Answered step by step

Verified Expert Solution

Question

1 Approved Answer

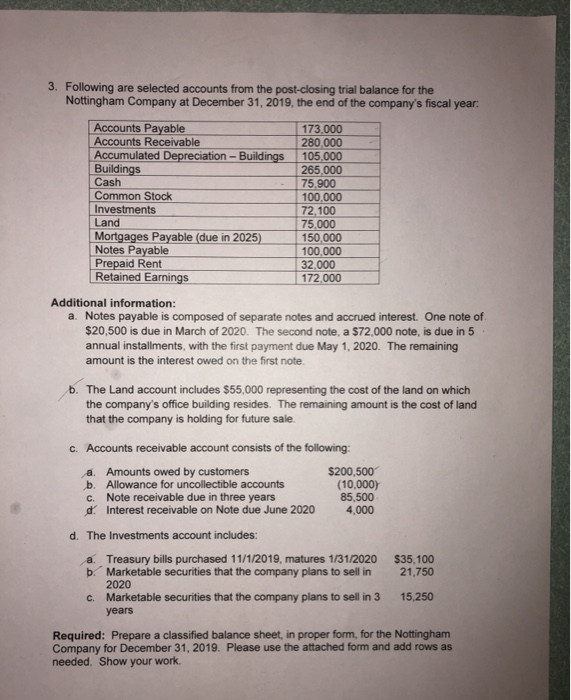

3. Following are selected accounts from the post-closing trial balance for the Nottingham Company at December 31, 2019, the end of the company's fiscal

3. Following are selected accounts from the post-closing trial balance for the Nottingham Company at December 31, 2019, the end of the company's fiscal year. Accounts Payable 173,000 Accounts Receivable 280,000 Accumulated Depreciation - Buildings 105,000 Buildings 265,000 Cash 75,900 Common Stock 100,000 Investments 72,100 Land 75,000 Mortgages Payable (due in 2025) 150,000 100,000 Notes Payable Prepaid Rent Retained Earnings 32,000 172,000 Additional information: a. Notes payable is composed of separate notes and accrued interest. One note of $20,500 is due in March of 2020. The second note, a $72,000 note, is due in 5 annual installments, with the first payment due May 1, 2020. The remaining amount is the interest owed on the first note. b. The Land account includes $55,000 representing the cost of the land on which the company's office building resides. The remaining amount is the cost of land that the company is holding for future sale. c. Accounts receivable account consists of the following: a. Amounts owed by customers $200,500 (10,000) b. Allowance for uncollectible accounts c. Note receivable due in three years 85,500 d. Interest receivable on Note due June 2020 4,000 d. The Investments account includes: a. Treasury bills purchased 11/1/2019, matures 1/31/2020 $35,100 21,750 b. Marketable securities that the company plans to sell in 2020 C. Marketable securities that the company plans to sell in 3 15,250 years Required: Prepare a classified balance sheet, in proper form, for the Nottingham Company for December 31, 2019. Please use the attached form and add rows as needed. Show your work.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

anebis se Nottingham Company Balance sheet as an December 31 2019 Assets Amt ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started