Answered step by step

Verified Expert Solution

Question

1 Approved Answer

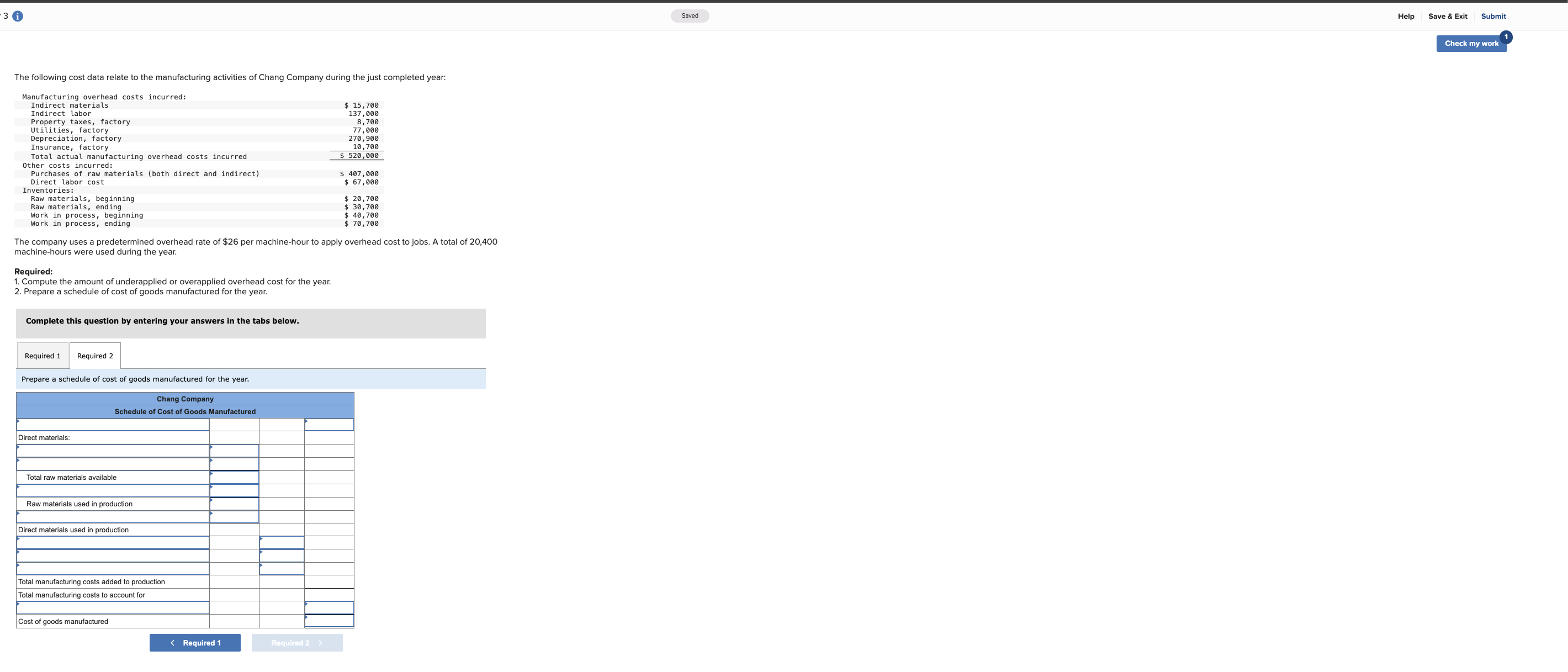

3 i The following cost data relate to the manufacturing activities of Chang Company during the just completed year: Manufacturing overhead costs incurred: Indirect

3 i The following cost data relate to the manufacturing activities of Chang Company during the just completed year: Manufacturing overhead costs incurred: Indirect materials Indirect labor Property taxes, factory. Utilities, factory Depreciation, factory Insurance, factory Total actual manufacturing overhead costs incurred Other costs incurred: Purchases of raw materials (both direct and indirect) Direct labor cost Inventories: Raw materials, beginning Raw materials, ending Work in process, beginning Work in process, ending $ 15,700 137,000 8,700 77,000 270,900 10,700 $520,000 $ 407,000 $ 67,000 $ 20,700 $ 30,700 $ 40,700 $ 70,700 The company uses a predetermined overhead rate of $26 per machine-hour to apply overhead cost to jobs. A total of 20,400 machine-hours were used during the year. Required: 1. Compute the amount of underapplied or overapplied overhead cost for the year. 2. Prepare a schedule of cost of goods manufactured for the year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule of cost of goods manufactured for the year. Chang Company Direct materials: Total raw materials available Schedule of Cost of Goods Manufactured Raw materials used in production Direct materials used in production Total manufacturing costs added to production Total manufacturing costs to account for Cost of goods manufactured < Required 1 Required 2 > Saved Help Save & Exit Submit Check my work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required 1 To compute the amount of underapplied or overapplied overhead cost for the year well use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started