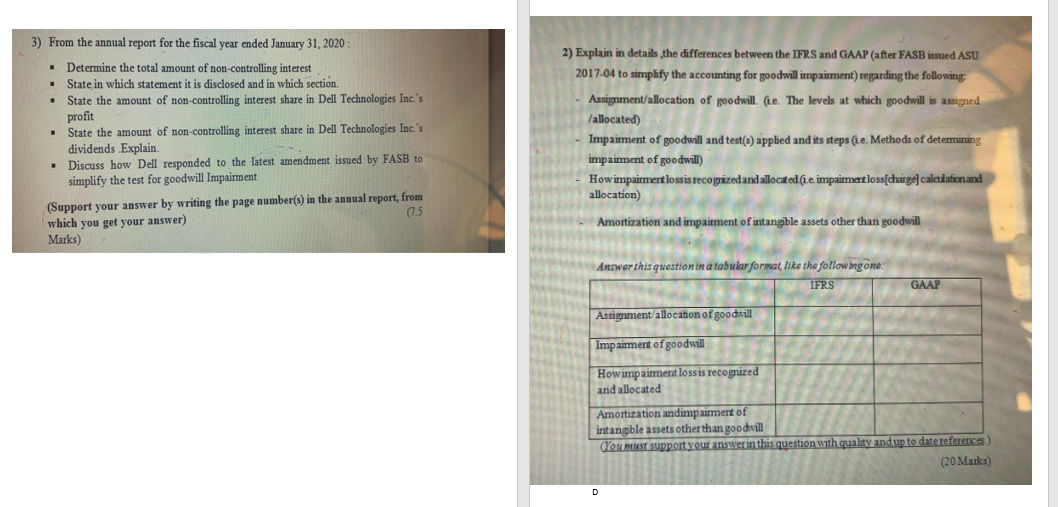

3) From the annual report for the fiscal year ended January 31, 2020 2) Explain in details, the differences between the IFRS and GAAP (after FASB issued ASU 2017-04 to simplify the accounting for goodwill impairment) regarding the following . . Assignment/allocation of goodwill. (.e. The levels at which goodwill is assigned /allocated) Determine the total amount of non-controlling interest State in which statement it is disclosed and in which section. State the amount of non-controlling interest share in Dell Technologies Inc.'s profit State the amount of non-controlling interest share in Dell Technologies Inc.'s dividends Explain. Discuss how Dell responded to the latest amendment issued by FASB to simplify the test for goodwill Impairment (Support your answer by writing the page number(s) in the annual report, from (7.5 which you get your answer) Marks) - Impairment of goodwill and test(s) applied and its steps (ie. Methods of determining impairment of goodwill) How impairment lossis recognized and allocated (.e. impairmatloss[charge calaslation and allocation) Amortization and impairment of intangible assets other than goodwill Answer this question in a tabular format like the following one: IFRS GAAP Assignment allocation of goodwill Impairment of goodwill How impaiment loss is recognized and allocated Amortization andimpairmert of intangible assets other than goodvill (You must support your answer in this question with quality and up to date references) (20 Marks) 3) From the annual report for the fiscal year ended January 31, 2020 2) Explain in details, the differences between the IFRS and GAAP (after FASB issued ASU 2017-04 to simplify the accounting for goodwill impairment) regarding the following . . Assignment/allocation of goodwill. (.e. The levels at which goodwill is assigned /allocated) Determine the total amount of non-controlling interest State in which statement it is disclosed and in which section. State the amount of non-controlling interest share in Dell Technologies Inc.'s profit State the amount of non-controlling interest share in Dell Technologies Inc.'s dividends Explain. Discuss how Dell responded to the latest amendment issued by FASB to simplify the test for goodwill Impairment (Support your answer by writing the page number(s) in the annual report, from (7.5 which you get your answer) Marks) - Impairment of goodwill and test(s) applied and its steps (ie. Methods of determining impairment of goodwill) How impairment lossis recognized and allocated (.e. impairmatloss[charge calaslation and allocation) Amortization and impairment of intangible assets other than goodwill Answer this question in a tabular format like the following one: IFRS GAAP Assignment allocation of goodwill Impairment of goodwill How impaiment loss is recognized and allocated Amortization andimpairmert of intangible assets other than goodvill (You must support your answer in this question with quality and up to date references) (20 Marks)