Answered step by step

Verified Expert Solution

Question

1 Approved Answer

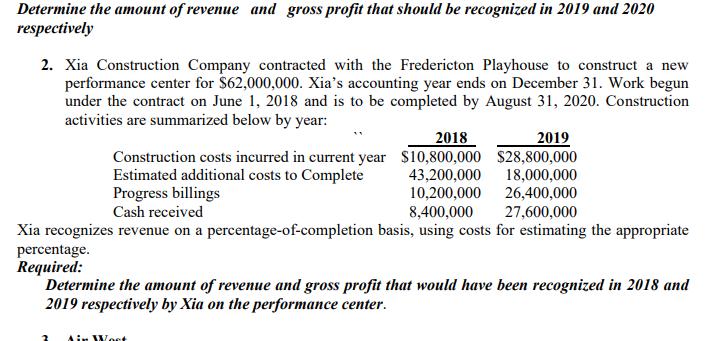

Determine the amount of revenue and gross profit that should be recognized in 2019 and 2020 respectively 2. Xia Construction Company contracted with the

Determine the amount of revenue and gross profit that should be recognized in 2019 and 2020 respectively 2. Xia Construction Company contracted with the Fredericton Playhouse to construct a new performance center for $62,000,000. Xia's accounting year ends on December 31. Work begun under the contract on June 1, 2018 and is to be completed by August 31, 2020. Construction activities are summarized below by year: 2018 2019 Construction costs incurred in current year $10,800,000 $28,800,000 Estimated additional costs to Complete Progress billings Cash received 43,200,000 10,200,000 8,400,000 18,000,000 26,400,000 27,600,000 Xia recognizes revenue on a percentage-of-completion basis, using costs for estimating the appropriate percentage. Required: Determine the amount of revenue and gross profit that would have been recognized in 2018 and 2019 respectively by Xia on the performance center. 2 Air West

Step by Step Solution

★★★★★

3.25 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount of revenue and gross profit recognized in 2018 and 2019 we can use the perce...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started