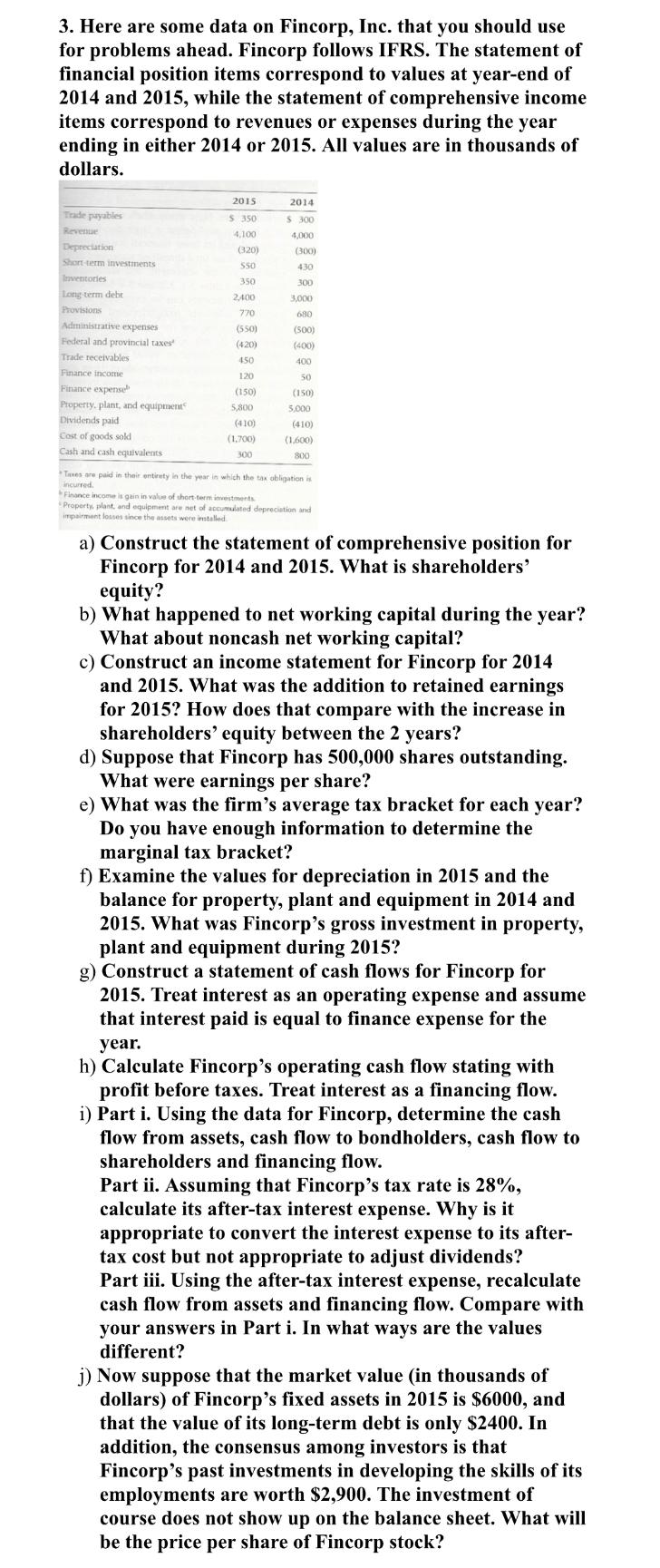

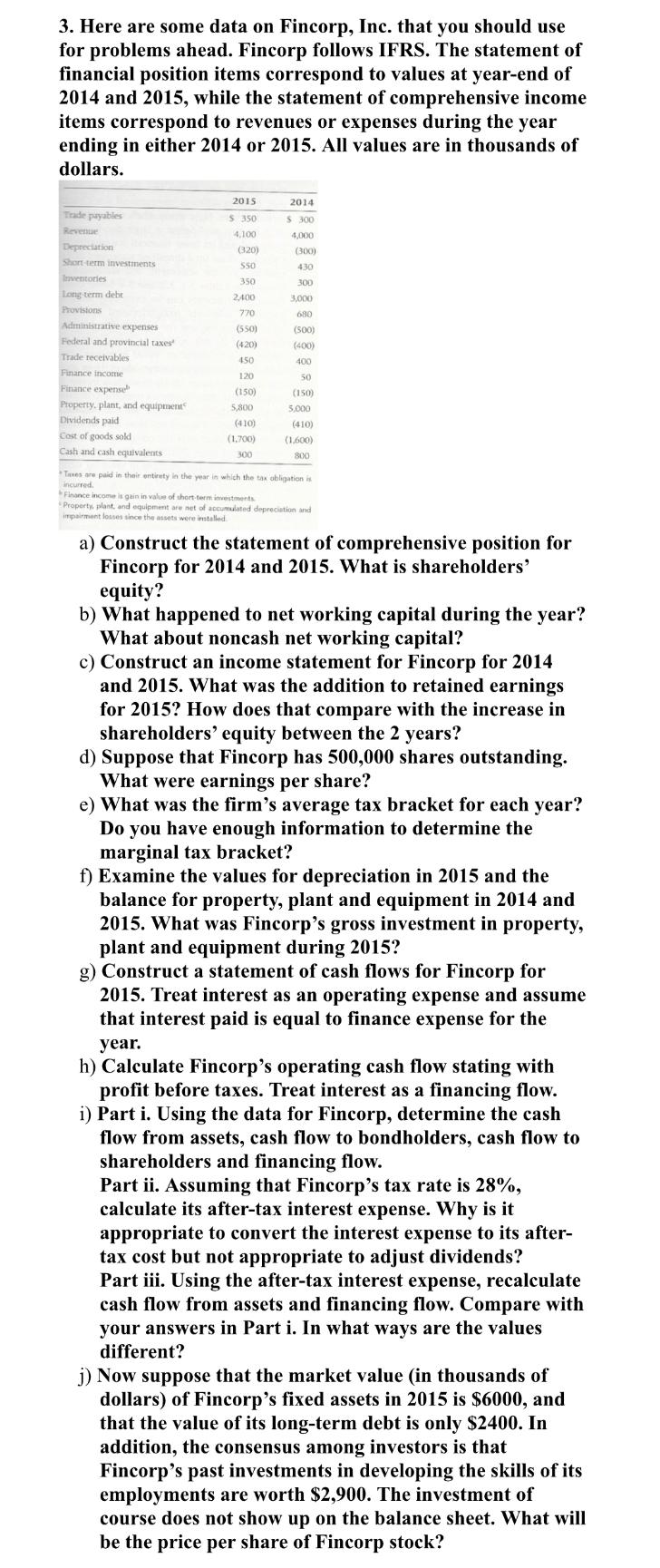

3. Here are some data on Fincorp, Inc. that you should use for problems ahead. Fincorp follows IFRS. The statement of financial position items correspond to values at year-end of 2014 and 2015, while the statement of comprehensive income items correspond to revenues or expenses during the year ending in either 2014 or 2015. All values are in thousands of dollars. 2015 2014 5 350 4,100 $ 300 4,000 (300) 430 (320) SSO 350 Trade payables Revente Depreciation Short term investments ventories Long term debt Provisions Administrative expenses Federal and provincial taxes Trade receivables Finance income Finance expense Property, plant, and equipments Dividends paid Cost of goods sold Cash and cash equivalents 2.400 770 (550) (420) 3,000 680 (800) (400) 150 400 120 (150) 5,800 (410) (1.700) 300 50 (150) 5.000 (410) (1.600) 800 Taxes are paid in the entirety in the year in which the tax obligationis incurred Finance income is gain in value of short term investments Property plant and equipment are not of accumulated depreciation and impairment losses since these were installed a) Construct the statement of comprehensive position for Fincorp for 2014 and 2015. What is shareholders' equity? b) What happened to net working capital during the year? What about noncash net working capital? c) Construct an income statement for Fincorp for 2014 and 2015. What was the addition to retained earnings for 2015? How does that compare with the increase in shareholders' equity between the 2 years? d) Suppose that Fincorp has 500,000 shares outstanding. What were earnings per share? e) What was the firm's average tax bracket for each year? Do you have enough information to determine the marginal tax bracket? f) Examine the values for depreciation in 2015 and the balance for property, plant and equipment in 2014 and 2015. What was Fincorp's gross investment in property, plant and equipment during 2015? g) Construct a statement of cash flows for Fincorp for 2015. Treat interest as an operating expense and assume that interest paid is equal to finance expense for the year. h) Calculate Fincorp's operating cash flow stating with profit before taxes. Treat interest as a financing flow. i) Part i. Using the data for Fincorp, determine the cash flow from assets, cash flow to bondholders, cash flow to shareholders and financing flow. Part ii. Assuming that Fincorp's tax rate is 28%, calculate its after-tax interest expense. Why is it appropriate to convert the interest expense to its after- tax cost but not appropriate to adjust dividends? Part iii. Using the after-tax interest expense, recalculate cash flow from assets and financing flow. Compare with your answers in Part i. In what ways are the values different? j) Now suppose that the market value (in thousands of dollars) of Fincorp's fixed assets in 2015 is $6000, and that the value of its long-term debt is only $2400. In addition, the consensus among investors is that Fincorp's past investments in developing the skills of its employments are worth $2,900. The investment of course does not show up on the balance sheet. What will be the price per share of Fincorp stock? 3. Here are some data on Fincorp, Inc. that you should use for problems ahead. Fincorp follows IFRS. The statement of financial position items correspond to values at year-end of 2014 and 2015, while the statement of comprehensive income items correspond to revenues or expenses during the year ending in either 2014 or 2015. All values are in thousands of dollars. 2015 2014 5 350 4,100 $ 300 4,000 (300) 430 (320) SSO 350 Trade payables Revente Depreciation Short term investments ventories Long term debt Provisions Administrative expenses Federal and provincial taxes Trade receivables Finance income Finance expense Property, plant, and equipments Dividends paid Cost of goods sold Cash and cash equivalents 2.400 770 (550) (420) 3,000 680 (800) (400) 150 400 120 (150) 5,800 (410) (1.700) 300 50 (150) 5.000 (410) (1.600) 800 Taxes are paid in the entirety in the year in which the tax obligationis incurred Finance income is gain in value of short term investments Property plant and equipment are not of accumulated depreciation and impairment losses since these were installed a) Construct the statement of comprehensive position for Fincorp for 2014 and 2015. What is shareholders' equity? b) What happened to net working capital during the year? What about noncash net working capital? c) Construct an income statement for Fincorp for 2014 and 2015. What was the addition to retained earnings for 2015? How does that compare with the increase in shareholders' equity between the 2 years? d) Suppose that Fincorp has 500,000 shares outstanding. What were earnings per share? e) What was the firm's average tax bracket for each year? Do you have enough information to determine the marginal tax bracket? f) Examine the values for depreciation in 2015 and the balance for property, plant and equipment in 2014 and 2015. What was Fincorp's gross investment in property, plant and equipment during 2015? g) Construct a statement of cash flows for Fincorp for 2015. Treat interest as an operating expense and assume that interest paid is equal to finance expense for the year. h) Calculate Fincorp's operating cash flow stating with profit before taxes. Treat interest as a financing flow. i) Part i. Using the data for Fincorp, determine the cash flow from assets, cash flow to bondholders, cash flow to shareholders and financing flow. Part ii. Assuming that Fincorp's tax rate is 28%, calculate its after-tax interest expense. Why is it appropriate to convert the interest expense to its after- tax cost but not appropriate to adjust dividends? Part iii. Using the after-tax interest expense, recalculate cash flow from assets and financing flow. Compare with your answers in Part i. In what ways are the values different? j) Now suppose that the market value (in thousands of dollars) of Fincorp's fixed assets in 2015 is $6000, and that the value of its long-term debt is only $2400. In addition, the consensus among investors is that Fincorp's past investments in developing the skills of its employments are worth $2,900. The investment of course does not show up on the balance sheet. What will be the price per share of Fincorp stock