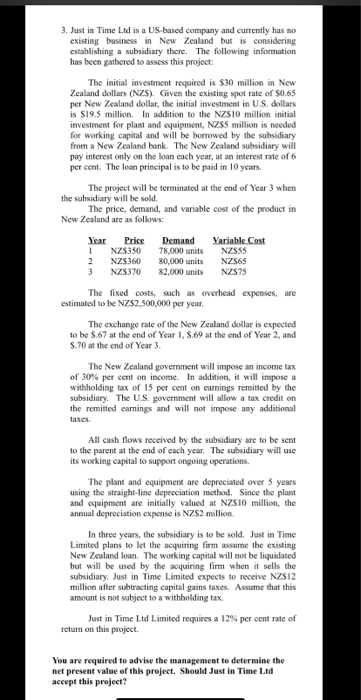

3. Just in Time Ltd is a US-based company and currently has no existing business in New Zealand but is considering establishing a subsidiary there. The following information has been gathered to assess this project: The initial investment required is $30 million in New Zealand dollars (NZS). Given the existing spot rate of $0.65 per New Zealand dollar, the initial investment in U.S. dollars is $19.5 million. In addition to the NZS10 million initial investment for plant and equipment, NZS5 million is needed for working capital and will be borrowed by the subsidiary from a New Zealand bank. The New Zealand subsidiary will pay interest only on the loan each year, at an interest rate of 6 per cent. The loan principal is to be paid in 10 years, The project will be terminated at the end of Year 3 when the subsidiary will be sold. The price, demand, and variable cost of the product in New Zealand are as follows: Year Price Demand Variable Cost NZS350 78.000 units NZSSS NZ$360 80,000 units NZS65 3 NZS370 82.000 units NZS75 The fixed costs, such as overhead expenses, are estimated to be NZ$2,500,000 per year. The exchange rate of the New Zealand dollar is expected to be 8.67 at the end of Year 1, S.69 at the end of Year 2, and 5.70 at the end of Year 3. The New Zealand government will impose an income tax of 30% per cent on income. In addition, it will impose a withholding tax of 15 per cent on earnings remitted by the subsidiary. The U.S. government will allow a tax credit on the remitted camnings and will not impose any additional All cash flows received by the subsidiary are to be sent to the parent at the end of each year. The subsidiary will use its working capital to support ongoing operations. The plant and equipment are depreciated over 5 years using the straight-line depreciation method. Since the plant and equipment are initially valued at NZSIO million, the annual depreciation expense is NZ$2 million. In three years, the subsidiary is to be sold. Justin Time Limited plans to let the acquiring firm assume the existing New Zealand loan. The working capital will not be liquidated but will be used by the acquiring firm when it sells the subsidiary. Just in Time Limited expects to receive NZS12 million after subtracting capital gains taxes. Assume that this amount is not subject to a withholding tax. Just in Time Ltd Limited requires a 12% per cent rate of retum on this project You are required to advise the management to determine the net present value of this project. Should Justin Time Ltd accept this project