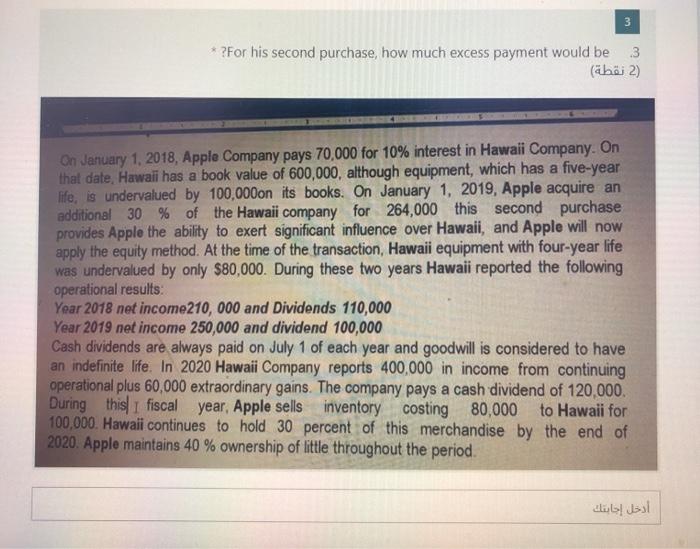

3 * ?For his second purchase, how much excess payment would be 3 (2 (2 ) On January 1, 2018, Apple Company pays 70,000 for 10% interest in Hawaii Company. On that date, Hawaii has a book value of 600,000, although equipment, which has a five-year life, is undervalued by 100,000on its books. On January 1, 2019, Apple acquire an additional 30 % of the Hawaii company for 264,000 this second purchase provides Apple the ability to exert significant influence over Hawaii, and Apple will now apply the equity method. At the time of the transaction, Hawaii equipment with four-year life was undervalued by only $80,000. During these two years Hawaii reported the following operational results: Year 2018 net income210, 000 and Dividends 110,000 Year 2019 net income 250,000 and dividend 100,000 Cash dividends are always paid on July 1 of each year and goodwill is considered to have an indefinite life. In 2020 Hawaii Company reports 400,000 in income from continuing operational plus 60,000 extraordinary gains. The company pays a cash dividend of 120,000. During this I fiscal year, Apple sells inventory costing 80,000 to Hawaii for 100,000. Hawaii continues to hold 30 percent of this merchandise by the end of 2020. Apple maintains 40 % ownership of little throughout the period. 3 * ?For his second purchase, how much excess payment would be 3 (2 (2 ) On January 1, 2018, Apple Company pays 70,000 for 10% interest in Hawaii Company. On that date, Hawaii has a book value of 600,000, although equipment, which has a five-year life, is undervalued by 100,000on its books. On January 1, 2019, Apple acquire an additional 30 % of the Hawaii company for 264,000 this second purchase provides Apple the ability to exert significant influence over Hawaii, and Apple will now apply the equity method. At the time of the transaction, Hawaii equipment with four-year life was undervalued by only $80,000. During these two years Hawaii reported the following operational results: Year 2018 net income210, 000 and Dividends 110,000 Year 2019 net income 250,000 and dividend 100,000 Cash dividends are always paid on July 1 of each year and goodwill is considered to have an indefinite life. In 2020 Hawaii Company reports 400,000 in income from continuing operational plus 60,000 extraordinary gains. The company pays a cash dividend of 120,000. During this I fiscal year, Apple sells inventory costing 80,000 to Hawaii for 100,000. Hawaii continues to hold 30 percent of this merchandise by the end of 2020. Apple maintains 40 % ownership of little throughout the period