange rate. a.) (5 points) Label both axes, both curves, and the initial equilibrium in the Mundell-Fleming diagram below. b.) (4 points) The government plans on reducing spending by 400 but also reducing taxes by 500. If the marginal propensity to consume is mpc = 0.75, by how much will this policy shift the 15 curve? Show the short run effects of this policy combination in the diagram. The Is Curve shifts to the left | right ] (circle one) by c.) (5 points) Suppose now the country's central bank decides to adopt a fixed exchange rate system. Use the diagram below to show the short run effects of the spending and taxation policy from part (a) under the fixed exchange rate system. d.) (4 points) Suppose money demand is given by M P=ay - br* where a and bare positive parameters. Assume that prices (P) are completely stuck in the short-run. Using your answer from part (b.), how much will the central bank have to change the money supply in the short run to keep the equilibrium exchange rate at the target value? Your answer should be in terms of parameters (a and/or b), P and numbers. Show Work