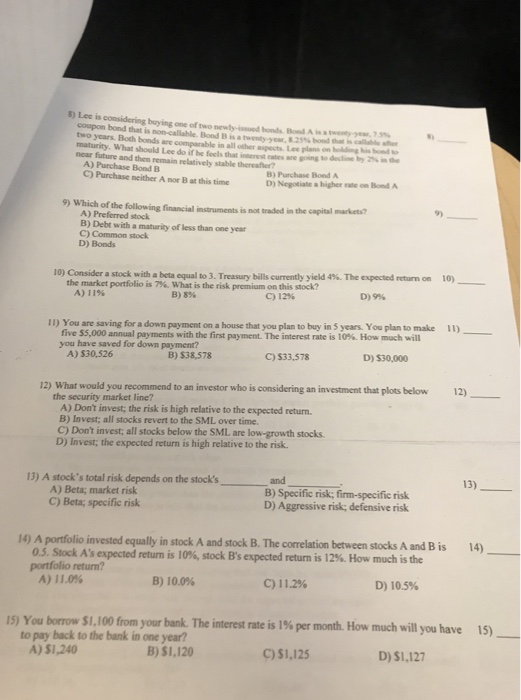

3) Lee is considering buying oftwo newly issued bonds. Bend A .twe tyyn,15% coupon bond that is two ycars. Both bonds are comparable in all other aspects. Lee plason ding his bond to maturity. What should Lee doif he feels that interest rates arepung to delie by 2% near future and then remain relatively stable thereafer? A) Purchase Bond E C) Purchase neither A mor B at this time 8) noncallable. Bond B is a twenty-year.25% bond th" callable sh B) Purchase Bond A D) Negotiate a higher te on Bond A 9) Which of the following financial instruments is not traded in the capital markets? A) Preferred stock B) Debt with a maturity of less than one year C) Common stock D) Bonds 10) 10) Consider a stock with abeta equal to 3. Treasury billscurrently yield 4% The expected return on the market portfolio is 7%. What is the risk premium on this stock? A) I 190 10) D)9% B)8% c) 12% 11) You are saving for a down payment on a house that you plan to buy in 5 years. You plan to make five $5,000 annual payments with the first payment. The interest rate is 10%, How you have saved for down payment? A) $30,526 1) much will D) $30,000 C) $33,578 B) $38,578 2) What would you recommend to an investor who is considering an investment that plots below the security market line? A) Don't invest, the risk is high relative to the expected return B) Invest; all stocks revert to the SML over time. C) Dont invest; all stocks below the SML are low-growth stocks D) Invest; the expected return is high relative to the risk. 12) 13) A stock's total risk depends on the stock's A) Beta; market risk C) Beta; specific risk 13) and B) Specific risk; firm-specific risk D) Aggressive risk; defensive risk 14) A portfolio invested equally in stock A and stock B. The corelation between stocks A and B is 05. Stock A's expected return is 10%, stock B's expected return is 12%. How much is the portfolio return? A) 11.0% 14) D) 10.5% B) 100% c) 11.2% interest rate is 1% per month. How much will you have 15) 15) You borrow $1,100from your bank. The to pay back to the bank in one year? A)$1,240 C$1,125 D) $1,127 B) S1,120