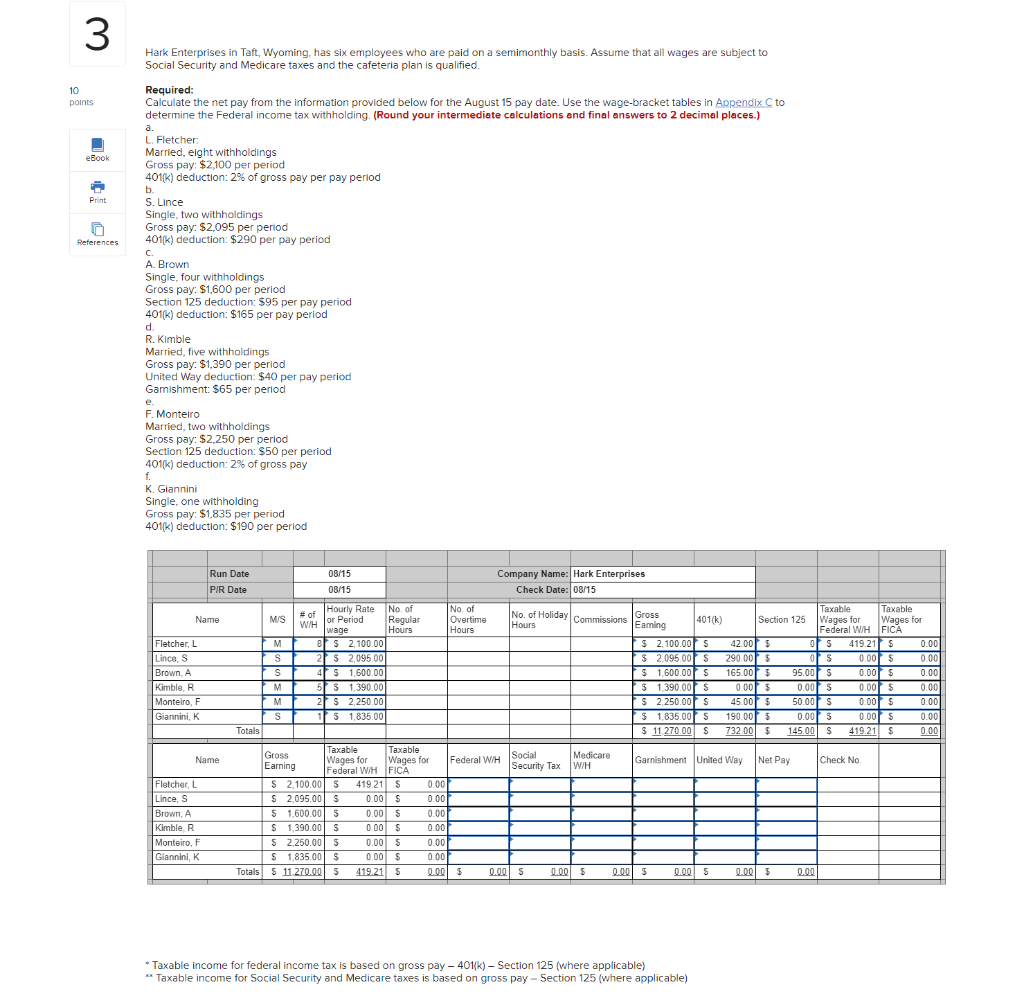

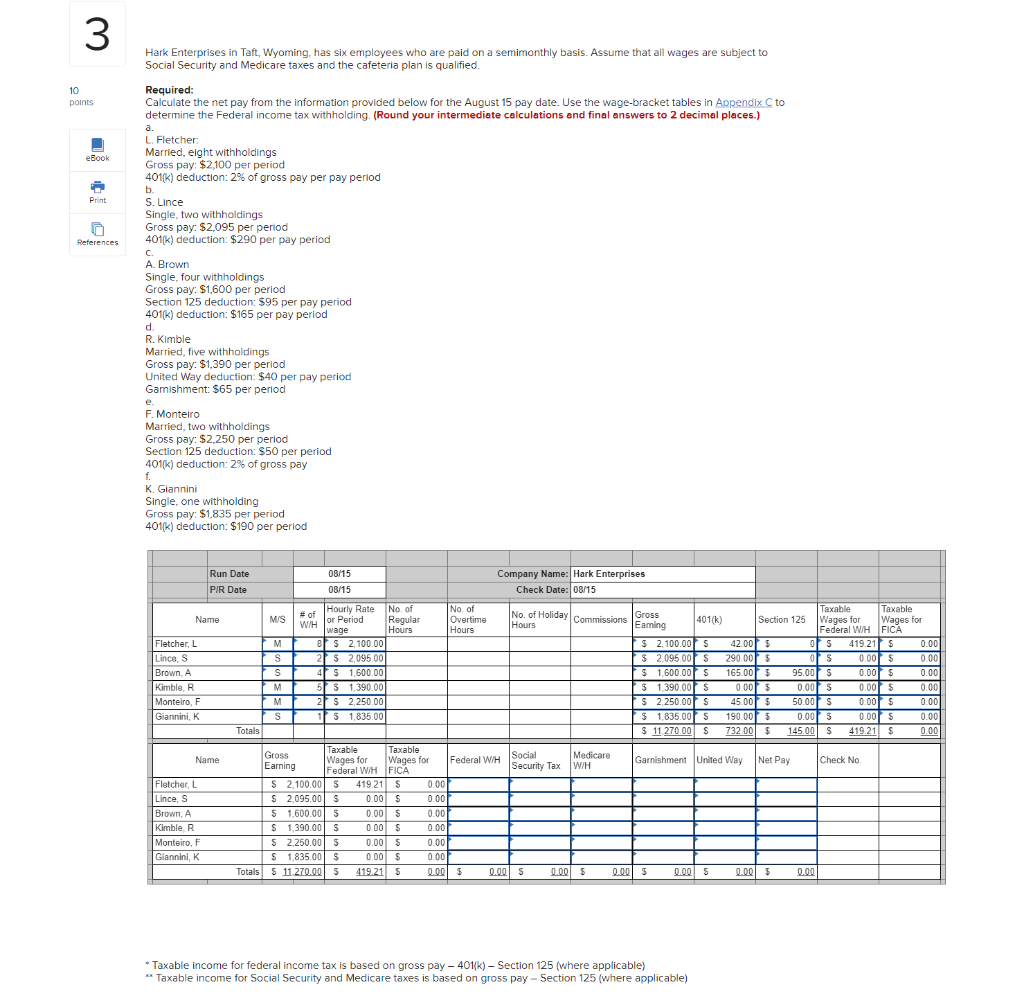

3 Hark Enterprises in Taft, Wyoming, has six employees who are paid on a semimonthly basis. Assume that all wages are subject to Social Security and Medicare taxes and the cafeteria plan is qualified. 10 points ebook Required: Calculate the net pay from the information provided below for the August 15 pay date. Use the wage-bracket tables in Appendix C to determine the Federal income tax withholding (Round your intermediate calculations and final answers to 2 decimal places.) a. L. Fletcher Married, eight withholdings Gross pay: $2,100 per period 401(k) deduction: 2% of gross pay per pay period b. S. Lince Single, two withholdings Gross pay: $2,095 per period 401(k) deduction: $290 per pay period Print References A. Brown Single, four withholdings Gross pay: $1,600 per period Section 125 deduction: $95 per pay period 401(k) deduction: $165 per pay period d R. Kimble Married, five withholdings Gross pay: $1,390 per period United Way deduction: $40 per pay period Gamishment: $65 per period e. F. Monteiro Married, two withholdings Gross pay: $2,250 per period Section 125 deduction: $50 per period 401(k) deduction: 2% of gross pay f. K. Giannini Single, one withholding Gross pay: $1,835 per period 401(k) deduction: $190 per period 08/15 Run Date PIR Date Company Name: Hark Enterprises Check Date:08/15 08/15 Mis Name No. of Holiday Commissions Earning No of Overtime Hours MIS Hours Fletcher, L Lince, S Brown, A Kimble, R Monteiro, F Giannini, K M . S S M M S of Hourly Rate No. of or Period Regular WIH wage Hours & $ 2,100.00 2 $ 2,095.00 4 $ 1,600.00 5 $ 1,390.00 21 $ 2.250.00 15 1,835.00 Taxable Taxable Gross 401(k) Section 125 Wages for Wages for Federal WH FICA $ 2.100.001 s 42.00 $ os 419.21 $ 0.00 $ 2,095.00 s 290.00 $ 0 S 0.001 s 0.00 $ 1.600.00 S 165.00 $ 95.00 $ 0.00 $ 0.00 $ 1.390.001 $ 0.00 $ 0.00 s 0.001s 0.00 $ 2.250.001 s $ 45.00 $ 50.00 S S 0.00 $ 0.00 5 1.835.00 S 190.00 $ 0.00 $ 0.00 $ 0.00 $ 11 270.00 S 732 000 $ 145.00 $ 419.21 $ 5 0.00 Totals Name Federal WH Social Medicare Security Tax WH Garnishment United Way Net Pay Check No Fletcher, L Lince, S Brown, A Kimble, R Monteiro, F Giannini K Gross Taxable Taxable Wages for Wages for Earning Federal WH FICA S 2,100.00 S 419.21 S s 0.00 $ 2,095.00 $ 0.00 $ 0.00 $ 1.600.00 S 0.00 $ 0.00 $ 1,390.00 $ s 0.00 $ 0.00 5 2.250.00 5 0.00 5 0.00 $ 1.835.00 s 0.00 $ 0.00 Totals $ 11.270.00 5 5 419.21 $ 0.00 5 0.00 5 0.00 5 0.00 5 0.00 5 0.00 *Taxable income for federal income tax is based on gross pay - 401(K) - Section 125 (where applicable) **Taxable income for Social Security and Medicare taxes is based on gross pay-Section 125 (where applicable) 3 Hark Enterprises in Taft, Wyoming, has six employees who are paid on a semimonthly basis. Assume that all wages are subject to Social Security and Medicare taxes and the cafeteria plan is qualified. 10 points ebook Required: Calculate the net pay from the information provided below for the August 15 pay date. Use the wage-bracket tables in Appendix C to determine the Federal income tax withholding (Round your intermediate calculations and final answers to 2 decimal places.) a. L. Fletcher Married, eight withholdings Gross pay: $2,100 per period 401(k) deduction: 2% of gross pay per pay period b. S. Lince Single, two withholdings Gross pay: $2,095 per period 401(k) deduction: $290 per pay period Print References A. Brown Single, four withholdings Gross pay: $1,600 per period Section 125 deduction: $95 per pay period 401(k) deduction: $165 per pay period d R. Kimble Married, five withholdings Gross pay: $1,390 per period United Way deduction: $40 per pay period Gamishment: $65 per period e. F. Monteiro Married, two withholdings Gross pay: $2,250 per period Section 125 deduction: $50 per period 401(k) deduction: 2% of gross pay f. K. Giannini Single, one withholding Gross pay: $1,835 per period 401(k) deduction: $190 per period 08/15 Run Date PIR Date Company Name: Hark Enterprises Check Date:08/15 08/15 Mis Name No. of Holiday Commissions Earning No of Overtime Hours MIS Hours Fletcher, L Lince, S Brown, A Kimble, R Monteiro, F Giannini, K M . S S M M S of Hourly Rate No. of or Period Regular WIH wage Hours & $ 2,100.00 2 $ 2,095.00 4 $ 1,600.00 5 $ 1,390.00 21 $ 2.250.00 15 1,835.00 Taxable Taxable Gross 401(k) Section 125 Wages for Wages for Federal WH FICA $ 2.100.001 s 42.00 $ os 419.21 $ 0.00 $ 2,095.00 s 290.00 $ 0 S 0.001 s 0.00 $ 1.600.00 S 165.00 $ 95.00 $ 0.00 $ 0.00 $ 1.390.001 $ 0.00 $ 0.00 s 0.001s 0.00 $ 2.250.001 s $ 45.00 $ 50.00 S S 0.00 $ 0.00 5 1.835.00 S 190.00 $ 0.00 $ 0.00 $ 0.00 $ 11 270.00 S 732 000 $ 145.00 $ 419.21 $ 5 0.00 Totals Name Federal WH Social Medicare Security Tax WH Garnishment United Way Net Pay Check No Fletcher, L Lince, S Brown, A Kimble, R Monteiro, F Giannini K Gross Taxable Taxable Wages for Wages for Earning Federal WH FICA S 2,100.00 S 419.21 S s 0.00 $ 2,095.00 $ 0.00 $ 0.00 $ 1.600.00 S 0.00 $ 0.00 $ 1,390.00 $ s 0.00 $ 0.00 5 2.250.00 5 0.00 5 0.00 $ 1.835.00 s 0.00 $ 0.00 Totals $ 11.270.00 5 5 419.21 $ 0.00 5 0.00 5 0.00 5 0.00 5 0.00 5 0.00 *Taxable income for federal income tax is based on gross pay - 401(K) - Section 125 (where applicable) **Taxable income for Social Security and Medicare taxes is based on gross pay-Section 125 (where applicable)