Question

3. In the following list for a business named Sew What Alterations, there are four asset accounts, three liability accounts, and one capital account.Accounts Cash

3. In the following list for a business named Sew What Alterations, there are four asset accounts, three liability accounts, and one capital account.Accounts Cash 6,000A/R - K.Mak 1,000Supplies 5,000Equipment 10,000A/P - Heiden Fashions 3,000A/P - Parry Supply Co 500Bank Loan 9,00B. Chan, Capital 9,500

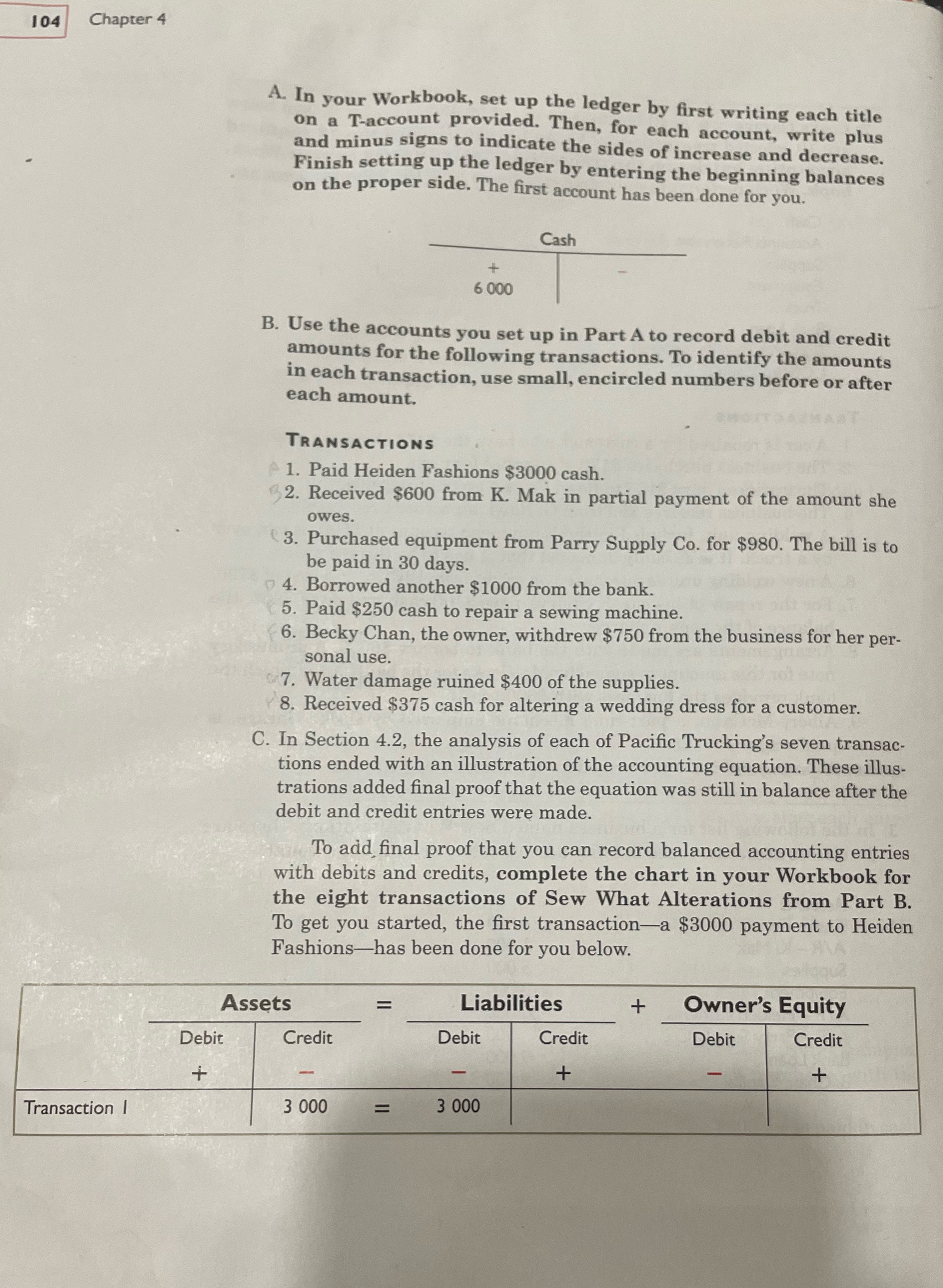

104 Chapter 4 Transaction I A. In your Workbook, set up the ledger by first writing each title on a T-account provided. Then, for each account, write plus and minus signs to indicate the sides of increase and decrease. Finish setting up the ledger by entering the beginning balances on the proper side. The first account has been done for you. Debit + B. Use the accounts you set up in Part A to record debit and credit amounts for the following transactions. To identify the amounts in each transaction, use small, encircled numbers before or after each amount. TRANSACTIONS 1. Paid Heiden Fashions $3000 cash. 32. Received $600 from K. Mak in partial payment of the amount she owes. 6 000 3. Purchased equipment from Parry Supply Co. for $980. The bill is to be paid in 30 days. 4. Borrowed another $1000 from the bank. 5. Paid $250 cash to repair a sewing machine. 6. Becky Chan, the owner, withdrew $750 from the business for her per- sonal use. 7. Water damage ruined $400 of the supplies. 8. Received $375 cash for altering a wedding dress for a customer. Assets Cash C. In Section 4.2, the analysis of each of Pacific Trucking's seven transac- tions ended with an illustration of the accounting equation. These illus- trations added final proof that the equation was still in balance after the debit and credit entries were made. To add final proof that you can record balanced accounting entries with debits and credits, complete the chart in your Workbook for the eight transactions of Sew What Alterations from Part B. To get you started, the first transaction-a $3000 payment to Heiden Fashions has been done for you below. Credit 3 000 = Liabilities Debit 3 000 Credit + + Owner's Equity Debit Credit +

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Financial Analysis of Sew What Alterations This ledger provides a snapshot of the financial position of Sew What Alterations as of a specific date Bas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started