3. help plz :)

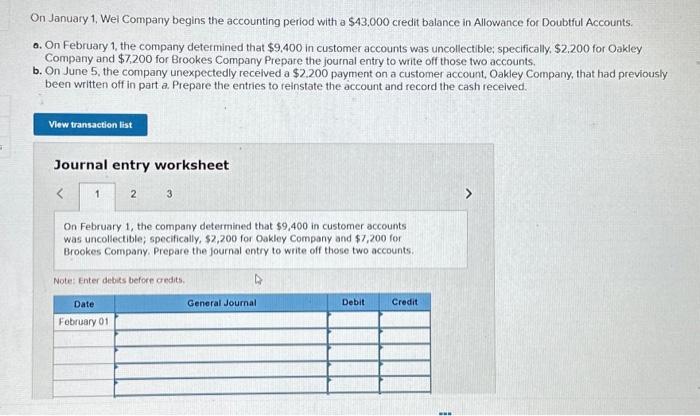

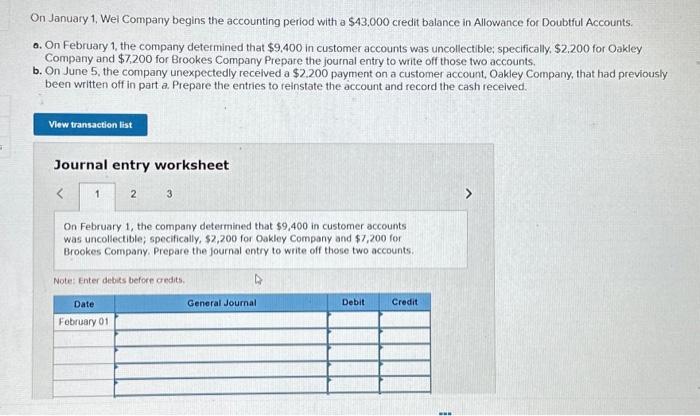

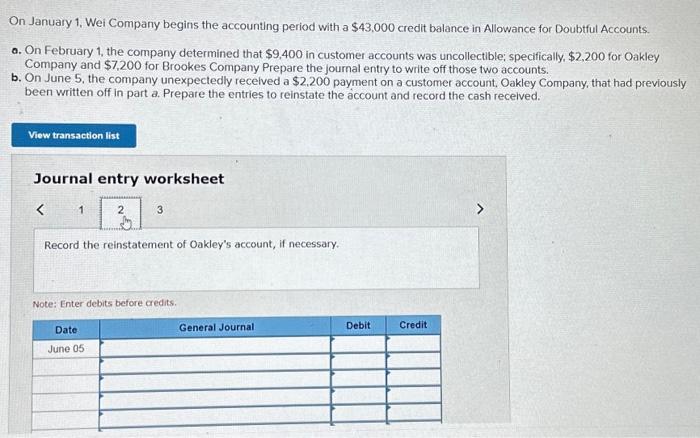

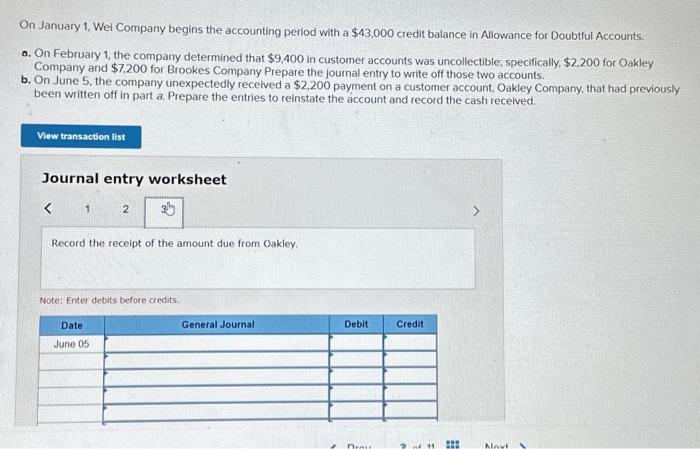

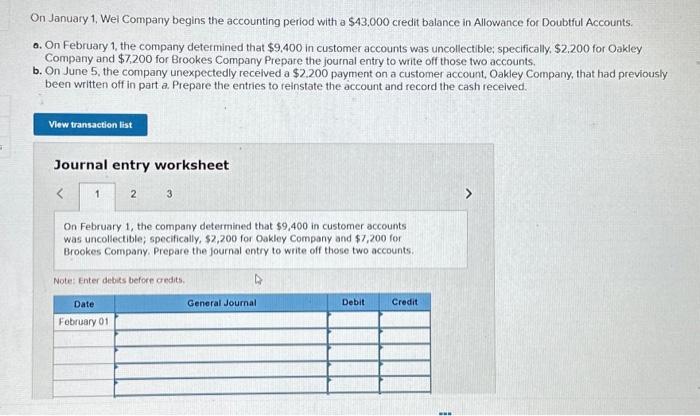

On January 1, Wei Company begins the accounting period with a $43,000 credit balance in Allowance for Doubtful Accounts. 0. On February 1 , the company determined that $9,400 in customer accounts was uncollectible; specifically, $2,200 for Oakley Company and $7,200 for Brookes Company Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly recelved a \$2.200 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received. Journal entry worksheet On February 1, the company determined that $9,400 in customer accounts was uncollectible; specifically, $2,200 for Oakley Company and $7,200 for Brookes Company. Prepare the Journal entry to write off these two accounts. Note: Enter debits before oedits. On January 1, Wei Company begins the accounting period with a $43,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $9,400 in customer accounts was uncollectible; specifically, $2,200 for Oakley Company and $7,200 for Brookes Company Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly recelved a $2,200 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash recelved. Journal entry worksheet Note: Enter debits before credits. On January 1 , Wei Company begins the accounting period with a $43,000 credit balance in Allowance for Doubtful Accounts. o. On February 1, the company determined that $9,400 in customer accounts was uncollectible; specifically, $2.200 for Oakley Company and $7,200 for Brookes Company Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $2,200 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash recelved. Journal entry worksheet Record the receipt of the amount due from Oakley. Note: Enter debits before credits