Answered step by step

Verified Expert Solution

Question

1 Approved Answer

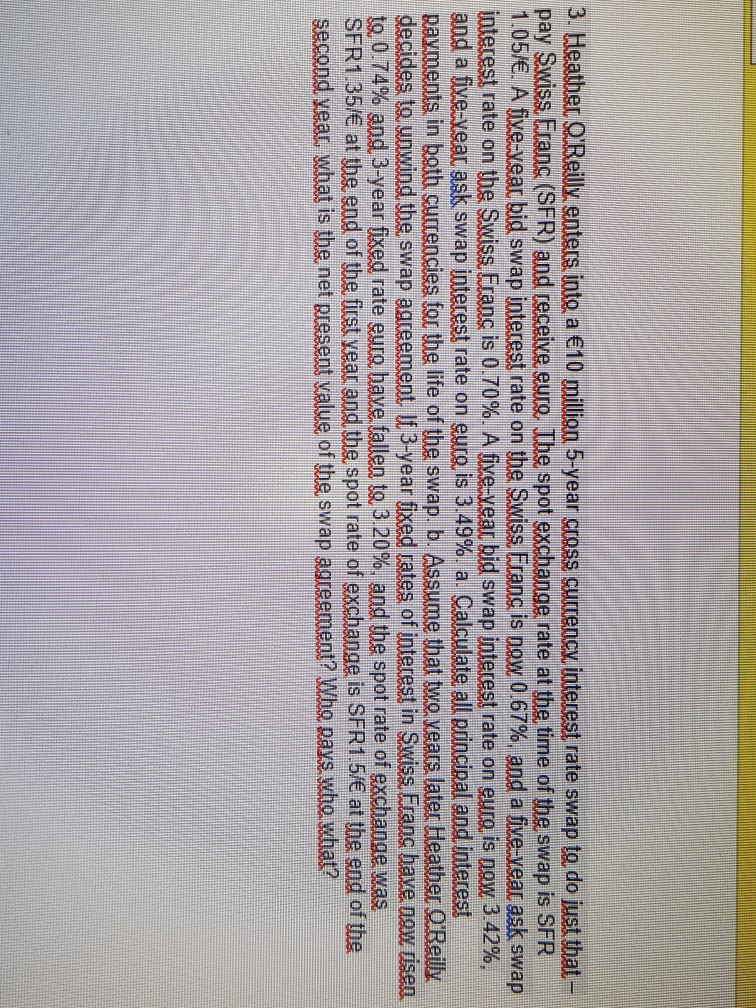

3. Heather QuReilly enters into a 10 milion 5-year cross currency interest rate swap to do just that- pay Swiss. Scans (SFR) and receixe, eure.

3. Heather QuReilly enters into a 10 milion 5-year cross currency interest rate swap to do just that- pay Swiss. Scans (SFR) and receixe, eure. The spot exchange rate at the time of the swap is SFR 205/. A fixe-year bid swap interest rate on the Swiss Franc is now 0.67%, and a five-year ask swap interest rate on the Swiss Franc is 0.70%. A five-year bid swap interest rate on euro is now 3.42%, and a fixe-xeac ask swap interest rate on euro is 3.49%. a. Calculate all principal and interest payments in both cuencies for the life of the swap. b. Assume that two years later Heather Belly decides to unwind the swap agreement U 3-year fixed rates of interest in Swiss Frans have now disen to 0.74% and 3-year fixed rate eung bave fallen to 3.20%. and the spot rate of exchange was SFR1.35/ at the end of the first year and the spot rate of exchange is SFR1.5/ at the end of the second year, what is the net present value of the swap agreement? Who Rays Wibe what 3. Heather QuReilly enters into a 10 milion 5-year cross currency interest rate swap to do just that- pay Swiss. Scans (SFR) and receixe, eure. The spot exchange rate at the time of the swap is SFR 205/. A fixe-year bid swap interest rate on the Swiss Franc is now 0.67%, and a five-year ask swap interest rate on the Swiss Franc is 0.70%. A five-year bid swap interest rate on euro is now 3.42%, and a fixe-xeac ask swap interest rate on euro is 3.49%. a. Calculate all principal and interest payments in both cuencies for the life of the swap. b. Assume that two years later Heather Belly decides to unwind the swap agreement U 3-year fixed rates of interest in Swiss Frans have now disen to 0.74% and 3-year fixed rate eung bave fallen to 3.20%. and the spot rate of exchange was SFR1.35/ at the end of the first year and the spot rate of exchange is SFR1.5/ at the end of the second year, what is the net present value of the swap agreement? Who Rays Wibe what

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started