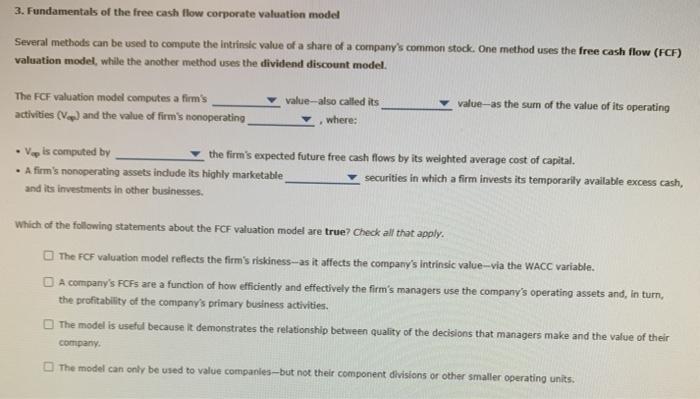

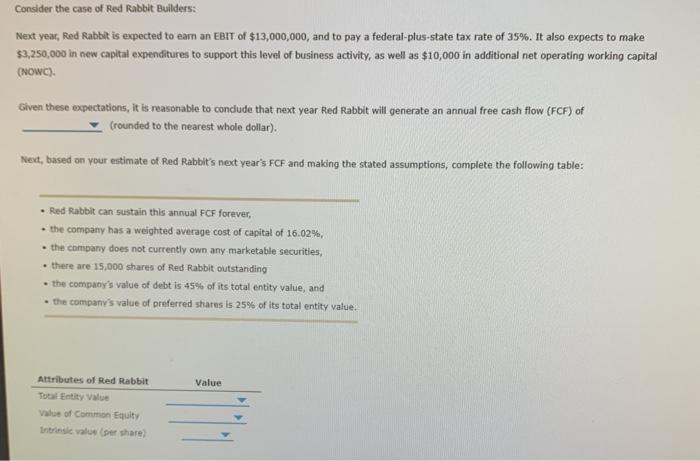

3. Fundamentals of the free cash flow corporate valuation model Several methods can be used to compute the intrinsic value of a share of a company's common stock. One method uses the free cash flow (FCF) valuation model, while the another method uses the dividend discount model. The FCF valuation model computes a firm's value-also called its value-as the sum of the value of its operating activities (Vc) and the value of firm's nonoperating where: Vopis computed by the firm's expected future free cash flows by its weighted average cost of capital. A firm's nonoperating assets indude its highly marketable securities in which a firm invests its temporarily available excess cash, and its investments in other businesses. Which of the following statements about the FCF valuation model are true? Check all that apply. The FCF valuation model reflects the firm's riskiness-as it affects the company's intrinsic value-via the WACC variable. A company's Fees are a function of how efficiently and effectively the firm's managers use the company's operating assets and, in turn, the profitability of the company's primary business activities. The model is useful because it demonstrates the relationship between quality of the decisions that managers make and the value of their company The model can only be used to value companies-but not their component divisions or other smaller operating units. Consider the case of Red Rabbit Builders: Next year, Red Rabbit is expected to earn an EBIT of $13,000,000, and to pay a federal-plus-state tax rate of 35%. It also expects to make $3,250,000 in new capital expenditures to support this level of business activity, as well as $10,000 in additional net operating working capital (NOWC). Given these expectations, it is reasonable to conclude that next year Red Rabbit will generate an annual free cash flow (FCF) of (rounded to the nearest whole dollar). Next, based on your estimate of Red Rabbit's next year's FCF and making the stated assumptions, complete the following table: Red Rabbit can sustain this annual FCF forever, the company has a weighted average cost of capital of 16.02%, the company does not currently own any marketable securities, . there are 15,000 shares of Red Rabbit outstanding the company's value of debt is 45% of its total entity value, and the company's value of preferred shares is 25% of its total entity value. Value Attributes of Red Rabbit Total Entity Value Vale of Common Equity Intro vale per share 3. Fundamentals of the free cash flow corporate valuation model Several methods can be used to compute the intrinsic value of a share of a company's common stock. One method uses the free cash flow (FCF) valuation model, while the another method uses the dividend discount model. The FCF valuation model computes a firm's value-also called its value-as the sum of the value of its operating activities (Vc) and the value of firm's nonoperating where: Vopis computed by the firm's expected future free cash flows by its weighted average cost of capital. A firm's nonoperating assets indude its highly marketable securities in which a firm invests its temporarily available excess cash, and its investments in other businesses. Which of the following statements about the FCF valuation model are true? Check all that apply. The FCF valuation model reflects the firm's riskiness-as it affects the company's intrinsic value-via the WACC variable. A company's Fees are a function of how efficiently and effectively the firm's managers use the company's operating assets and, in turn, the profitability of the company's primary business activities. The model is useful because it demonstrates the relationship between quality of the decisions that managers make and the value of their company The model can only be used to value companies-but not their component divisions or other smaller operating units. Consider the case of Red Rabbit Builders: Next year, Red Rabbit is expected to earn an EBIT of $13,000,000, and to pay a federal-plus-state tax rate of 35%. It also expects to make $3,250,000 in new capital expenditures to support this level of business activity, as well as $10,000 in additional net operating working capital (NOWC). Given these expectations, it is reasonable to conclude that next year Red Rabbit will generate an annual free cash flow (FCF) of (rounded to the nearest whole dollar). Next, based on your estimate of Red Rabbit's next year's FCF and making the stated assumptions, complete the following table: Red Rabbit can sustain this annual FCF forever, the company has a weighted average cost of capital of 16.02%, the company does not currently own any marketable securities, . there are 15,000 shares of Red Rabbit outstanding the company's value of debt is 45% of its total entity value, and the company's value of preferred shares is 25% of its total entity value. Value Attributes of Red Rabbit Total Entity Value Vale of Common Equity Intro vale per share