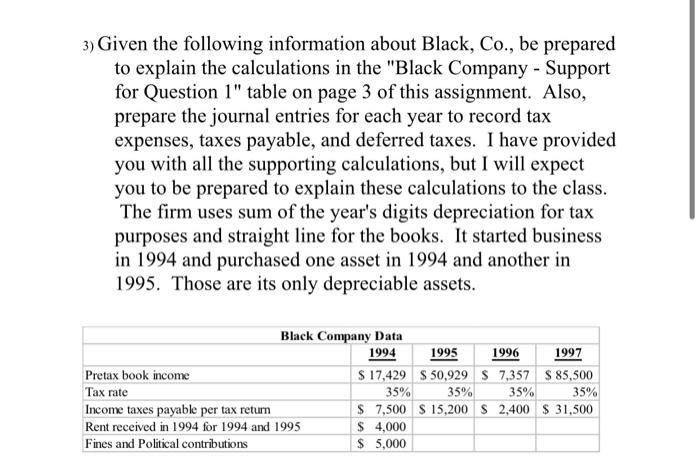

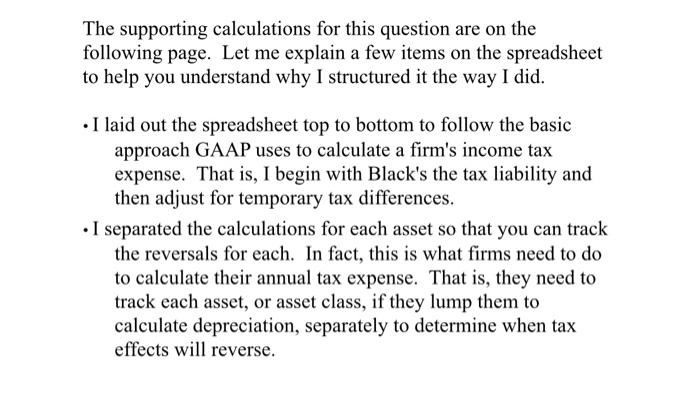

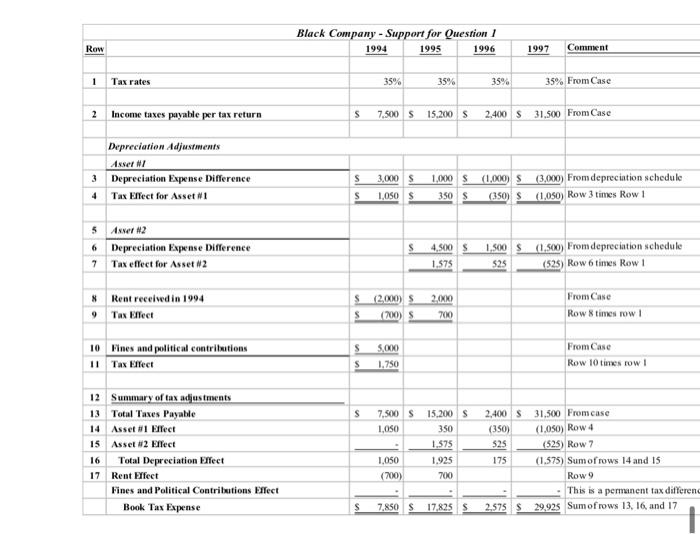

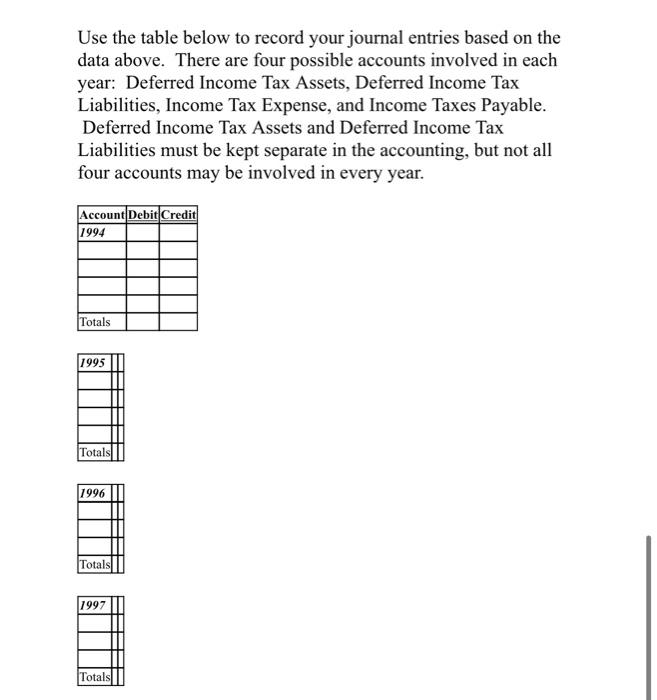

3) Given the following information about Black, Co., be prepared to explain the calculations in the "Black Company - Support for Question 1" table on page 3 of this assignment. Also, prepare the journal entries for each year to record tax expenses, taxes payable, and deferred taxes. I have provided you with all the supporting calculations, but I will expect you to be prepared to explain these calculations to the class. The firm uses sum of the year's digits depreciation for tax purposes and straight line for the books. It started business in 1994 and purchased one asset in 1994 and another in 1995. Those are its only depreciable assets. Black Company Data 1994 1995 1996 1997 Pretax book income $ 17,429 S 50,929 S 7,357 $ 85,500 Tax rate 35% 35% 35% 35% Income taxes payable per tax return $ 7,500 $ 15,200 $ 2,400 $ 31,500 Rent received in 1994 for 1994 and 1995 $ 4,000 Fines and Political contributions $5,000 The supporting calculations for this question are on the following page. Let me explain a few items on the spreadsheet to help you understand why I structured it the way I did. I laid out the spreadsheet top to bottom to follow the basic approach GAAP uses to calculate a firm's income tax expense. That is, I begin with Black's the tax liability and then adjust for temporary tax differences. I separated the calculations for each asset so that you can track the reversals for each. In fact, this is what firms need to do to calculate their annual tax expense. That is, they need to track each asset, or asset class, if they lump them to calculate depreciation, separately to determine when tax effects will reverse. Black Company - Support for Question / 1994 1995 1996 Row 1997 Comment 1 Tax rates 35% 35% 35% 35% From Case 2 Income taxes payable per tax return S 7.500 5 15.2005 2.400 S 31.500 From Case Depreciation Adjustments Asser w 3 Depreciation Expense Difference 4 Tax Effect for Asset #1 S 1.000 S (1.000) S 3,000 $ 1,050 S (3,000) From depreciation schedule (1,050) Row 3 times Row 1 S 350 S (350) 5 Anver 2 6 Depreciation Expense Difference 7 Tax effect for Asset 2 s 4,500 1.575 1,500 S (0.500) From depreciation schedule $25 (525) Row 6 times Row 1 2.000 * Rent received in 1994 Tas Elfect s s (2.000) S (700) From Case Row times row 700 S 10 Fines and political contributions 11 Tax Elect 5.000 1.750 From Case Row 10 times row 1 S S 7.500 S 1,050 2.400 S (350) 12 Summary of tax adjustments 13 Total Taxes Payable 14 Asset #1 Effect 15 Asset #2 Effect 16 Total Depreciation Elfect 17 Rent Effect Fines and Political Contributions Effect Book Tax Expense 15.200 s 350 1.575 1.925 700 525 175 1.050 (700) 31.500 Fromcase (1.050) Row 4 (525) Row 7 (1.575) Sum of rows 14 and 15 Row 9 This is a permanent tax differen 29,925 Sumof rows 13, 16 and 17 S 7.850 S 17,825 S 2.575 Use the table below to record your journal entries based on the data above. There are four possible accounts involved in each year: Deferred Income Tax Assets, Deferred Income Tax Liabilities, Income Tax Expense, and Income Taxes Payable. Deferred Income Tax Assets and Deferred Income Tax Liabilities must be kept separate in the accounting, but not all four accounts may be involved in every year. Account Debit Credit |1994 Totals 1995 Totals (1996 Totals 1997 Totals 3) Given the following information about Black, Co., be prepared to explain the calculations in the "Black Company - Support for Question 1" table on page 3 of this assignment. Also, prepare the journal entries for each year to record tax expenses, taxes payable, and deferred taxes. I have provided you with all the supporting calculations, but I will expect you to be prepared to explain these calculations to the class. The firm uses sum of the year's digits depreciation for tax purposes and straight line for the books. It started business in 1994 and purchased one asset in 1994 and another in 1995. Those are its only depreciable assets. Black Company Data 1994 1995 1996 1997 Pretax book income $ 17,429 S 50,929 S 7,357 $ 85,500 Tax rate 35% 35% 35% 35% Income taxes payable per tax return $ 7,500 $ 15,200 $ 2,400 $ 31,500 Rent received in 1994 for 1994 and 1995 $ 4,000 Fines and Political contributions $5,000 The supporting calculations for this question are on the following page. Let me explain a few items on the spreadsheet to help you understand why I structured it the way I did. I laid out the spreadsheet top to bottom to follow the basic approach GAAP uses to calculate a firm's income tax expense. That is, I begin with Black's the tax liability and then adjust for temporary tax differences. I separated the calculations for each asset so that you can track the reversals for each. In fact, this is what firms need to do to calculate their annual tax expense. That is, they need to track each asset, or asset class, if they lump them to calculate depreciation, separately to determine when tax effects will reverse. Black Company - Support for Question / 1994 1995 1996 Row 1997 Comment 1 Tax rates 35% 35% 35% 35% From Case 2 Income taxes payable per tax return S 7.500 5 15.2005 2.400 S 31.500 From Case Depreciation Adjustments Asser w 3 Depreciation Expense Difference 4 Tax Effect for Asset #1 S 1.000 S (1.000) S 3,000 $ 1,050 S (3,000) From depreciation schedule (1,050) Row 3 times Row 1 S 350 S (350) 5 Anver 2 6 Depreciation Expense Difference 7 Tax effect for Asset 2 s 4,500 1.575 1,500 S (0.500) From depreciation schedule $25 (525) Row 6 times Row 1 2.000 * Rent received in 1994 Tas Elfect s s (2.000) S (700) From Case Row times row 700 S 10 Fines and political contributions 11 Tax Elect 5.000 1.750 From Case Row 10 times row 1 S S 7.500 S 1,050 2.400 S (350) 12 Summary of tax adjustments 13 Total Taxes Payable 14 Asset #1 Effect 15 Asset #2 Effect 16 Total Depreciation Elfect 17 Rent Effect Fines and Political Contributions Effect Book Tax Expense 15.200 s 350 1.575 1.925 700 525 175 1.050 (700) 31.500 Fromcase (1.050) Row 4 (525) Row 7 (1.575) Sum of rows 14 and 15 Row 9 This is a permanent tax differen 29,925 Sumof rows 13, 16 and 17 S 7.850 S 17,825 S 2.575 Use the table below to record your journal entries based on the data above. There are four possible accounts involved in each year: Deferred Income Tax Assets, Deferred Income Tax Liabilities, Income Tax Expense, and Income Taxes Payable. Deferred Income Tax Assets and Deferred Income Tax Liabilities must be kept separate in the accounting, but not all four accounts may be involved in every year. Account Debit Credit |1994 Totals 1995 Totals (1996 Totals 1997 Totals