Answered step by step

Verified Expert Solution

Question

1 Approved Answer

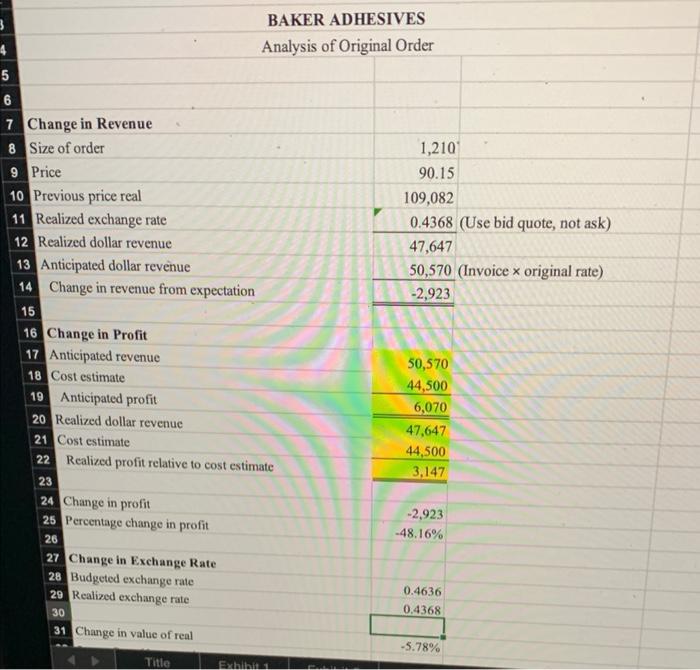

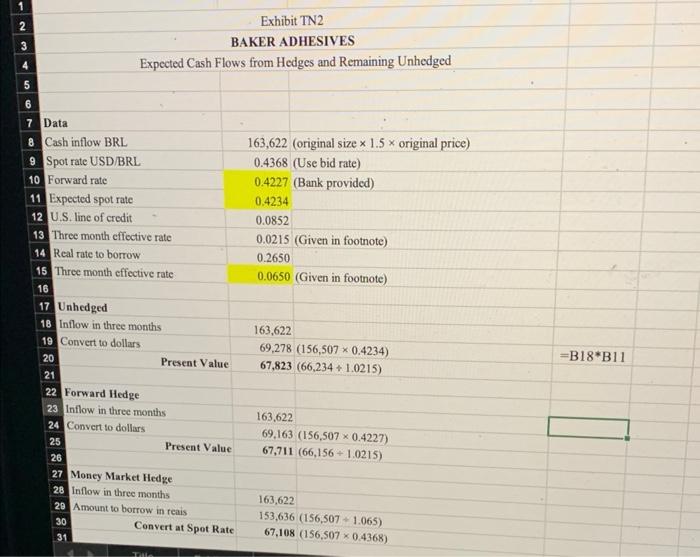

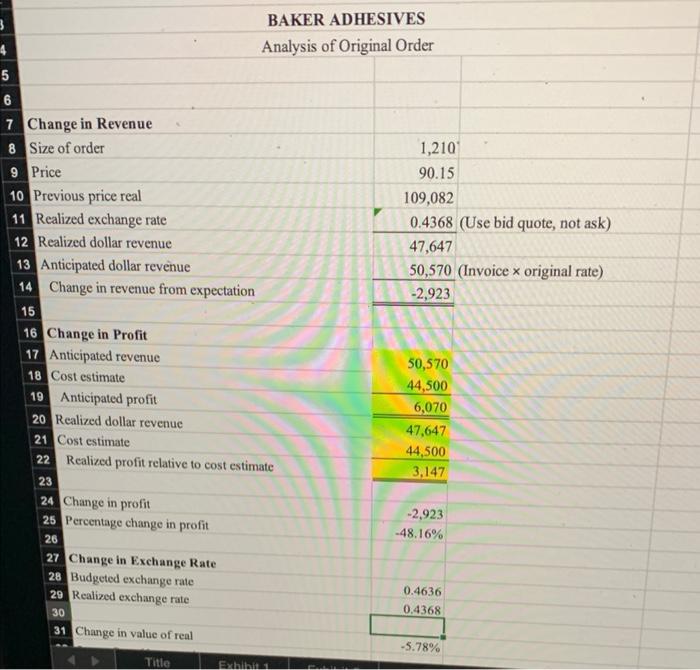

3. how profitable will the follow on order be? would you make this new sale? BAKER ADHESIVES Analysis of Original Order 7 Change in Revenue

3. how profitable will the follow on order be? would you make this new sale?

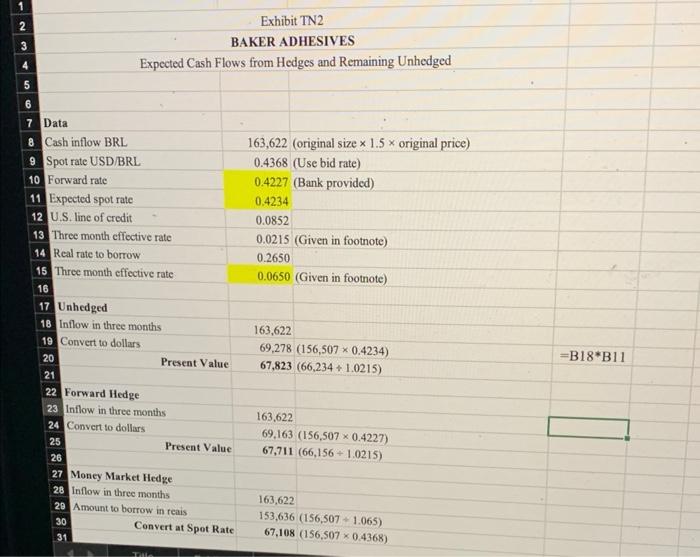

BAKER ADHESIVES Analysis of Original Order 7 Change in Revenue 8 Size of order 9 Price 10 Previous price real 11 Realized exchange rate 12 Realized dollar revenue 13 Anticipated dollar revenue 14 Change in revenue from expectation 50,570(Invoiceoriginalrate)2,923 15 Change in Profit 17 Anticipated revenue 18 Cost estimate 19 Anticipated profit 20 Realized dollar revenue 21 Cost estimate 22 Realized profit relative to cost estimate \begin{tabular}{l|l|} 23 & \\ 24 & Change in profit \\ \hline 25 & Perealized profit istation \end{tabular} 25 Percentage change in profit 50,57044,5006,07047,64744,5003,147 27 Change in Exchange Rate 28 Budgeted exchange rate 29 Realized exchange rate 31 Change in value of real 2,92348.16% Exhibit TN2 BAKER ADHESIVES Expected Cash Flows from Hedges and Remaining Unhedged 7 Data 22 Forward Hedge 27 Money Market Hedge Convert at Spot Rate 67,108(156,5070.4368) BAKER ADHESIVES Analysis of Original Order 7 Change in Revenue 8 Size of order 9 Price 10 Previous price real 11 Realized exchange rate 12 Realized dollar revenue 13 Anticipated dollar revenue 14 Change in revenue from expectation 50,570(Invoiceoriginalrate)2,923 15 Change in Profit 17 Anticipated revenue 18 Cost estimate 19 Anticipated profit 20 Realized dollar revenue 21 Cost estimate 22 Realized profit relative to cost estimate \begin{tabular}{l|l|} 23 & \\ 24 & Change in profit \\ \hline 25 & Perealized profit istation \end{tabular} 25 Percentage change in profit 50,57044,5006,07047,64744,5003,147 27 Change in Exchange Rate 28 Budgeted exchange rate 29 Realized exchange rate 31 Change in value of real 2,92348.16% Exhibit TN2 BAKER ADHESIVES Expected Cash Flows from Hedges and Remaining Unhedged 7 Data 22 Forward Hedge 27 Money Market Hedge Convert at Spot Rate 67,108(156,5070.4368)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started