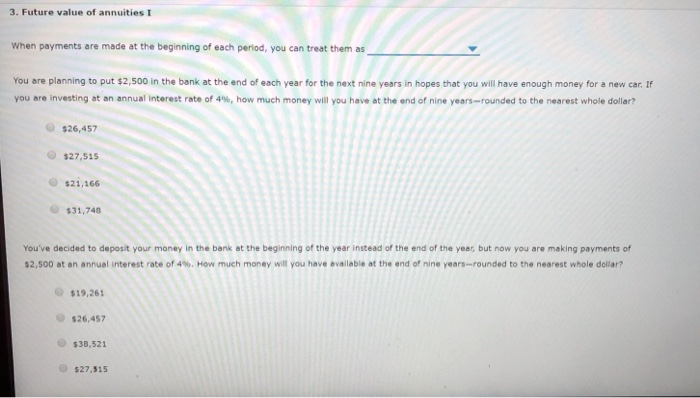

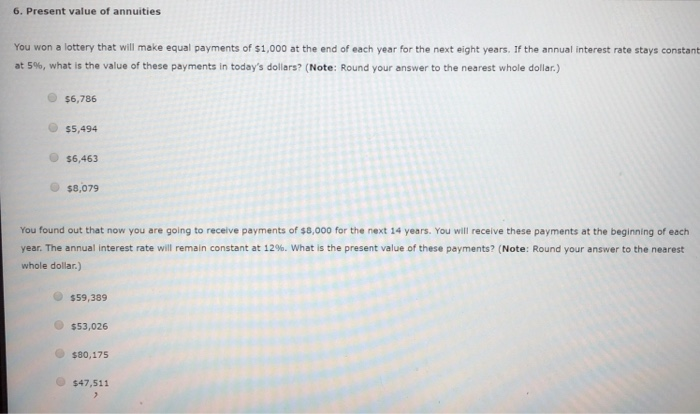

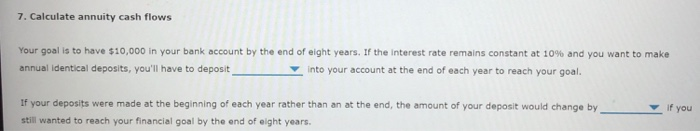

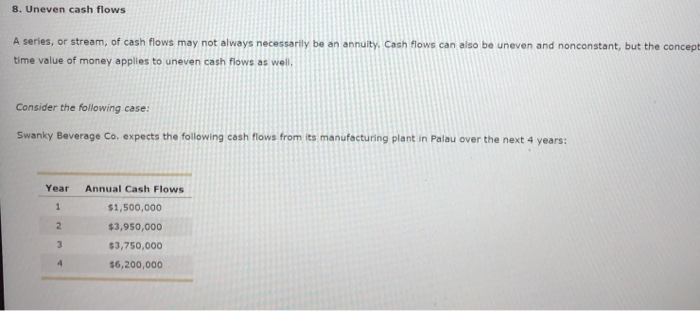

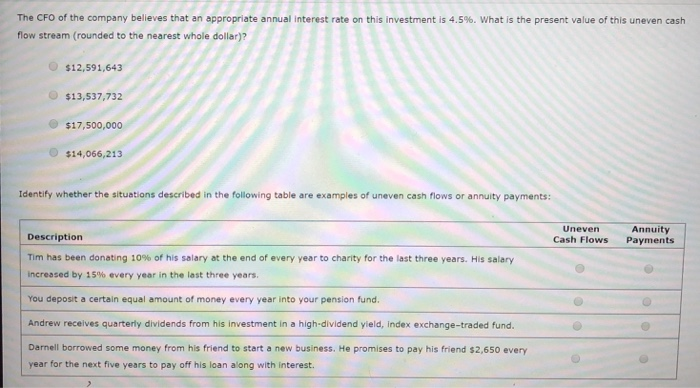

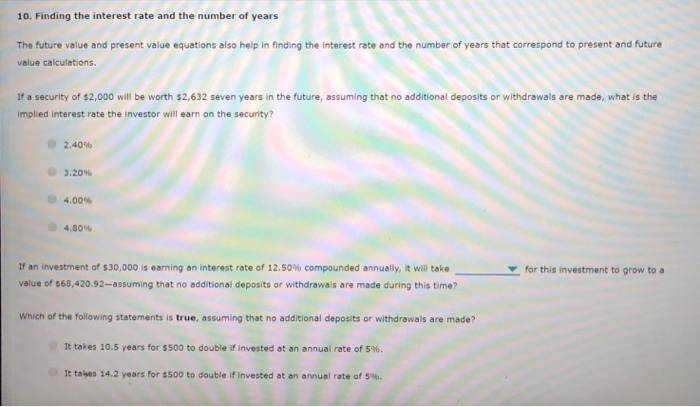

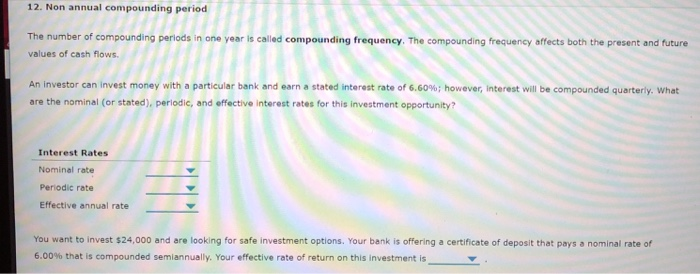

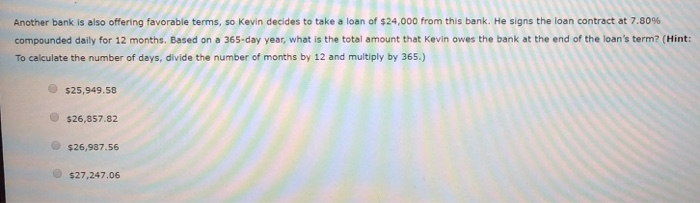

3. Future value of annuities I When payments are made at the beginning of each period, you can treat them as You are planning to put $2,500 in the bank at the end of each year for the next nine years in hopes that you will have enough money for a new car. If you are investing at an annual interest rate of 4%, how much money will you have at the end of nine years-rounded to the nearest whole dollar? $26,457 $27,515 $21,166 $31,748 You've decided to deposit your money in the bank at the beginning of the year instead of the end of the year, but now you are making payments of $2,500 at an annual interest rate of 4%. How much money will you have available at the end of nine years-rounded to the nearest whole dollar? $19,261 $26,457 $38,521 $27,315 6. Present value of annuities You won a lottery that will make equal payments of $1,000 at the end of each year for the next eight years. If the annual interest rate stays constant at 5%, what is the value of these payments in today's dollars, (Note: Round your answer to the nearest whole dollar.) $6,786 $5,494 $6,463 $8,079 You found out that now you are going to receive payments of $8,000 for the next 14 years. You will receive these payments at the beginning of each year. The annual interest rate will remain constant at 12%. what is the present value of these payments? (Note: Round your answer to the nearest whole dollar.) $59,389 $53,026 $80,175 $47,511 7. Calculate annuity cash flows Your goal is to have $10,000 in your bank account by the end of eight years. If the interest rate remains constant at 10% and you want to make annual identical deposits, you'll have to positinto your account at the end of each year to reach your goal If your deposits were made at the beginning of each year rather than an at the end, the amount of your deposit would change by still wanted to reach your financial goal by the end of eight years. if you 8. Uneven cash flows A series, or stream, of cash flows may not always necessarily be an annuity, Cash flows can also be uneven and nonconstant, but the concept time value of money applies to uneven cash flows as well Consider the following case: Swanky Beverage Co. expects the following cash flows from its manufacturing plant in Palau over the next 4 years: Year Annual Cash Flows $1,500,000 $3,950,000 $3,750,000 $6,200,000 The CFO of the company believes that an appropriate annual interest rate on this investment is 4.5%, what is the present value of this uneven cash flow stream (rounded to the nearest whole dollar)? $12,591,643 $13,537,732 $17,500,000 $14,066,213 Identify whether the situations described in the following table are examples of uneven cash flows or annuity payments: Uneven Annuity Description Tim has been donating 10% of his salary at the end of every year to charity for the last three years. His salary increased by 15% every year in the last three years. You deposit a certain equal amount of money every year into your pension fund. Andrew receives quarterly dividends from his investment in a high-dividend yield, index exchange-traded fund. Darnell borrowed some money from his friend to start a new business. He promises to pay his friend $2,650 every year for the next five years to pay off his loan along with interest. Cash Flows Payments 10. Finding the interest rate and the number of years The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations If a security of $2,000 will be worth $2,632 seven years in the future, assuming that no additional deposits or withdrawals are made, what is the implied interest rate the investor will earn on the security? 2.40% 3.20% 4.00% 4.00% If an investment of S 30,000 is earning an interest rate of 12.50% compounded annually, it will take value of s68,420.92-assuming that no additional deposits or withdrawals are made during this time? for this investment to grow toa Which of the following statements is true, assuming that no additional deposits or withdrawals are made? It takes 10.5 years for $500 to double if invested at an annual rate of 5% It tales 14,2 years for S500 to double if Invested at an annual rate of S96. 12. Non annual compounding period The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An investor can invest money with a particular bank and earn a stated interest rate of 6.60%; however, interest will be compounded quarterly. what are the nominal (or stated), periodic, and effective interest rates for this investment opportunity? Interest Rates Nominal rate Periodic rate Effective annual rate You want to invest $24,000 and are looking for safe investment options. Your bank is offering a certificate of deposit that pays a nominal rate of 6.00% that is compounded semiannually. Your effective rate of return on this investment is Another bank is also offering favorable terms, so Kevin decides to take a loan of $24,000 from this bank. He signs the loan contract at 7.80% compounded daily for 12 months. Based on a 365-day year, what is the total amount that Kevin owes the bank at the end of the loan's term? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.) $25,949.58 $26,857.82 $26,987.56 $27,247.06