Answered step by step

Verified Expert Solution

Question

1 Approved Answer

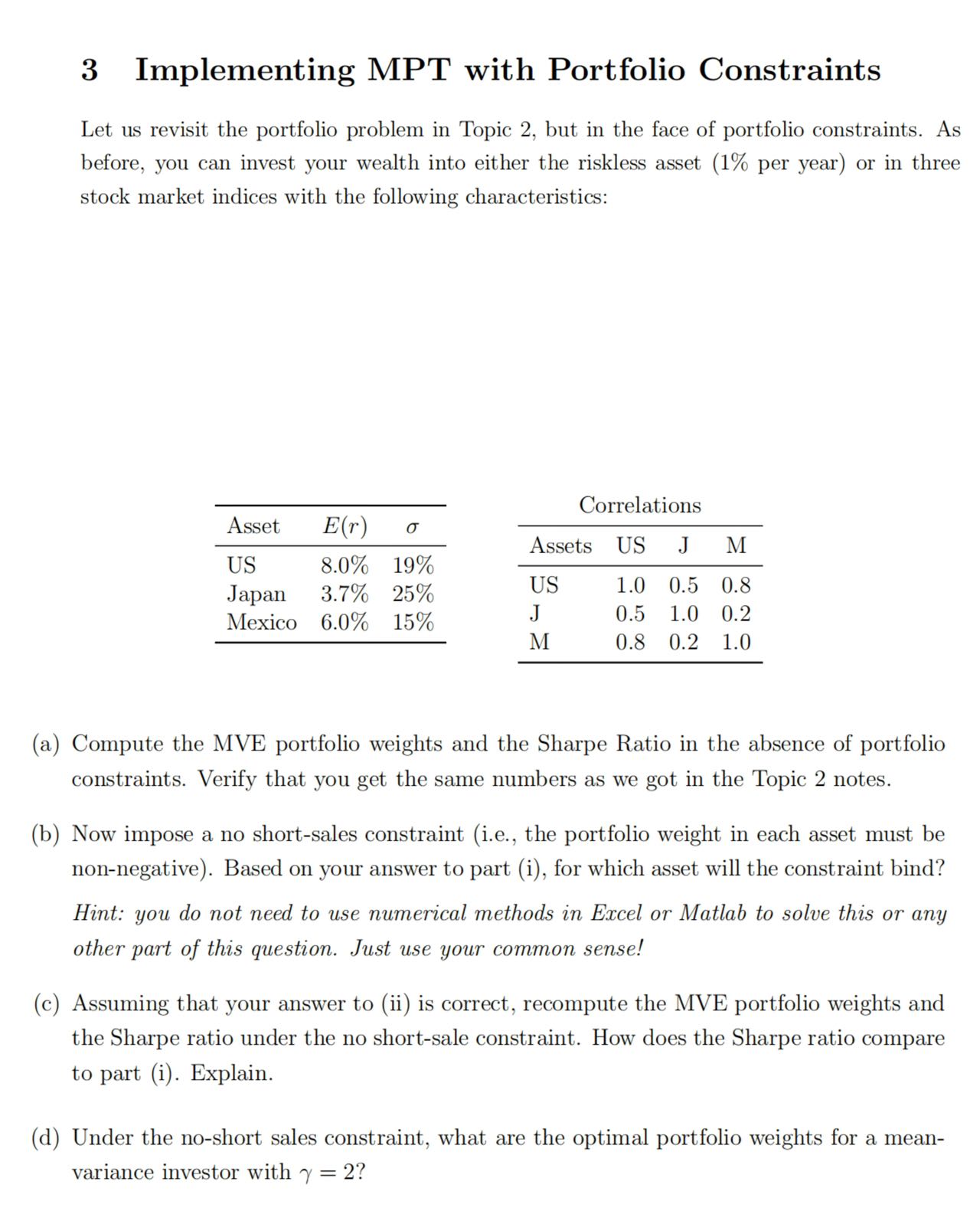

3 Implementing MPT with Portfolio Constraints Let us revisit the portfolio problem in Topic 2, but in the face of portfolio constraints. As before, you

3 Implementing MPT with Portfolio Constraints Let us revisit the portfolio problem in Topic 2, but in the face of portfolio constraints. As before, you can invest your wealth into either the riskless asset (1\% per year) or in three stock market indices with the following characteristics: (a) Compute the MVE portfolio weights and the Sharpe Ratio in the absence of portfolio constraints. Verify that you get the same numbers as we got in the Topic 2 notes. (b) Now impose a no short-sales constraint (i.e., the portfolio weight in each asset must be non-negative). Based on your answer to part (i), for which asset will the constraint bind? Hint: you do not need to use numerical methods in Excel or Matlab to solve this or any other part of this question. Just use your common sense! (c) Assuming that your answer to (ii) is correct, recompute the MVE portfolio weights and the Sharpe ratio under the no short-sale constraint. How does the Sharpe ratio compare to part (i). Explain. (d) Under the no-short sales constraint, what are the optimal portfolio weights for a meanvariance investor with =2 ? 3 Implementing MPT with Portfolio Constraints Let us revisit the portfolio problem in Topic 2, but in the face of portfolio constraints. As before, you can invest your wealth into either the riskless asset (1\% per year) or in three stock market indices with the following characteristics: (a) Compute the MVE portfolio weights and the Sharpe Ratio in the absence of portfolio constraints. Verify that you get the same numbers as we got in the Topic 2 notes. (b) Now impose a no short-sales constraint (i.e., the portfolio weight in each asset must be non-negative). Based on your answer to part (i), for which asset will the constraint bind? Hint: you do not need to use numerical methods in Excel or Matlab to solve this or any other part of this question. Just use your common sense! (c) Assuming that your answer to (ii) is correct, recompute the MVE portfolio weights and the Sharpe ratio under the no short-sale constraint. How does the Sharpe ratio compare to part (i). Explain. (d) Under the no-short sales constraint, what are the optimal portfolio weights for a meanvariance investor with =2

3 Implementing MPT with Portfolio Constraints Let us revisit the portfolio problem in Topic 2, but in the face of portfolio constraints. As before, you can invest your wealth into either the riskless asset (1\% per year) or in three stock market indices with the following characteristics: (a) Compute the MVE portfolio weights and the Sharpe Ratio in the absence of portfolio constraints. Verify that you get the same numbers as we got in the Topic 2 notes. (b) Now impose a no short-sales constraint (i.e., the portfolio weight in each asset must be non-negative). Based on your answer to part (i), for which asset will the constraint bind? Hint: you do not need to use numerical methods in Excel or Matlab to solve this or any other part of this question. Just use your common sense! (c) Assuming that your answer to (ii) is correct, recompute the MVE portfolio weights and the Sharpe ratio under the no short-sale constraint. How does the Sharpe ratio compare to part (i). Explain. (d) Under the no-short sales constraint, what are the optimal portfolio weights for a meanvariance investor with =2 ? 3 Implementing MPT with Portfolio Constraints Let us revisit the portfolio problem in Topic 2, but in the face of portfolio constraints. As before, you can invest your wealth into either the riskless asset (1\% per year) or in three stock market indices with the following characteristics: (a) Compute the MVE portfolio weights and the Sharpe Ratio in the absence of portfolio constraints. Verify that you get the same numbers as we got in the Topic 2 notes. (b) Now impose a no short-sales constraint (i.e., the portfolio weight in each asset must be non-negative). Based on your answer to part (i), for which asset will the constraint bind? Hint: you do not need to use numerical methods in Excel or Matlab to solve this or any other part of this question. Just use your common sense! (c) Assuming that your answer to (ii) is correct, recompute the MVE portfolio weights and the Sharpe ratio under the no short-sale constraint. How does the Sharpe ratio compare to part (i). Explain. (d) Under the no-short sales constraint, what are the optimal portfolio weights for a meanvariance investor with =2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started