Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3) HH, II and JJ were partners with capital balances as of January 1, 20x7, of P100,000, P150,000 and P200,000, respectively, sharing profit and

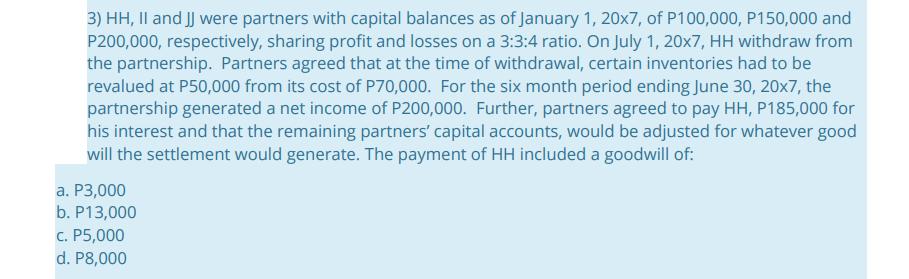

3) HH, II and JJ were partners with capital balances as of January 1, 20x7, of P100,000, P150,000 and P200,000, respectively, sharing profit and losses on a 3:3:4 ratio. On July 1, 20x7, HH withdraw from the partnership. Partners agreed that at the time of withdrawal, certain inventories had to be revalued at P50,000 from its cost of P70,000. For the six month period ending June 30, 20x7, the partnership generated a net income of P200,000. Further, partners agreed to pay HH, P185,000 for his interest and that the remaining partners' capital accounts, would be adjusted for whatever good will the settlement would generate. The payment of HH included a goodwill of: a. P3,000 b. P13,000 c. P5,000 d. P8,000

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the goodwill included in the payment to HH upon withdrawal from the partnership we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started