Question

3. JTM's treasury office is looking at buying a bond to earn some money on its cash balances. It has four options, all semi-annual bonds,

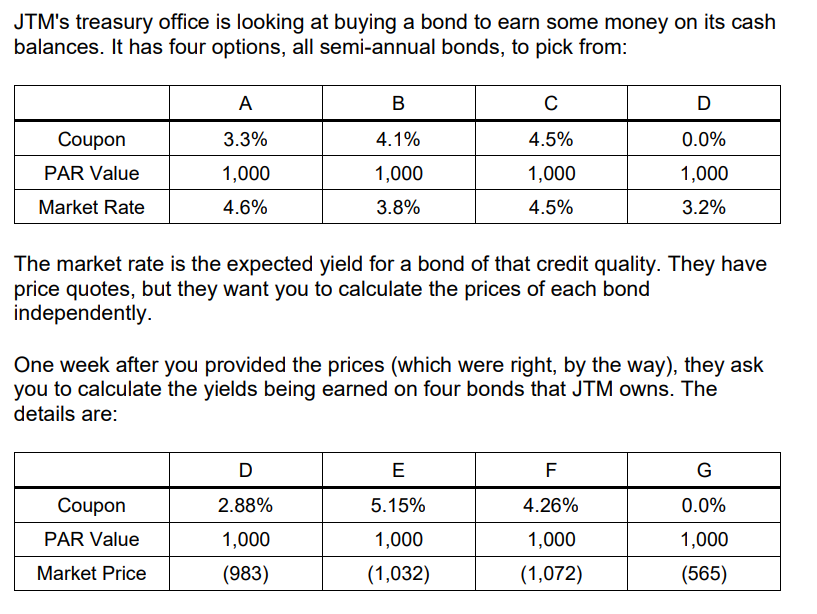

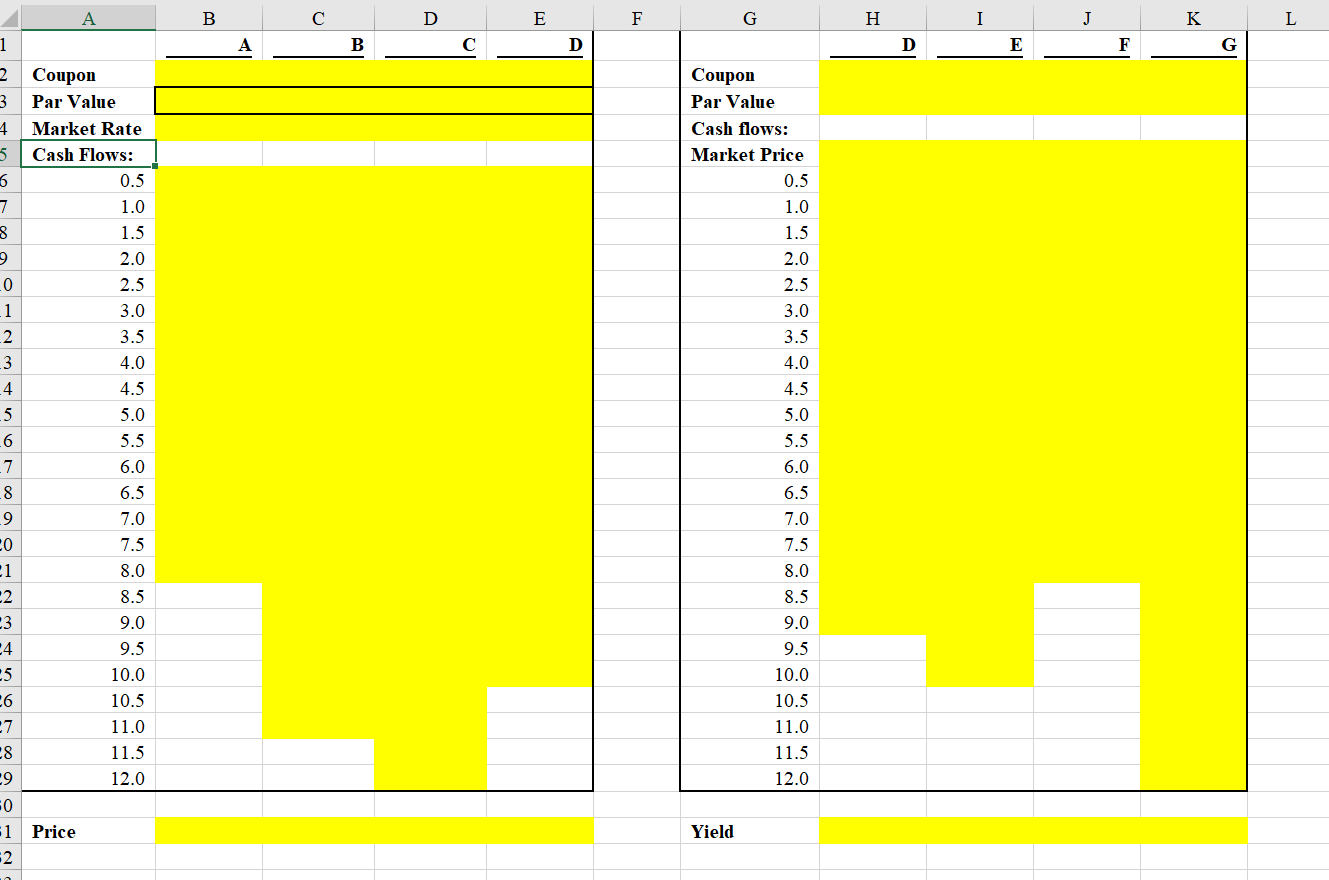

3. JTM's treasury office is looking at buying a bond to earn some money on its cash balances. It has four options, all semi-annual bonds, to pick from: A B C D Coupon 3.3% 4.1% 4.5% 0.0% PAR Value 1,000 1,000 1,000 1,000 Market Rate 4.6% 3.8% 4.5% 3.2% The market rate is the expected yield for a bond of that credit quality. They have price quotes, but they want you to calculate the prices of each bond independently. One week after you provided the prices (which were right, by the way), they ask you to calculate the yields being earned on four bonds that JTM owns. The details are: D E F G Coupon 2.88% 5.15% 4.26% 0.0% PAR Value 1,000 1,000 1,000 1,000 Market Price (983) (1,032) (1,072) (565)

PLEASE SHOW WITH EXCEL FORMULAS. THANK YOU

JTM's treasury office is looking at buying a bond to earn some money on its cash balances. It has four options, all semi-annual bonds, to pick from: A B D 3.3% 4.1% 4.5% 0.0% Coupon PAR Value 1,000 1,000 1,000 1,000 Market Rate 4.6% 3.8% 4.5% 3.2% The market rate is the expected yield for a bond of that credit quality. They have price quotes, but they want you to calculate the prices of each bond independently. One week after you provided the prices (which were right, by the way), they ask you to calculate the yields being earned on four bonds that JTM owns. The details are: D E F G 2.88% 5.15% 4.26% 0.0% Coupon PAR Value 1,000 1,000 1,000 1,000 (565) Market Price (983) (1,032) (1,072) A B D E F G H I J K L 1 A B D D E F 2 Coupon 3 Par Value 4 Market Rate 5. Cash Flows: 5 0.5 7 1.0 8 1.5 9 2.0 0 2.5 1 3.0 2 3.5 3 4.0 4 4.5 5 5.0 6 5.5 7 6.0 8 6.5 9 7.0 20 7.5 -1 8.0 -2 8.5 -3 9.0 -4 9.5 25 10.0 6 10.5 27 11.0 28 11.5 -9 12.0 50 1 Price 2 Coupon Par Value Cash flows: Market Price 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 10.5 11.0 11.5 12.0 YieldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started