Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3/ help me out plz a. The following questions relate to the sale of the warehouse: 1. What is the adjusted basis of the warehouse?

3/ help me out plz

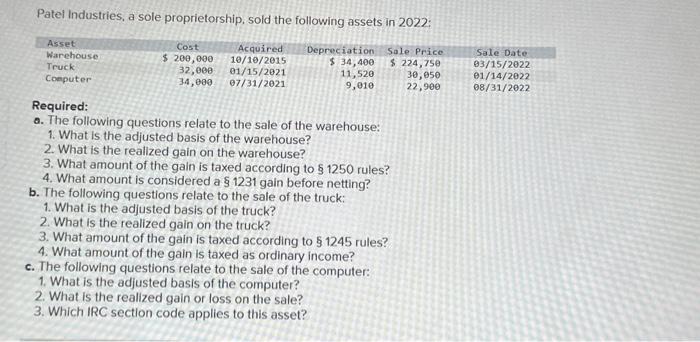

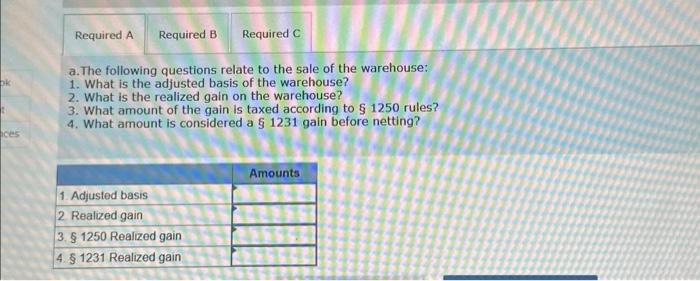

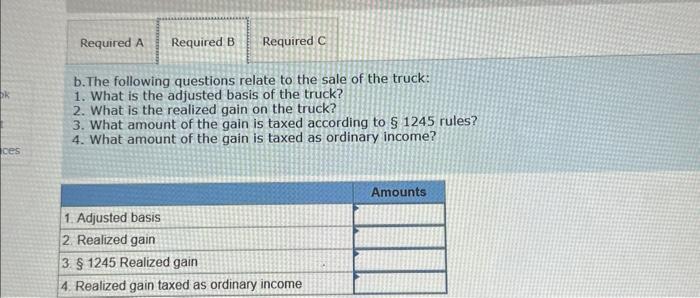

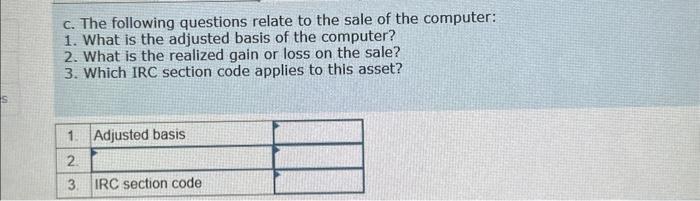

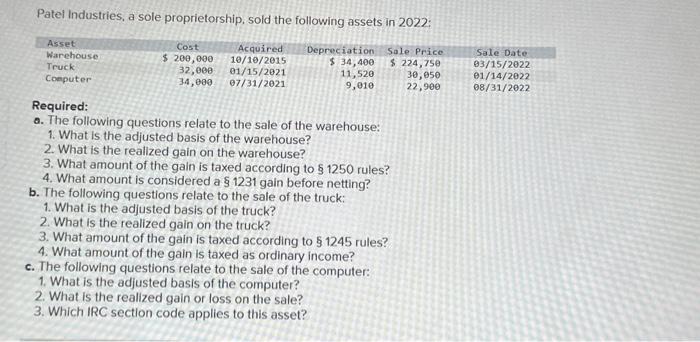

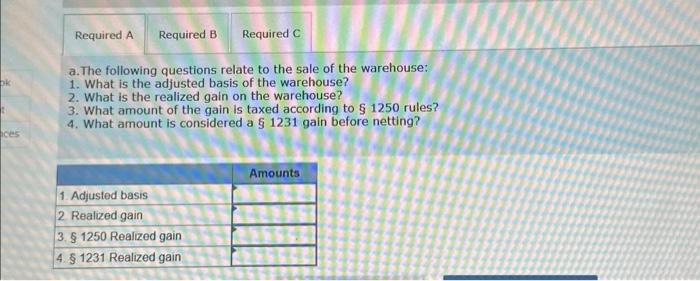

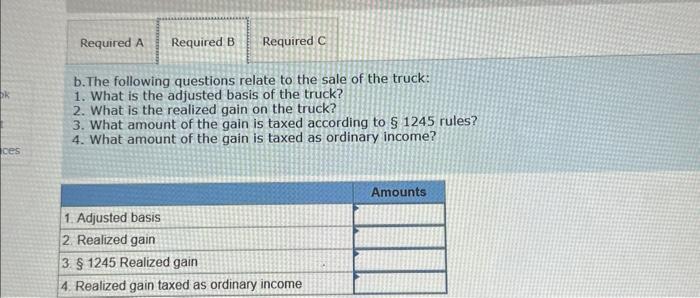

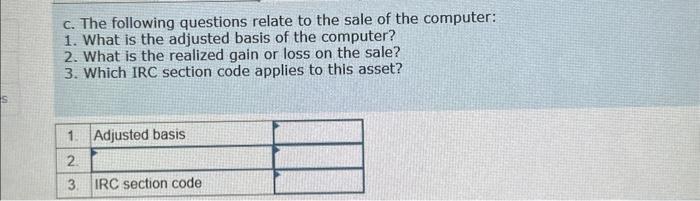

a. The following questions relate to the sale of the warehouse: 1. What is the adjusted basis of the warehouse? 2. What is the realized gain on the warehouse? 3. What amount of the gain is taxed according to $1250 rules? 4. What amount is considered a $1231 gain before netting? c. The following questions relate to the sale of the computer: 1. What is the adjusted basis of the computer? 2. What is the realized gain or loss on the sale? 3. Which IRC section code applies to this asset? b. The following questions relate to the sale of the truck: 1. What is the adjusted basis of the truck? 2. What is the realized gain on the truck? 3. What amount of the gain is taxed according to $1245 rules? 4. What amount of the gain is taxed as ordinary income? Patel Industries, a sole proprietorship, sold the following assets in 2022 : Required: a. The following questions relate to the sale of the warehouse: 1. What is the adjusted basis of the warehouse? 2. What is the reallzed gain on the warehouse? 3. What amount of the gain is taxed according to $1250 rules? 4. What amount is considered a $1231 galn before netting? b. The following questions relate to the sale of the truck: 1. What is the adjusted basis of the truck? 2. What is the realized gain on the truck? 3. What amount of the gain is taxed according to $1245 rules? 4. What amount of the gain is taxed as ordinary income? c. The following questions relate to the sale of the computer: 1. What is the adjusted basis of the computer? 2. What is the realized gain or loss on the sale? 3. Which IRC section code applies to this asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started