Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#3 is in refrence for question 7, I DO NOT NEED 3 answerd. Please guve step by step for question 7. XYZ Is expected to

#3 is in refrence for question 7, I DO NOT NEED 3 answerd. Please guve step by step for question 7.

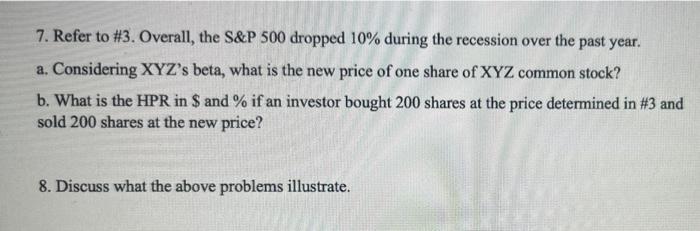

7. Refer to #3. Overall, the S&P 500 dropped 10% during the recession over the past year. a. Considering XYZ's beta, what is the new price of one share of XYZ common stock? b. What is the HPR in $ and % if an investor bought 200 shares at the price determined in #3 and sold 200 shares at the new price? 8. Discuss what the above problems illustrate XYZ Is expected to pay dividends on it's common stock (i.e.,) D1) of $3 over the next year. Dividends have been growing steadily at 3% for years. Currently, investors are requiring a return of 15% for an investment in XYZ common stock. What is the value of 200 shares of XYZ common stock today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started