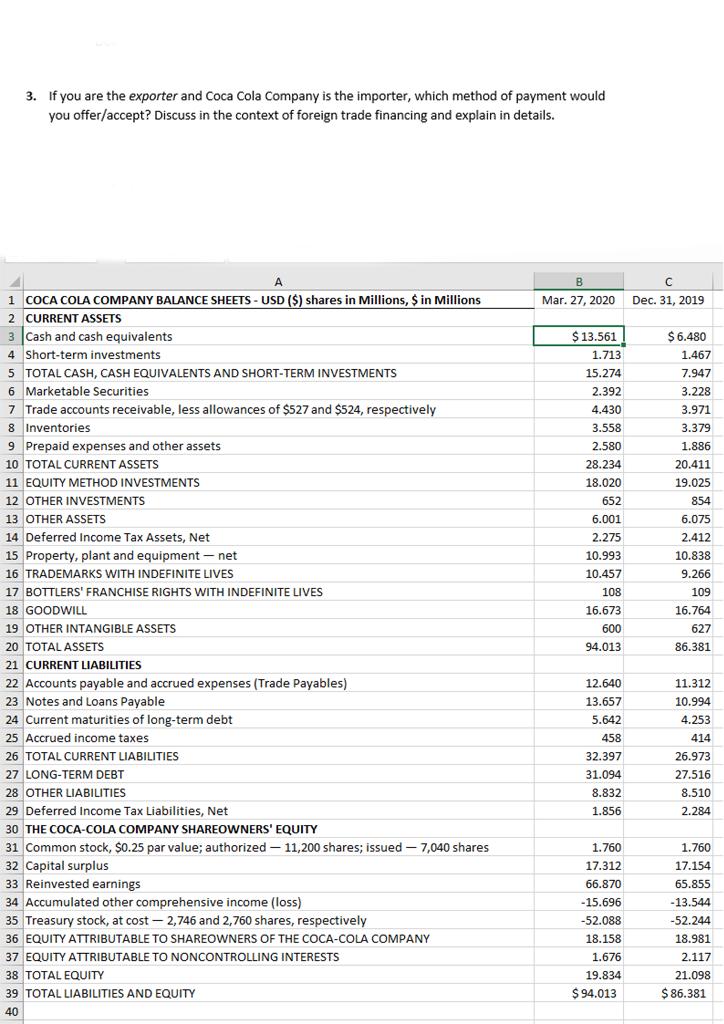

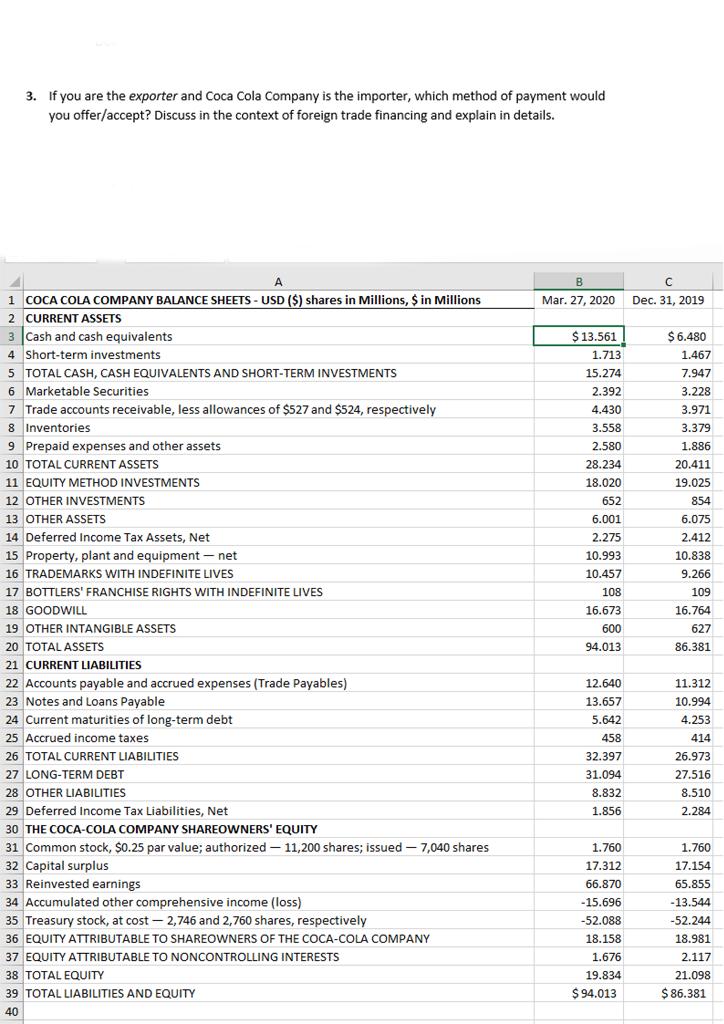

3. If you are the exporter and Coca Cola Company is the importer, which method of payment would you offer/accept? Discuss in the context of foreign trade financing and explain in details. A B C Mar. 27, 2020 Dec. 31, 2019 $6.480 $ 13.561 1.713 1.467 15.274 7.947 2.392 3.228 4.430 3.971 3.558 3.379 2.580 1.886 28.234 20.411 19.025 18.020 652 854 6.001 6.075 2.275 2.412 10.993 10.838 10.457 9.266 108 109 16.673 16.764 1 COCA COLA COMPANY BALANCE SHEETS - USD ($) shares in Millions, $ in Millions 2 CURRENT ASSETS 2 3 Cash and cash equivalents 4 4 Short-term investments 5 TOTAL CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS 6 Marketable Securities 7 Trade accounts receivable, less allowances of $527 and $524, respectively 8 Inventories 9 Prepaid expenses and other assets 10 TOTAL CURRENT ASSETS 11 EQUITY METHOD INVESTMENTS 12 OTHER INVESTMENTS 13 OTHER ASSETS 14 Deferred Income Tax Assets, Net 15 Property, plant and equipment - net 16 TRADEMARKS WITH INDEFINITE LIVES 17 BOTTLERS' FRANCHISE RIGHTS WITH INDEFINITE LIVES 18 GOODWILL 19 OTHER INTANGIBLE ASSETS 20 TOTAL ASSETS 21 CURRENT LIABILITIES 22 Accounts payable and accrued expenses (Trade Payables) 23 Notes and Loans Payable 24 Current maturities of long-term debt 25 Accrued income taxes 26 TOTAL CURRENT LIABILITIES 27 LONG-TERM DEBT 28 OTHER LIABILITIES 29 Deferred Income Tax Liabilities, Net 30 THE COCA-COLA COMPANY SHAREOWNERS' EQUITY 31 Common stock, $0.25 par value; authorized - 11,200 shares; issued - 7,040 shares 32 Capital surplus 33 Reinvested earnings 34 Accumulated other comprehensive income (loss) 35 Treasury stock, at cost - 2,746 and 2,760 shares, respectively 36 EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 600 627 94.013 86.381 12.640 11.312 13.657 10.994 5.642 4.253 458 414 32.397 26.973 31.094 27.516 8.832 8.510 1.856 2.284 1.760 1.760 17.312 17.154 66.870 65.855 - 15.696 -13.544 -52.088 -52.244 18.158 18.981 1.676 2.117 37 EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS 38 TOTAL EQUITY 39 TOTAL LIABILITIES AND EQUITY 19.834 21.098 $94.013 $ 86.381 40