Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Let's consider the market for cups of coffee purchased at local coffee shops. Suppose that aggregate demand for coffee is given by QP=20,000-2500P,

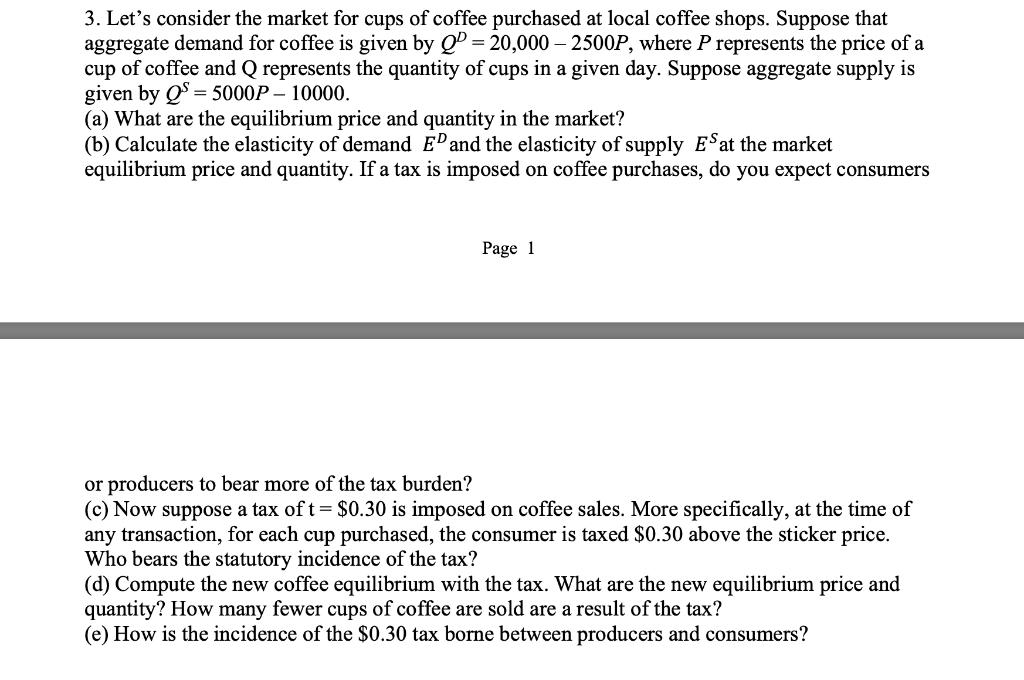

3. Let's consider the market for cups of coffee purchased at local coffee shops. Suppose that aggregate demand for coffee is given by QP=20,000-2500P, where P represents the price of a cup of coffee and Q represents the quantity of cups in a given day. Suppose aggregate supply is given by QS = 5000P - 10000. (a) What are the equilibrium price and quantity in the market? (b) Calculate the elasticity of demand ED and the elasticity of supply ES at the market equilibrium price and quantity. If a tax is imposed on coffee purchases, do you expect consumers Page 1 or producers to bear more of the tax burden? (c) Now suppose a tax of t = $0.30 is imposed on coffee sales. More specifically, at the time of any transaction, for each cup purchased, the consumer is taxed $0.30 above the sticker price. Who bears the statutory incidence of the tax? (d) Compute the new coffee equilibrium with the tax. What are the new equilibrium price and quantity? How many fewer cups of coffee are sold are a result of the tax? (e) How is the incidence of the $0.30 tax borne between producers and consumers?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To find the equilibrium price and quantity we need to set the quantity demanded equal to the quantity supplied and solve for P QD QS 20000 25...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started