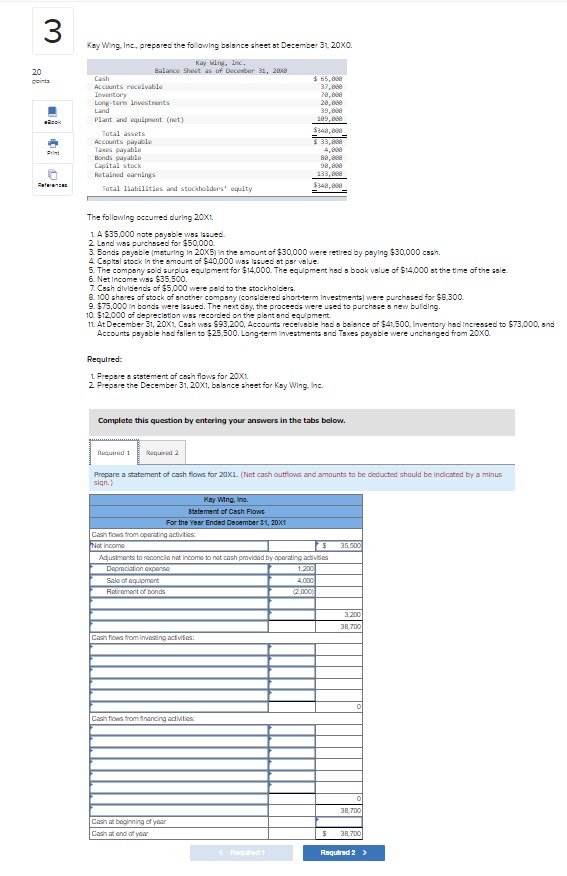

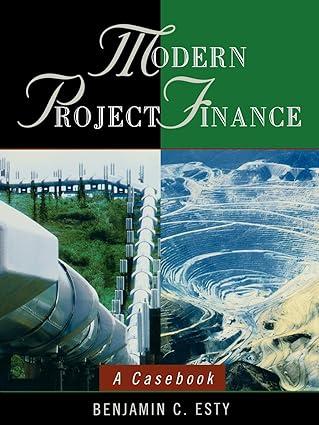

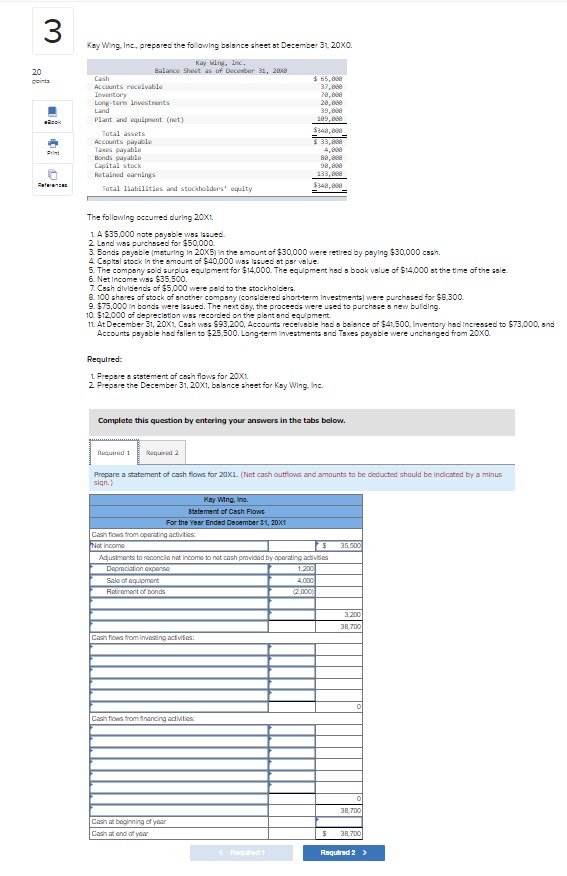

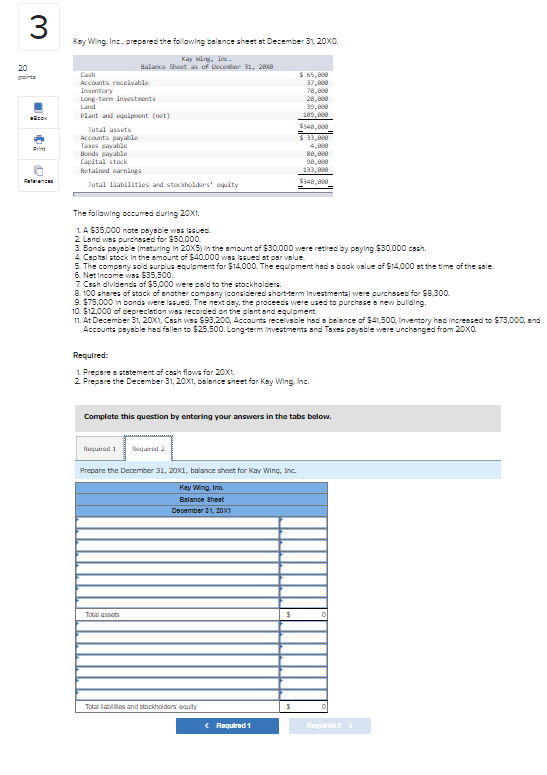

3 Kay Wing, Inc. prepared the folowing balance sheet st December 31, 20X0. 20 ginta . Kay Wing In Balance Sheet as of December 31, 2018 Accounts receivable Inventory Long-term investments Land Plant and equipment (net) Total assets Accounts payable Taxes payable Bonds payable Capital stock Retained earnings Total liabilities and stockholders' equity $ 55, 37,80 70,00 28, 39.00 125,00 $340,00 $ 33,888 4, 8. 9.ae 133,8 $340, Rare The following occurred during 20X1. LA $35,000 note payable was issued 2 Land was purchased for $50,000. 3. Bands payable maturing in 20x5) in the amount of $30,000 were retired by paying $30,000 cash. 4 Capital stock in the amount of $40,000 was issued at par value. 5. The company sold surplus equipment for $14,000. The equipment had a book value of $14,000 at the time of the sale. 6. Net Income was $35.500 7. Cash dividends of $5,000 were paid to the stockholders. 8.100 shares of stock of another company considered short-term Investments were purchased for $8.300 9 $75.000 in bonds were sued. The next day, the proceeds were used to purchase a new building. 10. $12.000 of depreciation was recorded on the plant and equipment. 11 At December 31, 20X1. Cash was $93,200, Accounts receivable had a balance of $41500, Inventory has increased to $73,000, and Accounts payable hadislen to $25.500. Long-term investments and Taxes payable were unchanged from 20x0. Required: Prepare a statement of cash flows for 20X1. 2. Prepare the December 31, 20x1, balance sheet for Kay Wing, Inc. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a statement of cash flows for 20X1. (Net cash outflows and amounts to be deducted should be indicated by a minus sign. Kay Wing, Inc. Btatement of Cash Flow For the Year Ended December 31, 20X1 Cashflows from operating activities Not Income $ Adustments to reconcile not income to not cash provided by operating activities Depreciation expense 1.200 Sale of equipment 4.000 Forment of bonds 2.000 35.500 3.200 38.700 Cash flows from investing acties: Cash flows from financing activities 38.700 Cash at beginning of your Cachat end of your $ 38.700 Required Required 2 > 3 20 ginta Kay Wing, Inc. prepared the folowing balance sheet st December 31, 20X0. Kay Wing In Balance Sheet as of December 31, 2018 $ 65,00 Accounts receivable 37,6ce Inventory 78.ce Long term investments 28.80 Land 39,800 Plant and equipment (net) 129,80 Total assets $348,8ce Accounts payable $ 33,00 Taxes payable 4, Bonds payable 82,00 Capital stock 92,80 Retained earnings 133,00 Total liabilities and stockholders' equity $340, PIE Pawan The following occurred during 20X1. 1A $35,000 note payable was issued 2 Land was purchased for $50,000. 3. Bands payable maturing in 20x5) in the amount of $30,000 were retired by paying $30,000 cash. 4 Capital stock in the amount of $40,000 was issued at par value. 5. The company sold surplus equipment for $14,000. The equipment had a book value of $14,000 st the time of the sale. 6. Net Income was $35.500. 7. Cash dividends of $5,000 were paid to the stockholders. 8.100 shares of stock of another company considered short-term Investments were purchased for $8.300 9 $75,000 in bonds were issued. The next day, the proceeds were used to purchase a new building. 10 $12,000 of depreciation was recorded on the plant and equipment. 11 At December 31, 20X1. Cash was 593,200, Accounts receivable had a balance of $41500, Inventory has increased to $73,000, and Accounts payable had fallen to $25.500. Long-term investments and Taxes payable were unchanged from 20X0. Required: 2. Prepare a statement of cash flows for 20X1. 2 Prepare the December 31, 20x1, balance sheet for Kay Wing, Inc. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the December 31, 20x1, balance sheet for Kay Wing, Inc Kay Wing, Inc. Balance Sheet December 31, 20X1 Total assis Total and stockholders equity