Answered step by step

Verified Expert Solution

Question

1 Approved Answer

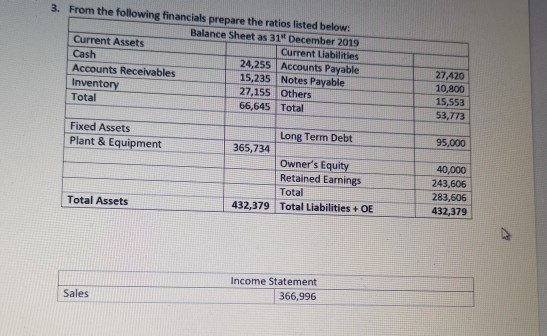

3. From the following financials prepare the ratios listed below: Balance Sheet as 31 December 2019 Current Assets Current Uabilities Cash 24,255 Accounts Payable Accounts

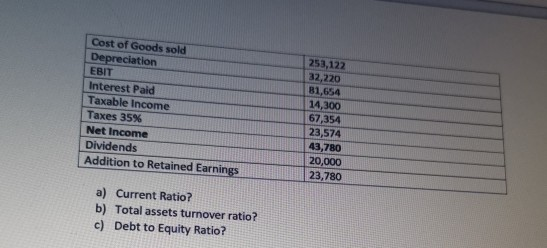

3. From the following financials prepare the ratios listed below: Balance Sheet as 31 December 2019 Current Assets Current Uabilities Cash 24,255 Accounts Payable Accounts Receivables 15,235 Notes Payable Inventory 27,155 Others Total 66,645 Total 27.420 10,800 15,553 53,773 Fixed Assets Plant & Equipment 95,000 Long Term Debt 365,734 Owner's Equity Retained Earnings Total 432,379 Total Liabilities + OE 40,000 243,606 283,606 432,379 Total Assets Sales Income Statement 366,996 Cost of Goods sold Depreciation EBIT Interest Paid Taxable income Taxes 35% Net Income Dividends Addition to Retained Earnings 253,122 32,220 81,654 14,300 67,354 23,574 43,780 20,000 23,780 a) Current Ratio? b) Total assets turnover ratio? c) Debt to Equity Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started