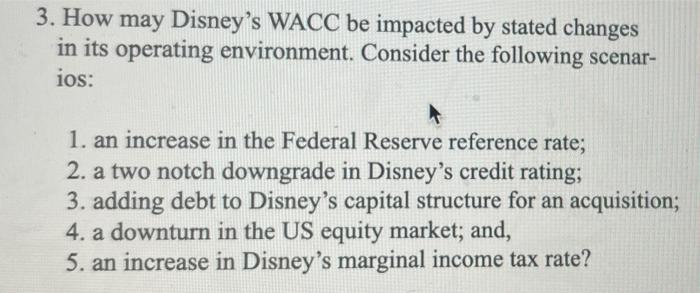

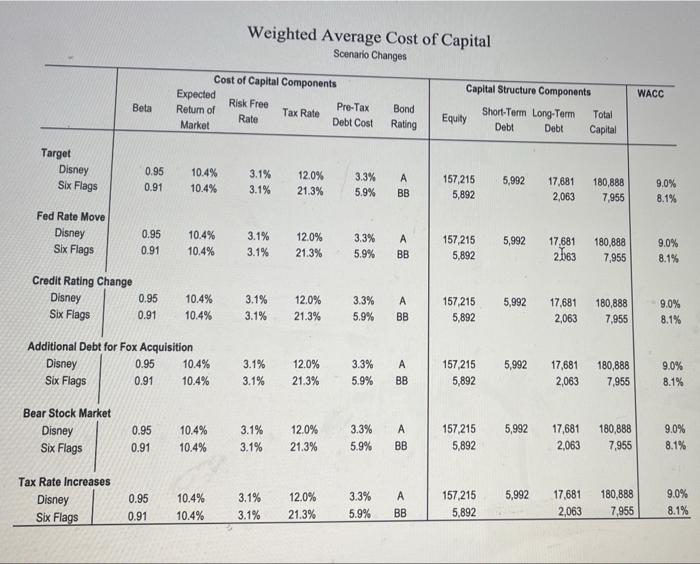

3. How may Disney's WACC be impacted by stated changes in its operating environment. Consider the following scenar- ios: 1. an increase in the Federal Reserve reference rate; 2. a two notch downgrade in Disney's credit rating; 3. adding debt to Disney's capital structure for an acquisition; 4. a downturn in the US equity market; and, a 5. an increase in Disney's marginal income tax rate? Weighted Average Cost of Capital Scenario Changes WACC Cost of Capital Components Expected Risk Free Pre-Tax Return of Tax Rate Rate Debt Cost Market Beta Bond Rating Capital Structure Components Short-Term Long-Term Total Equity Debt Debt Capital Target Disney Six Flags 0.95 0.91 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% A BB 5,992 157 215 5,892 17,681 2,063 180,888 7,955 9.0% 8.1% Fed Rate Move Disney Six Flags 0.95 0.91 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% BB 5,992 157 215 5,892 17,681 2.163 180,888 7,955 9.0% 8.1% Credit Rating Change Disney 0.95 Six Flags 0.91 3.3% 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% BB 5,992 157 215 5,892 5.9% 17,681 2,063 180,888 7,955 9.0% 8.1% Additional Debt for Fox Acquisition Disney 0.95 10.4% Six Flags 0.91 10.4% 5,992 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% A BB 157 215 5,892 17,681 2,063 180,888 7,955 9.0% 8.1% Bear Stock Market Disney Six Flags 5,992 0.95 0.91 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% A BB 157 215 5,892 17,681 2,063 180,888 7,955 9.0% 8.1% Tax Rate Increases Disney Six Flags 5,992 0.95 0.91 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% BB 157 215 5,892 17,681 2,063 180,888 7,955 9.0% 8.1% 3. How may Disney's WACC be impacted by stated changes in its operating environment. Consider the following scenar- ios: 1. an increase in the Federal Reserve reference rate; 2. a two notch downgrade in Disney's credit rating; 3. adding debt to Disney's capital structure for an acquisition; 4. a downturn in the US equity market; and, a 5. an increase in Disney's marginal income tax rate? Weighted Average Cost of Capital Scenario Changes WACC Cost of Capital Components Expected Risk Free Pre-Tax Return of Tax Rate Rate Debt Cost Market Beta Bond Rating Capital Structure Components Short-Term Long-Term Total Equity Debt Debt Capital Target Disney Six Flags 0.95 0.91 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% A BB 5,992 157 215 5,892 17,681 2,063 180,888 7,955 9.0% 8.1% Fed Rate Move Disney Six Flags 0.95 0.91 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% BB 5,992 157 215 5,892 17,681 2.163 180,888 7,955 9.0% 8.1% Credit Rating Change Disney 0.95 Six Flags 0.91 3.3% 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% BB 5,992 157 215 5,892 5.9% 17,681 2,063 180,888 7,955 9.0% 8.1% Additional Debt for Fox Acquisition Disney 0.95 10.4% Six Flags 0.91 10.4% 5,992 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% A BB 157 215 5,892 17,681 2,063 180,888 7,955 9.0% 8.1% Bear Stock Market Disney Six Flags 5,992 0.95 0.91 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% A BB 157 215 5,892 17,681 2,063 180,888 7,955 9.0% 8.1% Tax Rate Increases Disney Six Flags 5,992 0.95 0.91 10.4% 10.4% 3.1% 3.1% 12.0% 21.3% 3.3% 5.9% BB 157 215 5,892 17,681 2,063 180,888 7,955 9.0% 8.1%