Question

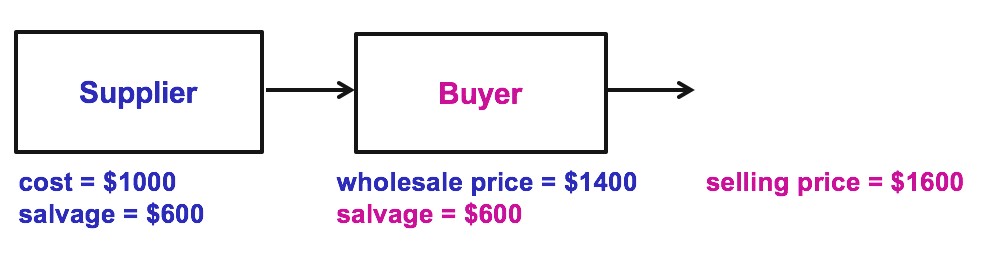

3. Given the following supply chain made up of a manufacturer and a supplier: Demand is normally distributed with mean = 500 and standard deviation

3. Given the following supply chain made up of a manufacturer and a supplier:

Demand is normally distributed with mean = 500 and standard deviation = 100.

3a. What is the optimal order quantity for the supplier in this supply chain?

Hint: for the supplier

Cu = w - c = 1400 1000 = 400

Co = c - v = 1000 600 = 400

Select one:

- 400

- 500

- 530

- 590

3b. What is the optimal order quantity for the buyer in this supply chain?

Hint: for the buyer

Cu = p - w = 1600 1400 = 200

Co = w - v = 1400 - 600 = 800

Select one:

- 400

- 416

- 584

- 600

The optimal order quantity for the entire supply chain can be calculated as:

Cu = p - c = 1600 1000 = 600

Co = c - v = 1000 600 = 400 Critical Ratio = 0.6000 z (round up rule) = 0.26 Q* = 500 +0.26*100 = 526

Here we see that considering the supply chain as a whole, instead of two separate entities, results in a higher critical ratio and a higher optimal order quantity. This is the best we can do!

3c. Which statement is correct?

Select one:

- The supplier would like the buyer to order less.

- The supplier would like the buyer to order more.

- The situation is optimized.

3d. How can this situation be optimized?

Select one:

- The buyer offers the supplier a buy-back price b, offering to buy-back any unsold goods for this buyback price.

- The supplier offers the buyer a buy-back price b, offering to buy-back any unsold goods for this buyback price.

3e. What is the optimal buy back price for this supply chain given (assume shipping costs are zero) rounded to the nearest dollar?

b = Shipping costs + Price

(Price Wholesale Price) (Price SalvageValue@retailer)/(Price Cost)

Select one:

- 1200

- 1267

- 1430

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started