Question

3. Journal the following trans actions related to the business Barbara's Book Nook, a bookstore owned by Barbara Baker. Start Microsoft Excel, and open the

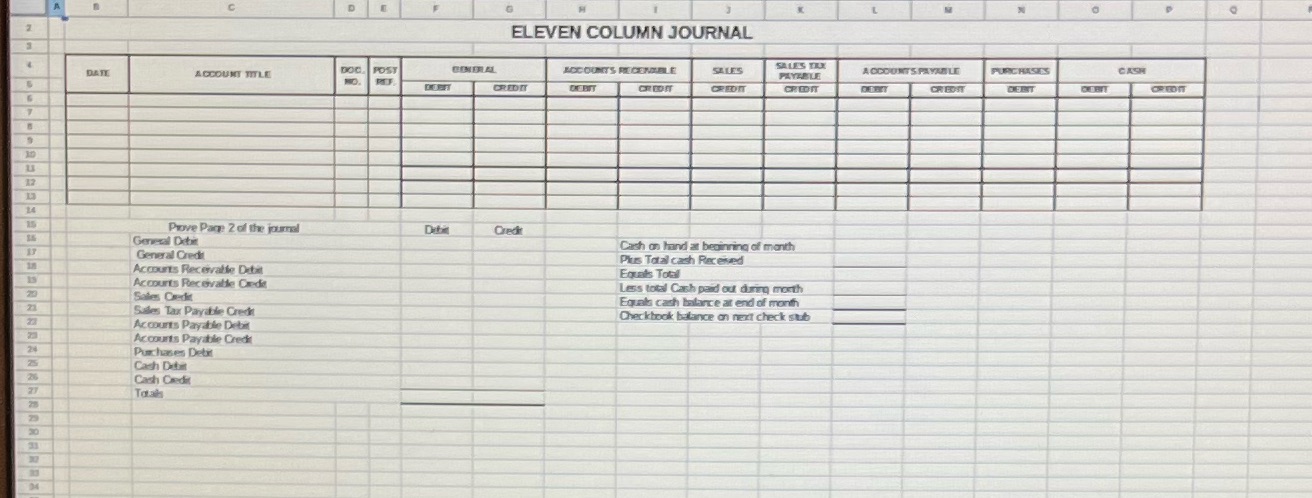

3. Journal the following trans actions related to the business Barbara's Book Nook, a bookstore owned by Barbara Baker. Start Microsoft Excel, and open the BUS113_06_06. xlsx file from C. ACTTI\DatalUnit_6. Click the File tab, and click Save As. Save the file to C:lACTTI\StudentiUnit 6. c. August 1. Purchased merchandise for cash, $1,200.00. Check No. 121. d. August 9. Purchased merchandise on account from Book Wholesalers, $1,950.00. Purchase Invoice No. 132. e. August 14. Barbara Baker withdrew merchandise for personal use, $300.00. Merorandum No. 143. August 30. Recorded cash and credit card sales, $5, 459.00, plus sales tax, $545.90. Cash Register Tape No. 124. g. Total the columns and prove and rule page 1 of the journal. h. Prove cash. The beginning cash balance on August 1 is $2,340.00. The balance on the next unused check stub is $7,144.90 Save and close the spreadsheet. Submit your file to your instructor for grading.

3 ELEVEN COLUMN JOURNAL 4 DATE ACCOUNT TITLE DOC. POST NO. CENTRAL DE BET CREDIT ACCOUNTS RECENTABLE DE BUT SALES SALES TAX PAYABLE CREDIT CREDIT CREDIT ACCOUNTS PAYABLE CREDIT PURCHASES CASH CEINT CLOBIT CREDIT G 7 B 9 30 11 12 13 14 15 Prove Page 2 of the journal Debit Credi 16 General Debit 17 General Credit 10 Accounts Recevable Debit 15 Accounts Receivable Credit 23 21 22 23 24 25 Sales Credit Sales Tax Payable Cred Accounts Payable Debit Accounts Payable Cred Purchases Debit Cash Debit 26 Cash Credit 27 Totals 28 29 30 31 32 33 Cash on hand at beginning of manth Plus Total cash Received Equals Totall Less total Cash paid out during morth Equals cash balance at end of month Checkbook balance on next check stub

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started